Region:Central and South America

Author(s):Shubham

Product Code:KRAA3595

Pages:95

Published On:September 2025

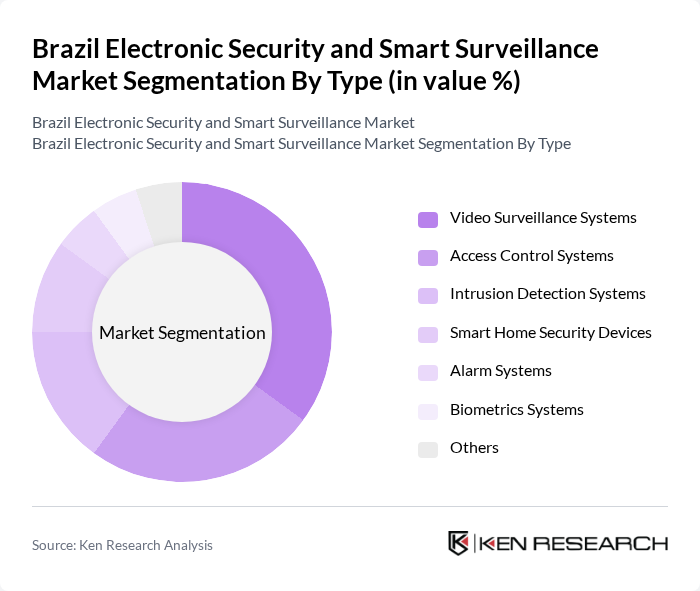

By Type:The market is segmented into various types of electronic security and smart surveillance systems, including video surveillance systems, access control systems, intrusion detection systems, smart home security devices, alarm systems, biometrics systems, and others. Each sub-segment plays a critical role in enhancing security measures across residential, commercial, industrial, and government applications .

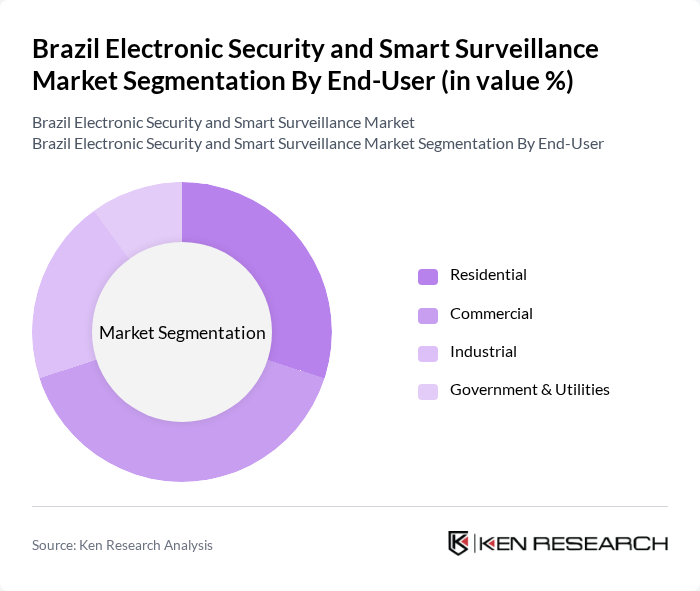

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. Each segment has distinct security requirements, driving demand for tailored electronic security solutions. Residential and commercial sectors are the largest adopters, reflecting the need for asset protection and safety in densely populated urban environments .

The Brazil Electronic Security and Smart Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Axis Communications AB, Robert Bosch GmbH (Bosch Security Systems), Honeywell International Inc. (Honeywell Security), Motorola Solutions, Inc., Ubiquiti Inc., Anviz Global Inc., Magnetic Autocontrol GmbH, Global Guardian, LLC, Genetec Inc., FLIR Systems, Inc., Panasonic Corporation (Panasonic Security), Hanwha Techwin (formerly Samsung Techwin), Milestone Systems A/S, SecureTech (local Brazilian player, if available), ZKTeco Brasil (local subsidiary, if available) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian electronic security and smart surveillance market appears promising, driven by ongoing technological innovations and increasing public safety investments. As urbanization accelerates, the demand for integrated security solutions will likely rise, fostering collaboration between government and private sectors. Additionally, the focus on smart city initiatives will propel the adoption of advanced surveillance technologies, ensuring enhanced safety and security for citizens. The market is poised for significant growth as stakeholders adapt to evolving security needs and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Access Control Systems Intrusion Detection Systems Smart Home Security Devices Alarm Systems Biometrics Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Retail Security Transportation Security Banking and Financial Services Public Infrastructure Home Automation Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores |

| By Region | Southeast Brazil (São Paulo, Rio de Janeiro, Minas Gerais) South Brazil (Rio Grande do Sul, Paraná, Santa Catarina) North Brazil (Amazonas, Pará, Rondônia) Northeast Brazil (Bahia, Pernambuco, Ceará) Central-West Brazil (Distrito Federal, Goiás, Mato Grosso) |

| By Price Range | Low-End Mid-Range High-End |

| By Policy Support | Government Subsidies Tax Incentives Grants for Security Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Security Systems | 60 | Homeowners, Property Managers |

| Commercial Surveillance Solutions | 50 | Facility Managers, Security Directors |

| Government Surveillance Initiatives | 40 | Public Safety Officials, Urban Planners |

| Smart City Surveillance Projects | 45 | City Officials, Technology Consultants |

| Integrated Security Systems | 55 | IT Managers, Security System Integrators |

The Brazil Electronic Security and Smart Surveillance Market is valued at approximately USD 2.6 billion, driven by urbanization, rising crime rates, and the demand for advanced security solutions across various sectors, including residential, commercial, and government.