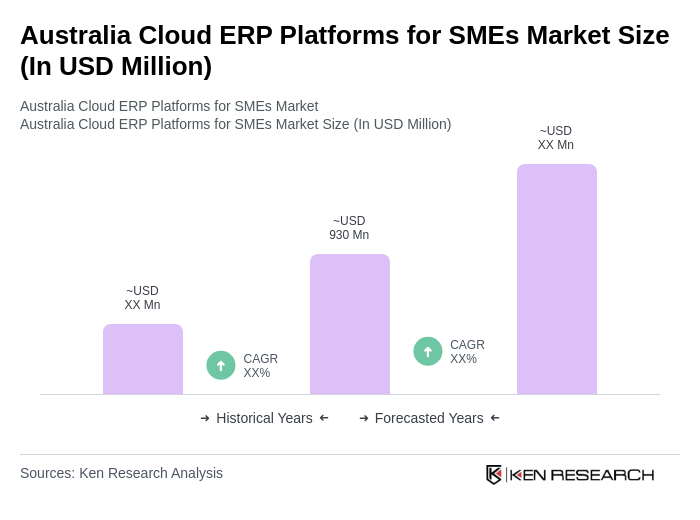

Australia Cloud ERP Platforms for SMEs Market Overview

- The Australia Cloud ERP Platforms for SMEs market is valued at USD 930 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of cloud technologies among small and medium enterprises, which seek to enhance operational efficiency and reduce costs. The shift towards digital transformation, rising IT spending, and the need for real-time data access have further propelled the demand for cloud-based ERP solutions. Key drivers include the migration from legacy on-premise systems to cloud-based platforms for greater flexibility and scalability, as well as the integration of AI and automation to streamline business processes and enhance decision-making capabilities .

- Key cities dominating this market includeSydney, Melbourne, and Brisbane. These urban centers are characterized by a high concentration of SMEs, robust technological infrastructure, and a supportive business environment. The presence of numerous tech startups and established companies in these cities fosters innovation and competition, making them pivotal in the growth of cloud ERP platforms .

- In 2023, the Australian government implemented theDigital Economy Strategy, which aims to enhance the digital capabilities of SMEs. This initiative includes funding of AUD 1.2 billion to support the adoption of digital technologies, including cloud ERP systems, thereby encouraging SMEs to modernize their operations and improve productivity. The Digital Economy Strategy 2030, issued by the Department of the Treasury, sets out operational targets for SME digital adoption, with compliance requirements for digital capability grants and technology investment incentives .

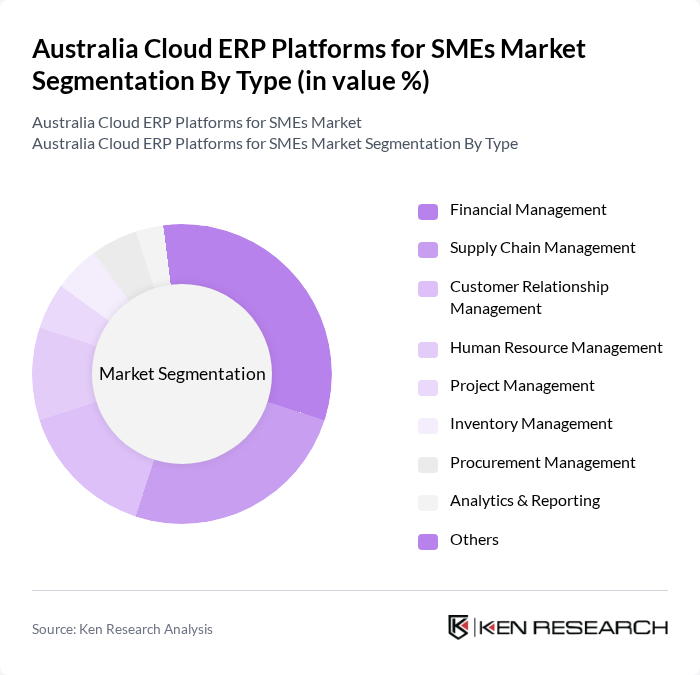

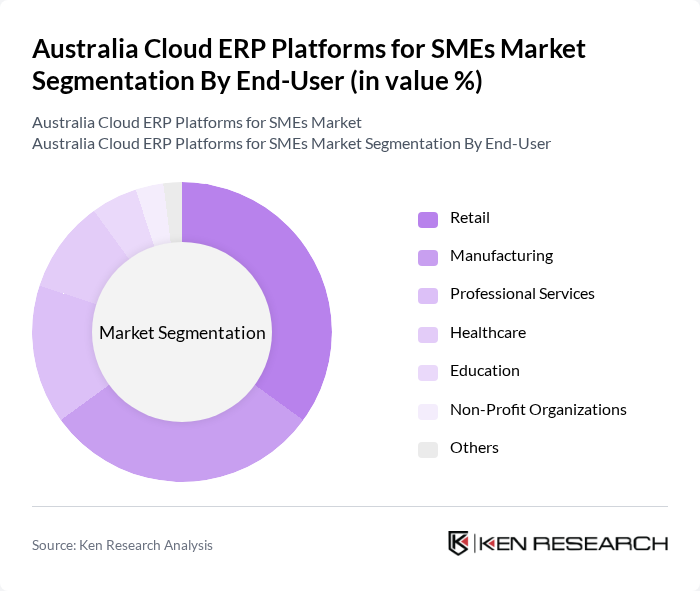

Australia Cloud ERP Platforms for SMEs Market Segmentation

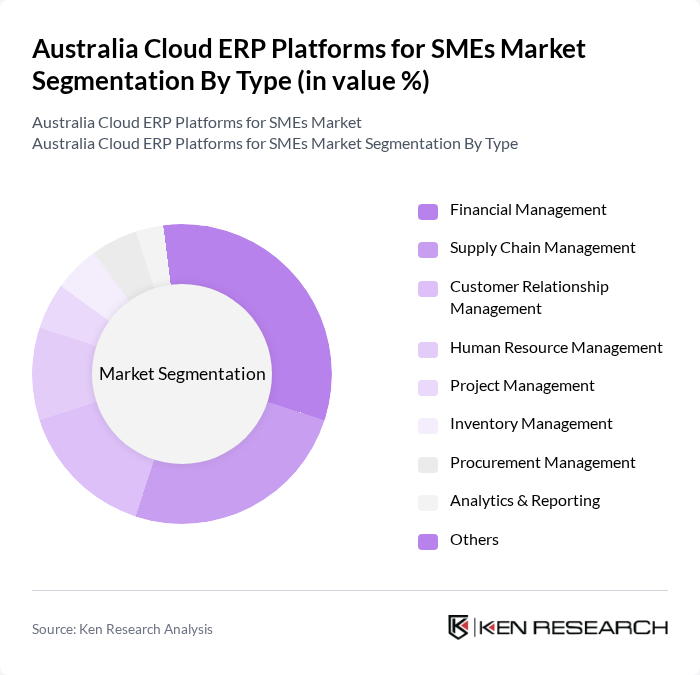

By Type:The market is segmented into various types of cloud ERP solutions, including Financial Management, Supply Chain Management, Customer Relationship Management, Human Resource Management, Project Management, Inventory Management, Procurement Management, Analytics & Reporting, and Others. Among these,Financial ManagementandSupply Chain Managementare particularly prominent due to their critical roles in enhancing financial oversight and operational efficiency for SMEs. Financial modules are typically the entry point for ERP adoption, providing a single source of truth for transactions and compliance, while supply chain modules enable real-time inventory and logistics optimization .

By End-User:The end-user segmentation includes Retail, Manufacturing, Professional Services, Healthcare, Education, Non-Profit Organizations, and Others. TheRetailandManufacturingsectors are leading in the adoption of cloud ERP solutions, driven by their need for efficient inventory management, supply chain visibility, and customer relationship handling. These sectors benefit from real-time analytics and automation, which support rapid decision-making and operational agility .

Australia Cloud ERP Platforms for SMEs Market Competitive Landscape

The Australia Cloud ERP Platforms for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as MYOB, Xero, SAP SE, Oracle Corporation, Microsoft Corporation, NetSuite (Oracle), Sage Group plc, Zoho Corporation, Intuit QuickBooks, Reckon Limited, Acumatica, Inc., Infor, Inc., Odoo S.A., FreshBooks, ERPNext (Frappe Technologies Pvt. Ltd.), Pronto Software, TechnologyOne, Epicor Software Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Australia Cloud ERP Platforms for SMEs Market Industry Analysis

Growth Drivers

- Increased Demand for Automation:The Australian SME sector is experiencing a significant shift towards automation, with over 60% of SMEs reporting plans to automate processes in future. This trend is driven by the need to enhance operational efficiency and reduce human error. According to the Australian Bureau of Statistics, the productivity growth rate in the SME sector is projected to reach 2.5% annually, further fueling the demand for cloud ERP solutions that facilitate automation and streamline business operations.

- Rising Adoption of Cloud Solutions:In future, approximately 75% of Australian SMEs are expected to utilize cloud-based solutions, reflecting a 15% increase from previous years. This surge is attributed to the flexibility and accessibility offered by cloud platforms, allowing SMEs to operate efficiently from various locations. The Australian government’s Digital Economy Strategy aims to increase cloud adoption, with an investment of AUD 1 billion to support digital infrastructure, further driving the growth of cloud ERP platforms.

- Enhanced Data Security Features:With cyber threats on the rise, Australian SMEs are prioritizing data security, leading to a 30% increase in investments in secure cloud solutions. According to Cyber Security Australia, the average cost of a data breach for SMEs is AUD 46,000, prompting businesses to adopt cloud ERP systems that offer advanced security features. In future, 80% of SMEs are expected to prioritize vendors with robust security certifications, ensuring compliance with stringent data protection regulations.

Market Challenges

- High Initial Implementation Costs:The upfront costs associated with implementing cloud ERP systems can be a significant barrier for SMEs. On average, Australian SMEs face implementation costs ranging from AUD 40,000 to AUD 120,000, depending on the complexity of the system. This financial burden can deter many SMEs from adopting cloud solutions, especially in a post-pandemic economy where cash flow management is critical for survival and growth.

- Data Privacy Concerns:Data privacy remains a pressing challenge for Australian SMEs, with 65% expressing concerns over data breaches and compliance with the Australian Privacy Principles. The Office of the Australian Information Commissioner reported that 32% of SMEs experienced a data breach in the past year. This apprehension can hinder the adoption of cloud ERP platforms, as businesses seek to protect sensitive customer information while navigating complex regulatory landscapes.

Australia Cloud ERP Platforms for SMEs Market Future Outlook

The future of the Australia Cloud ERP Platforms for SMEs market appears promising, driven by technological advancements and evolving business needs. As SMEs increasingly embrace digital transformation, the integration of AI and machine learning into cloud ERP systems is expected to enhance decision-making and operational efficiency. Additionally, the growing emphasis on sustainability practices will likely influence the development of eco-friendly cloud solutions, aligning with the broader goals of the Australian government to promote sustainable business practices across industries.

Market Opportunities

- Growing Trend of Remote Work:The shift towards remote work has created a substantial opportunity for cloud ERP platforms, with 57% of SMEs planning to adopt flexible work arrangements in future. This trend necessitates robust cloud solutions that facilitate collaboration and productivity, positioning cloud ERP providers to capture a larger share of the market as businesses adapt to new work environments.

- Expansion of E-commerce Platforms:The e-commerce sector in Australia is projected to reach AUD 47 billion, presenting a significant opportunity for cloud ERP solutions tailored for online businesses. As SMEs increasingly integrate e-commerce into their operations, the demand for cloud ERP systems that streamline inventory management and order processing will rise, enabling providers to cater to this expanding market segment effectively.