Chile Cybersecurity and SOC-aaS Market Overview

- The Chile Cybersecurity and SOC-aaS Market is valued at USD 500 million, based on a five-year historical analysis. This growth is primarily driven by the increasing frequency and sophistication of cyber threats, the rising need for data protection, and the accelerated adoption of cloud services across sectors such as BFSI, healthcare, and government. Organizations are investing heavily in cybersecurity solutions to safeguard digital assets, address compliance requirements, and mitigate financial and reputational risks associated with cyber breaches. The market is further propelled by the expansion of Internet of Things (IoT) devices and digital transformation initiatives, which have broadened the attack surface for organizations .

- Santiago remains the dominant city in the Chile Cybersecurity and SOC-aaS Market, attributed to its status as the economic and technological hub of the country. The concentration of financial institutions, technology companies, and government agencies in Santiago drives demand for advanced cybersecurity solutions. Other notable regions, including Valparaíso and Concepción, are also experiencing increased cybersecurity investments, supported by growing digital infrastructure and regional business expansion .

- In 2023, the Chilean government enacted the “Ley Marco sobre Ciberseguridad e Infraestructura Crítica de la Información” (Framework Law on Cybersecurity and Critical Information Infrastructure), issued by the Ministry of the Interior and Public Security. This law mandates that operators of critical infrastructure sectors—including energy, telecommunications, banking, and healthcare—implement specific cybersecurity measures, such as risk assessments, incident reporting, and minimum technical standards. The regulation aims to enhance national resilience against cyber threats and ensure the protection of sensitive data, thereby fostering a secure digital environment for businesses and citizens .

Chile Cybersecurity and SOC-aaS Market Segmentation

By Solution Type:The solution type segmentation includes Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management (IAM), and Others (such as Security Operations and Threat Intelligence). Network Security is currently the leading subsegment, driven by the need to protect increasingly complex enterprise networks from unauthorized access, malware, and advanced persistent threats. Organizations are prioritizing investments in network security solutions to safeguard infrastructure and data, particularly as remote work, IoT adoption, and cloud migration accelerate. Endpoint and cloud security are also gaining traction due to the proliferation of mobile devices and cloud-based operations .

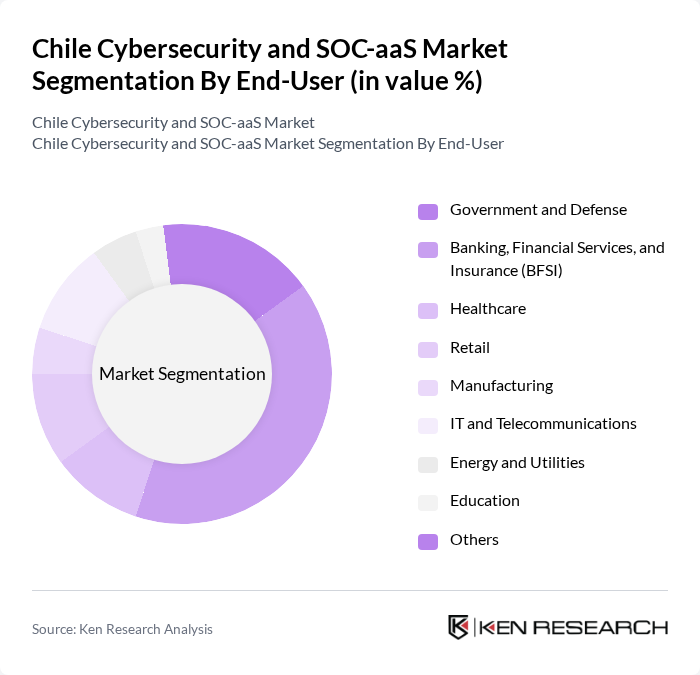

By End-User:The end-user segmentation covers Government and Defense, Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail, Manufacturing, IT and Telecommunications, Energy and Utilities, Education, and Others. The BFSI sector is the dominant end-user, reflecting the sector's exposure to sophisticated cyber threats, regulatory pressures, and high-value data. Financial institutions are leading investments in cybersecurity to comply with evolving regulations and protect against financial fraud and data breaches. Government, healthcare, and IT/telecommunications sectors are also notable contributors, driven by the need to secure critical infrastructure and sensitive information .

Chile Cybersecurity and SOC-aaS Market Competitive Landscape

The Chile Cybersecurity and SOC-aaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., IBM Security, Microsoft Corporation, Trend Micro Incorporated, Entel S.A., SONDA S.A., NovaRed S.A., RSA Security LLC, CyberArk Software Ltd., Deloitte Chile, EY Chile (Ernst & Young), and KPMG Chile contribute to innovation, geographic expansion, and service delivery in this space.

Chile Cybersecurity and SOC-aaS Market Industry Analysis

Growth Drivers

- Increasing Cyber Threats:The Chilean cybersecurity landscape is significantly influenced by the rise in cyber threats, with reported incidents increasing by 30% in future. The National Cybersecurity Agency of Chile noted that over 1,500 cyberattacks were recorded in the first half of future alone. This alarming trend has prompted organizations to invest heavily in cybersecurity measures, driving demand for advanced solutions and services, particularly in the SOC-as-a-Service (SOC-aaS) sector, which is expected to see substantial growth.

- Government Initiatives for Cybersecurity:The Chilean government has prioritized cybersecurity, allocating approximately USD 25 million in future to enhance national cybersecurity infrastructure. This funding supports the implementation of the National Cybersecurity Strategy, which aims to bolster defenses against cyber threats. Additionally, the government is promoting public-private partnerships to foster innovation in cybersecurity technologies, further stimulating market growth and encouraging enterprises to adopt robust cybersecurity frameworks.

- Rising Demand for Compliance and Regulatory Standards:As global data protection regulations tighten, Chilean businesses are increasingly focused on compliance. The implementation of the Personal Data Protection Law in future has led to a surge in demand for cybersecurity solutions that ensure compliance with these regulations. Companies are investing in SOC-aaS to meet these standards, with an estimated 45% of organizations planning to enhance their cybersecurity measures to align with regulatory requirements in future.

Market Challenges

- Lack of Skilled Workforce:The cybersecurity sector in Chile faces a significant skills gap, with an estimated shortage of 12,000 cybersecurity professionals as of future. This shortage hampers the ability of organizations to effectively implement and manage cybersecurity solutions. The lack of trained personnel not only increases operational risks but also drives up costs as companies are forced to invest in external services, further complicating the market landscape.

- High Costs of Cybersecurity Solutions:The financial burden of implementing comprehensive cybersecurity measures poses a challenge for many organizations in Chile. The average cost of deploying advanced cybersecurity solutions can exceed USD 120,000 annually for medium-sized enterprises. This high investment requirement often leads to budget constraints, particularly for small and medium-sized enterprises (SMEs), which may delay or limit their cybersecurity initiatives, leaving them vulnerable to attacks.

Chile Cybersecurity and SOC-aaS Market Future Outlook

The Chilean cybersecurity market is poised for significant evolution, driven by technological advancements and increasing awareness of cyber threats. As organizations continue to embrace digital transformation, the demand for integrated cybersecurity solutions will rise. Furthermore, the adoption of AI and machine learning technologies is expected to enhance threat detection and response capabilities. In future, the market is likely to witness a shift towards more automated and proactive cybersecurity measures, ensuring better protection against evolving threats.

Market Opportunities

- Expansion of Managed Security Services:The growing complexity of cyber threats presents an opportunity for managed security service providers (MSSPs) to expand their offerings. With an increasing number of organizations seeking outsourced cybersecurity solutions, the MSSP market in Chile is projected to grow, providing businesses with access to expert resources and advanced technologies without the need for significant internal investment.

- Adoption of AI and Machine Learning in Cybersecurity:The integration of AI and machine learning into cybersecurity practices is becoming a critical opportunity for organizations in Chile. These technologies can enhance threat detection and response times, reducing the impact of cyber incidents. As companies increasingly recognize the value of AI-driven solutions, investments in this area are expected to rise, fostering innovation and improving overall cybersecurity resilience.