Region:Global

Author(s):Shubham

Product Code:KRAA3596

Pages:92

Published On:September 2025

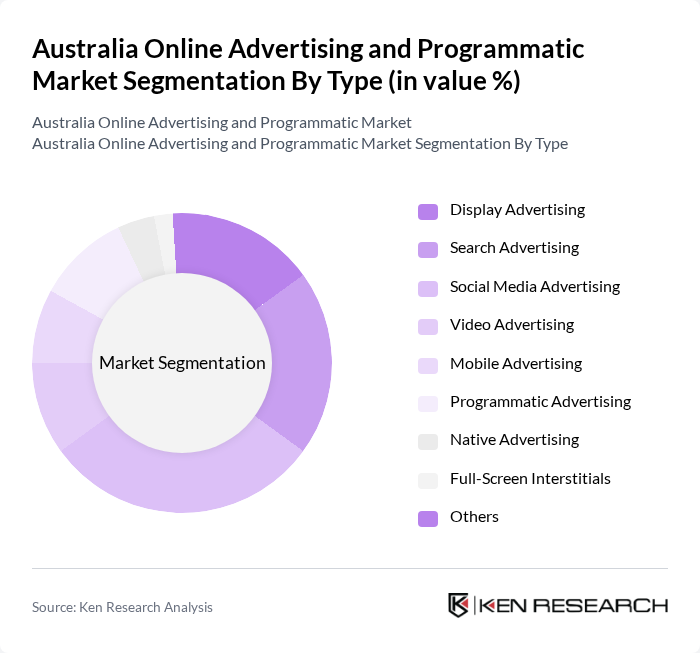

By Type:The online advertising market is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Mobile Advertising, Programmatic Advertising, Native Advertising, Full-Screen Interstitials, and Others. Among these, Social Media Advertising has emerged as a dominant force, driven by the increasing time spent by users on platforms like Facebook, Instagram, and TikTok. Advertisers are leveraging these platforms to reach targeted demographics effectively, resulting in higher engagement rates and return on investment. The market is also experiencing rapid growth in video and mobile advertising, reflecting broader shifts in consumer media consumption .

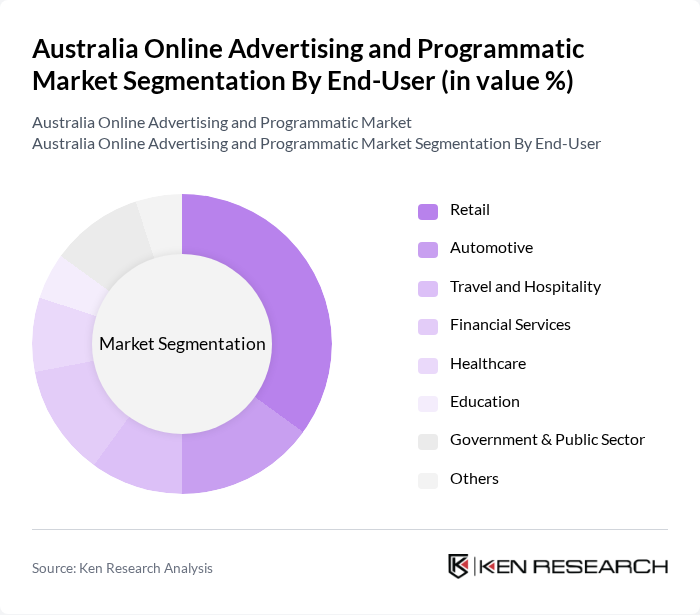

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Hospitality, Financial Services, Healthcare, Education, Government & Public Sector, and Others. The Retail sector is the leading end-user, as businesses increasingly shift their marketing budgets towards online platforms to capture the growing number of consumers shopping online. This trend is further fueled by the COVID-19 pandemic, which accelerated the adoption of e-commerce and digital marketing strategies. Financial services and automotive sectors are also significant contributors, leveraging targeted digital campaigns to drive customer acquisition and engagement .

The Australia Online Advertising and Programmatic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Australia Pty Ltd, Meta Platforms Australia Pty Ltd (Facebook & Instagram), Adobe Systems Australia Pty Ltd, The Trade Desk Australia Pty Ltd, Sizmek by Amazon, X Australia Pty Ltd (formerly Twitter), MediaMath Australia Pty Ltd, Verizon Media Australia Pty Ltd (formerly Oath), AdRoll Australia Pty Ltd, Taboola Australia Pty Ltd, Outbrain Australia Pty Ltd, Criteo Australia Pty Ltd, Quantcast Australia Pty Ltd, Adform Australia Pty Ltd, Rakuten Advertising Australia Pty Ltd, Amobee Australia Pty Ltd, PubMatic Australia Pty Ltd, Magnite Australia Pty Ltd, SpotX Australia Pty Ltd, GroupM Australia Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian online advertising market appears promising, driven by technological advancements and evolving consumer preferences. As programmatic buying continues to gain traction, advertisers are expected to increasingly leverage automated solutions for more efficient ad placements. Additionally, the integration of artificial intelligence will enhance targeting capabilities, allowing for more personalized and effective campaigns. These trends indicate a dynamic landscape where innovation and adaptability will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Mobile Advertising Programmatic Advertising Native Advertising Full-Screen Interstitials Others |

| By End-User | Retail Automotive Travel and Hospitality Financial Services Healthcare Education Government & Public Sector Others |

| By Industry Vertical | E-commerce Telecommunications Media and Entertainment Real Estate Consumer Goods Financial Institutions Others |

| By Advertising Format | Banner Ads Rich Media Ads Text Ads Video Ads Sponsored Content Native Ads Others |

| By Sales Channel | Direct Sales Agency Sales Programmatic Sales Affiliate Marketing Ad Exchanges Others |

| By Geographic Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Northern Territory Australian Capital Territory Others |

| By Customer Segment | Small and Medium Enterprises Large Enterprises Startups Non-Profit Organizations Agencies & Media Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Digital Advertising | 120 | Marketing Directors, Digital Strategists |

| Programmatic Ad Platforms | 100 | Product Managers, Sales Executives |

| Media Buying Agencies | 80 | Media Buyers, Account Managers |

| Consumer Insights on Digital Ads | 120 | Market Researchers, Brand Managers |

| Technology Providers in Advertising | 70 | CTOs, Data Analysts |

The Australia Online Advertising and Programmatic Market is valued at approximately USD 17 billion, reflecting significant growth driven by digitalization, e-commerce, and consumer preferences for online shopping and services.