Colombia Luggage & Bags Retail Market Overview

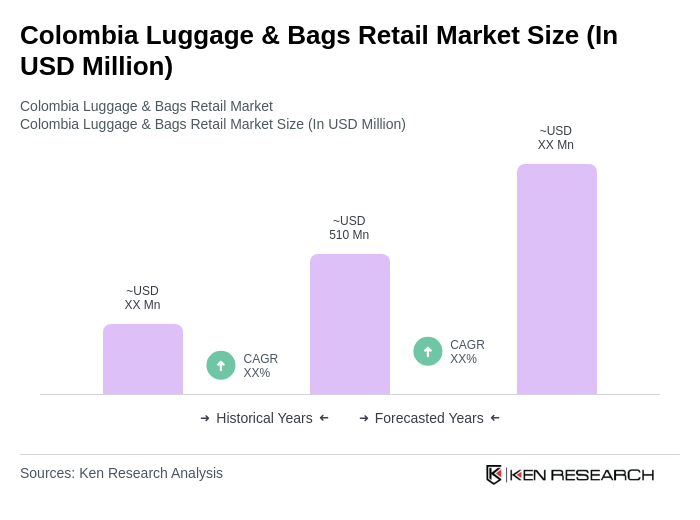

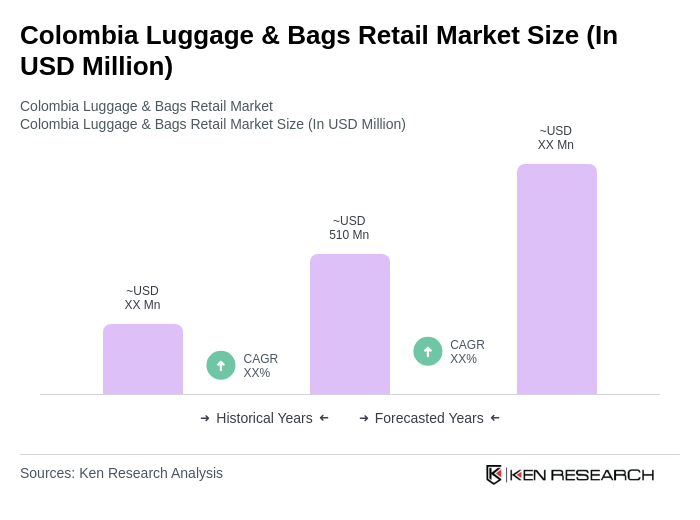

- The Colombia Luggage & Bags Retail Market is valued at USD 510 million, based on a five-year historical analysis. This value reflects the combined size of the luggage and handbag segments, with luggage accounting for over USD 90 million and handbags representing a substantial portion of the market. Growth is primarily driven by increased travel activities, both domestic and international, as well as a rising trend among fashion-conscious consumers seeking stylish and functional luggage and bags. The market has seen a notable uptick in demand for high-quality, durable, and premium products, reflecting evolving consumer preferences for both practicality and aesthetics .

- Key cities such asBogotá, Medellín, and Calidominate the market due to their large populations and robust economic activities. Bogotá, as the capital, serves as a central hub for commerce and tourism, while Medellín and Cali contribute significantly through their dynamic retail sectors and expanding middle-class populations. These urban centers are characterized by a high concentration of retail outlets and the rapid growth of e-commerce platforms, which continue to enhance market accessibility and consumer choice .

- In 2023, the Colombian government introduced sustainability-focused regulations for the luggage and bags sector, including incentives for manufacturers to adopt eco-friendly materials and processes, and requirements to reduce plastic usage in packaging. These measures are set forth in the “Resolución 1407 de 2018” issued by the Ministerio de Ambiente y Desarrollo Sostenible, which establishes guidelines for the management of packaging waste and encourages the use of recyclable and sustainable materials. The regulation mandates compliance thresholds for producers and importers, aligning with global sustainability objectives and promoting environmentally responsible consumption .

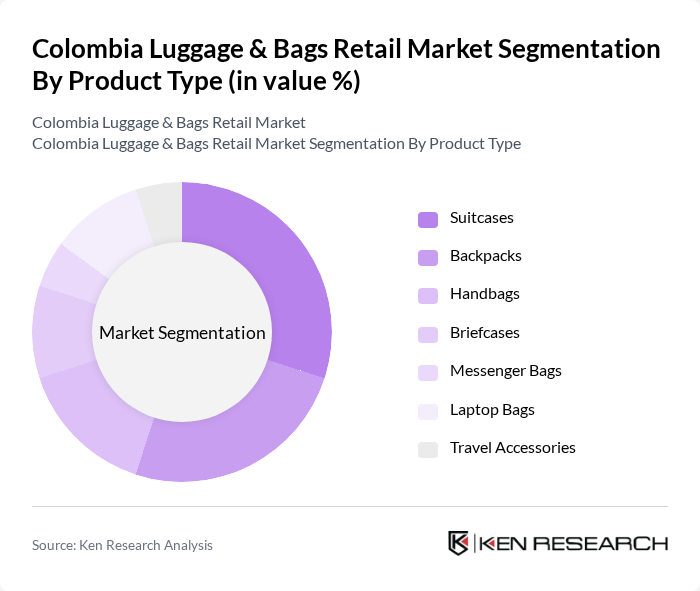

Colombia Luggage & Bags Retail Market Segmentation

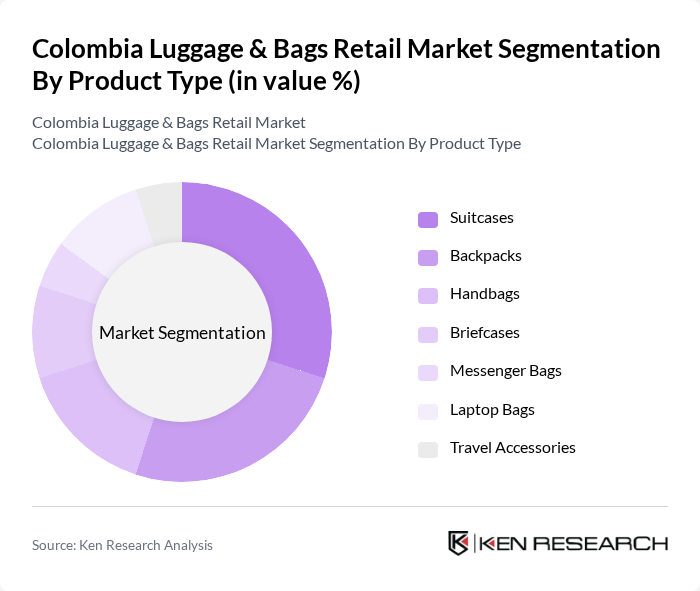

By Product Type:The product type segmentation includes suitcases, backpacks, handbags, briefcases, messenger bags, laptop bags, and travel accessories.Suitcases and backpacksare especially popular due to their practicality for travel and daily use. The increasing trend of travel, particularly among younger consumers and professionals, has fueled demand for stylish, functional backpacks, while suitcases remain essential for longer journeys. Handbags and laptop bags are also experiencing growth, driven by rising urbanization and the influence of global fashion trends .

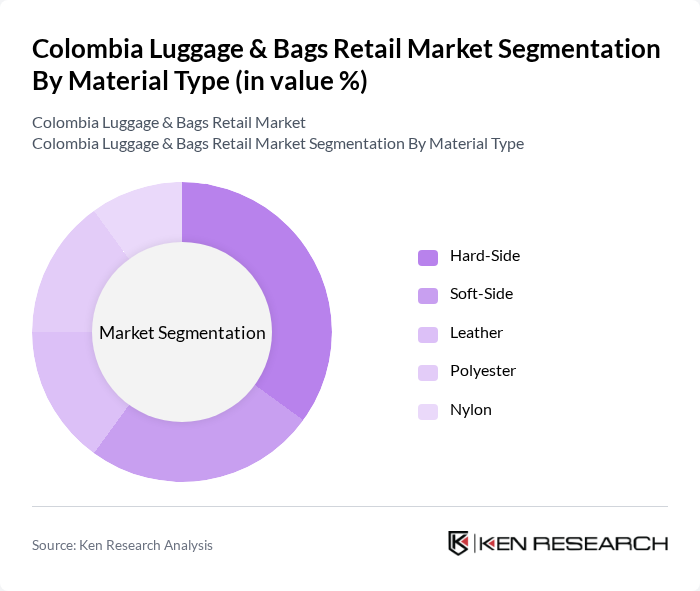

By Material Type:The material segmentation includes hard-side, soft-side, leather, polyester, and nylon.Hard-side luggageis gaining traction for its durability and security, making it a preferred choice for frequent travelers.Soft-side luggageoffers flexibility and lightweight features, appealing to a broad consumer base.Leather productsare favored for their premium appearance and longevity, whilepolyester and nylonremain popular for affordability and variety. The market is also witnessing a shift toward sustainable and vegan materials, reflecting growing environmental awareness among Colombian consumers .

Colombia Luggage & Bags Retail Market Competitive Landscape

The Colombia Luggage & Bags Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite, American Tourister, Totto, Kappa, LVMH Moët Hennessy Louis Vuitton SE, PVH Corp., Dolce & Gabbana S.r.l., Capri Holdings Limited, Chanel SA, Adidas AG, Fossil Group, Inc., H & M Hennes & Mauritz AB, Andes Bags Ltda, Kipling, and Delsey contribute to innovation, geographic expansion, and service delivery in this space .

Colombia Luggage & Bags Retail Market Industry Analysis

Growth Drivers

- Increasing Travel and Tourism:In future, Colombia is projected to welcome approximately 4.5 million international tourists, a significant increase from 4 million in the previous year. This surge in travel is driven by improved safety and marketing efforts by the government, which aims to boost tourism revenue to $5 billion. As travel increases, so does the demand for luggage and bags, creating a robust market for retailers in this sector.

- Rising Disposable Income:The average disposable income in Colombia is expected to reach $6,500 per capita in future, up from $6,200 in the previous year. This increase allows consumers to spend more on non-essential items, including luggage and bags. As more Colombians enter the middle class, their purchasing power enhances demand for higher-quality and branded luggage, driving growth in the retail market.

- Growing E-commerce Adoption:E-commerce sales in Colombia are projected to exceed $20 billion in future, reflecting a 15% increase from the previous year. The rise of online shopping platforms has made it easier for consumers to access a variety of luggage options. This trend is particularly appealing to younger consumers, who prefer the convenience of online shopping, thus expanding the market for luggage retailers significantly.

Market Challenges

- Economic Instability:Colombia's economy is facing challenges, with GDP growth projected at only 2% in future, down from 3.5% in the previous year. This slowdown can lead to reduced consumer spending on discretionary items like luggage. Economic uncertainty may also affect retailers' ability to invest in inventory and marketing, hindering overall market growth.

- Competition from Low-Cost Imports:The influx of low-cost luggage imports, particularly from Asia, poses a significant challenge for local manufacturers. In future, it is estimated that imports will account for 40% of the luggage market in Colombia. This competition pressures local brands to lower prices, potentially impacting profit margins and market share for domestic retailers.

Colombia Luggage & Bags Retail Market Future Outlook

The Colombia luggage and bags retail market is poised for dynamic growth, driven by increasing travel and a burgeoning middle class. As disposable incomes rise, consumers are likely to seek higher-quality products, while the expansion of e-commerce will facilitate access to diverse offerings. Additionally, the trend towards sustainable and eco-friendly products is expected to gain traction, aligning with global consumer preferences. Retailers that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

Market Opportunities

- Expansion of Online Retail Channels:With e-commerce projected to grow significantly, retailers can enhance their online presence to capture a larger market share. By investing in digital marketing and user-friendly platforms, companies can reach a broader audience, particularly younger consumers who prefer online shopping.

- Development of Eco-Friendly Products:As consumer awareness of environmental issues increases, there is a growing demand for sustainable luggage options. Retailers can capitalize on this trend by introducing eco-friendly materials and production processes, appealing to environmentally conscious consumers and differentiating themselves in a competitive market.