Region:Global

Author(s):Geetanshi

Product Code:KRAA3289

Pages:88

Published On:September 2025

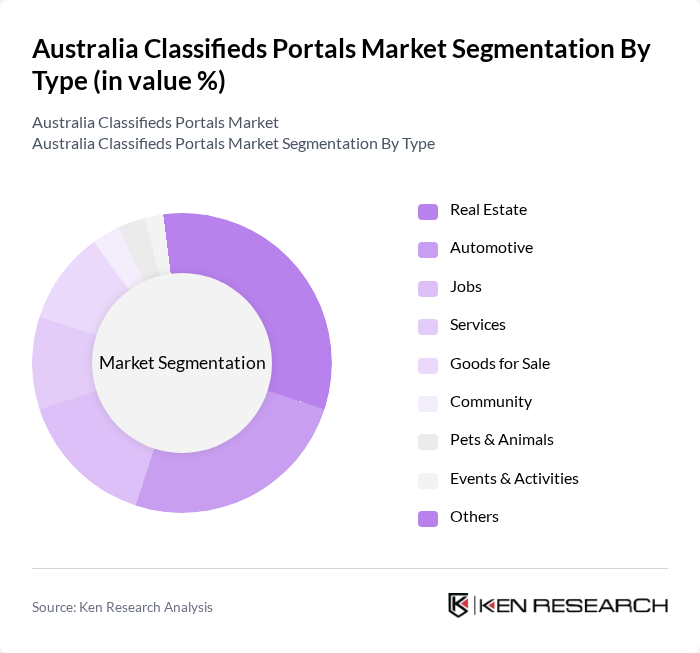

By Type:The market is segmented into various types, includingReal Estate, Automotive, Jobs, Services, Goods for Sale, Community, Pets & Animals, Events & Activities, and Others. Each of these segments caters to specific consumer needs and preferences, with varying levels of demand and engagement. Real Estate and Automotive remain the largest segments, reflecting strong demand for property and vehicle listings, while Jobs and Services are supported by resilient employment trends and the gig economy.

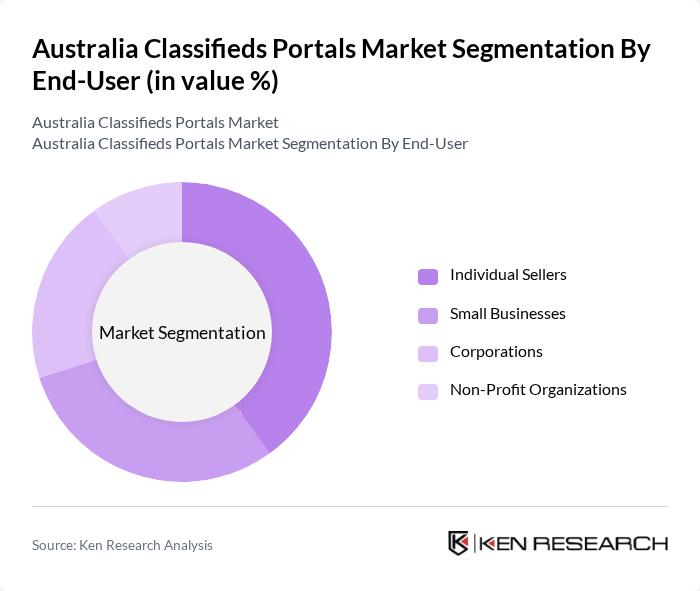

By End-User:The end-user segmentation includesIndividual Sellers, Small Businesses, Corporations, and Non-Profit Organizations. Each segment has distinct motivations and usage patterns, influencing how they engage with classifieds portals. Individual sellers and small businesses dominate due to the accessibility and low entry barriers of digital classifieds platforms.

The Australia Classifieds Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seek Limited, Gumtree Australia, eBay Australia, Carsales.com Ltd, Domain Group, Realestate.com.au, Trading Post, Facebook Marketplace, Locanto Australia, Adzuna Australia, Jora, JobActive, Allhomes, Rent.com.au, Oodle Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia classifieds portals market appears promising, driven by technological advancements and evolving consumer behaviors. As mobile usage continues to rise, with over 90% of users accessing classifieds via smartphones, platforms must prioritize mobile optimization. Additionally, the integration of AI and machine learning will enhance user experience through personalized recommendations. These trends indicate a shift towards more efficient, user-friendly platforms that cater to the growing demand for online transactions and advertising solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Jobs Services Goods for Sale Community Pets & Animals Events & Activities Others |

| By End-User | Individual Sellers Small Businesses Corporations Non-Profit Organizations |

| By Sales Channel | Direct Listings Auction Listings Classified Ads Subscription Services Social Media Marketplaces |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By Pricing Model | Free Listings Paid Listings Premium Listings Subscription-Based Listings |

| By User Demographics | Age Groups Income Levels Geographic Distribution |

| By Advertising Format | Text Ads Image Ads Video Ads Sponsored Content Featured Listings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales | 60 | Car Dealership Owners, Automotive Sales Managers |

| Job Listings | 110 | HR Managers, Recruitment Consultants |

| Consumer Goods Sales | 80 | Small Business Owners, E-commerce Managers |

| Service Offerings | 50 | Service Providers, Freelancers |

The Australia Classifieds Portals Market is valued at approximately USD 660 million, driven by the increasing adoption of digital platforms for buying and selling goods and services, along with the rise of mobile internet usage and AI-driven personalization.