Region:North America

Author(s):Geetanshi

Product Code:KRAA3635

Pages:100

Published On:September 2025

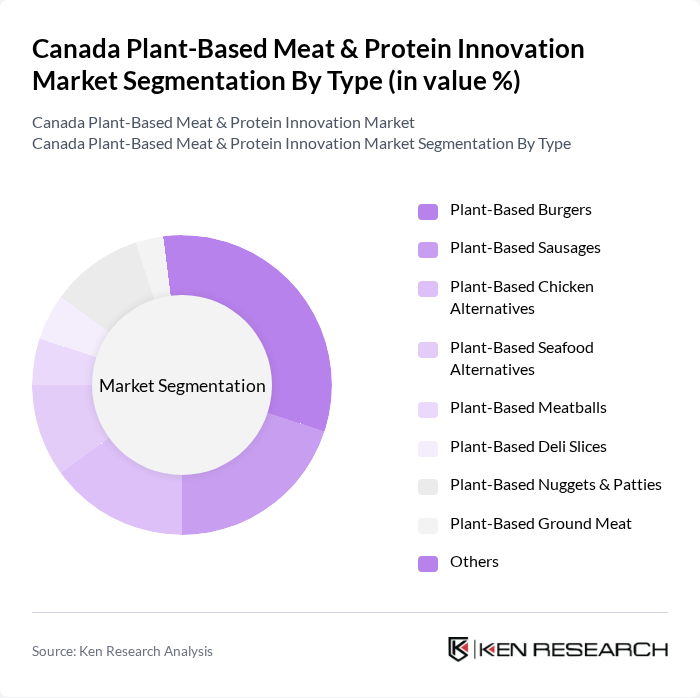

By Type:The market is segmented into various types of plant-based meat products, including Plant-Based Burgers, Plant-Based Sausages, Plant-Based Chicken Alternatives, Plant-Based Seafood Alternatives, Plant-Based Meatballs, Plant-Based Deli Slices, Plant-Based Nuggets & Patties, Plant-Based Ground Meat, and Others. Among these, Plant-Based Burgers have emerged as the leading sub-segment due to their popularity and versatility in meal preparation. Consumers are increasingly opting for burgers as a convenient and satisfying alternative to traditional meat products, driving significant sales growth in this category. This trend is supported by retail and foodservice data indicating burgers as the top-selling plant-based meat product in Canada .

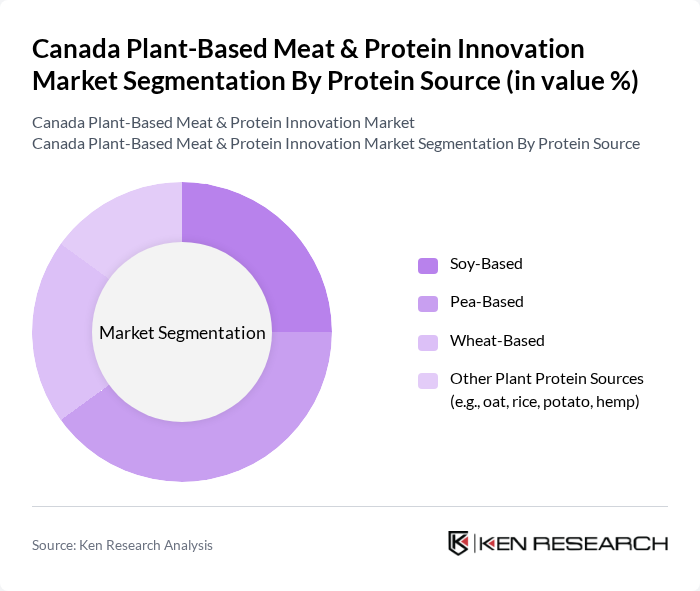

By Protein Source:The market is also segmented by protein source, including Soy-Based, Pea-Based, Wheat-Based, and Other Plant Protein Sources (e.g., oat, rice, potato, hemp). The Pea-Based protein segment is currently leading the market due to its favorable nutritional profile and versatility in product formulations. Consumers are increasingly aware of the health benefits associated with pea protein, such as its high protein content and low allergenic potential, making it a preferred choice among manufacturers and consumers alike. Industry reports confirm pea protein's dominance in new product launches and retail sales .

The Canada Plant-Based Meat & Protein Innovation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beyond Meat, Maple Leaf Foods (Lightlife, Field Roast), Gardein (Conagra Brands), The Very Good Food Company (The Very Good Butchers), Daiya Foods, Yves Veggie Cuisine, Tofurky, MorningStar Farms (Kellogg Company), Quorn Foods, Eat Just, Oumph!, Alpha Foods, Impossible Foods, Big Mountain Foods, Modern Meat contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian plant-based meat and protein market appears promising, driven by increasing consumer awareness and demand for sustainable food options. As the market evolves, innovations in product development and technology will likely enhance the appeal of plant-based alternatives. Additionally, the anticipated growth in the vegan and vegetarian population will further stimulate market dynamics. Companies that adapt to consumer preferences and invest in quality improvements are expected to thrive in this competitive landscape, fostering a more sustainable food system.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-Based Burgers Plant-Based Sausages Plant-Based Chicken Alternatives Plant-Based Seafood Alternatives Plant-Based Meatballs Plant-Based Deli Slices Plant-Based Nuggets & Patties Plant-Based Ground Meat Others |

| By Protein Source | Soy-Based Pea-Based Wheat-Based Other Plant Protein Sources (e.g., oat, rice, potato, hemp) |

| By End-User | Retail Consumers Food Service Industry Institutional Buyers Online Retailers |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Specialty Stores E-commerce Platforms Direct-to-Consumer Sales |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Nutritional Profile | High Protein Low Carb Gluten-Free |

| By Product Form | Frozen Products Chilled Products Shelf-Stable Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plant-Based Meat Retailers | 80 | Store Managers, Category Buyers |

| Food Service Providers | 60 | Restaurant Owners, Menu Developers |

| Health and Wellness Influencers | 40 | Nutritionists, Fitness Coaches |

| Consumer Insights from Focus Groups | 50 | Health-Conscious Consumers, Vegans |

| Industry Experts and Analysts | 40 | Market Analysts, Food Scientists |

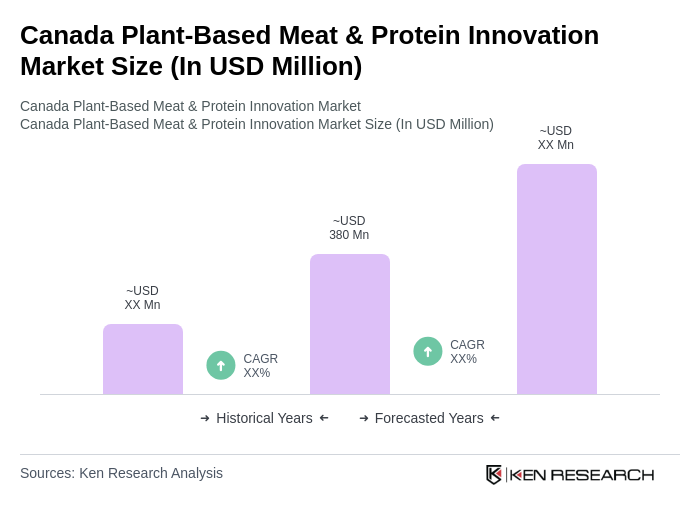

The Canada Plant-Based Meat & Protein Innovation Market is valued at approximately USD 380 million, reflecting a significant growth trend driven by consumer demand for healthier and sustainable food options.