Region:Africa

Author(s):Geetanshi

Product Code:KRAA3666

Pages:88

Published On:September 2025

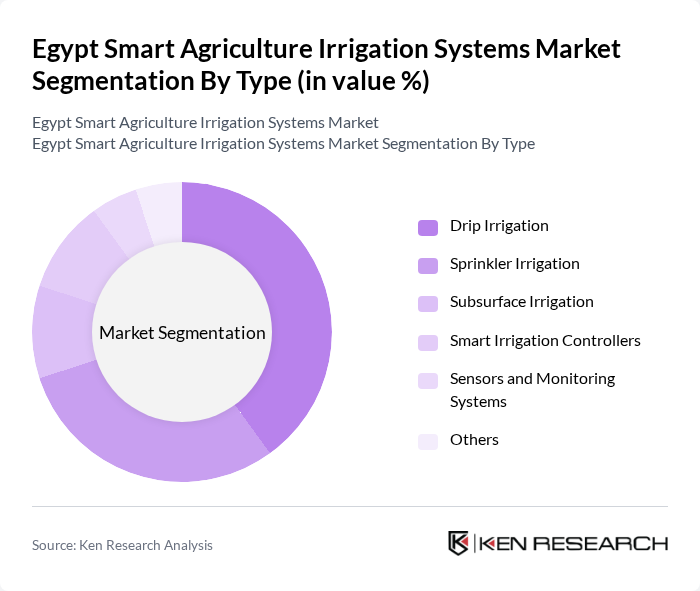

By Type:The market is segmented into various types of irrigation systems, including Drip Irrigation, Sprinkler Irrigation, Subsurface Irrigation, Smart Irrigation Controllers, Sensors and Monitoring Systems, and Others. Drip Irrigation is the most widely adopted due to its high efficiency in water usage and ability to deliver nutrients directly to plant roots, which is crucial in Egypt's water-scarce environment. Sprinkler Irrigation also holds a significant share, particularly in larger agricultural setups where uniform water distribution is essential. The adoption of smart controllers and sensors is increasing, driven by the need for real-time monitoring and automation .

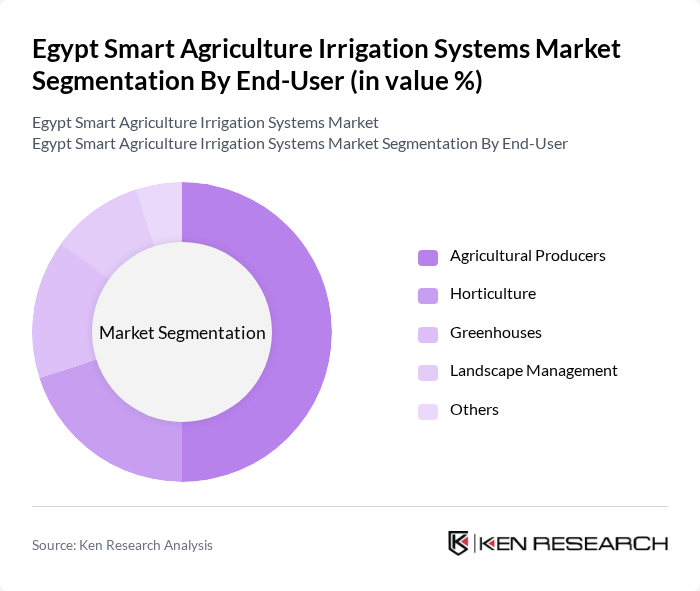

By End-User:The end-user segmentation includes Agricultural Producers, Horticulture, Greenhouses, Landscape Management, and Others. Agricultural Producers dominate the market as the primary users of irrigation systems to enhance crop yield and manage water resources effectively. The increasing focus on sustainable farming practices and the need for higher productivity in agriculture are driving the adoption of smart irrigation solutions among this segment. Horticulture and greenhouse operators are also rapidly adopting these systems for precision water management and improved crop quality .

The Egypt Smart Agriculture Irrigation Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netafim, Jain Irrigation Systems Ltd., Rain Bird Corporation, Hunter Industries, The Toro Company, Valmont Industries, Inc., Lindsay Corporation, Rivulis Irrigation, El-Sewedy Electric Company, and Misr El Kheir Foundation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart agriculture irrigation systems market in Egypt appears promising, driven by increasing government support and technological advancements. As water scarcity intensifies, the demand for efficient irrigation solutions will likely rise. Furthermore, the integration of renewable energy sources and data analytics into irrigation practices is expected to enhance operational efficiency. In future, the market is anticipated to witness a surge in smart farming practices, fostering innovation and sustainability in the agricultural sector, ultimately contributing to food security.

| Segment | Sub-Segments |

|---|---|

| By Type | Drip Irrigation Sprinkler Irrigation Subsurface Irrigation Smart Irrigation Controllers Sensors and Monitoring Systems Others |

| By End-User | Agricultural Producers Horticulture Greenhouses Landscape Management Others |

| By Application | Crop Irrigation Turf and Landscape Irrigation Greenhouse Irrigation Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships |

| By Distribution Channel | Direct Sales Online Sales Distributors and Dealers Others |

| By Component | Irrigation Equipment Control Systems Software Solutions Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smallholder Farmers Using Smart Irrigation | 120 | Agricultural Producers, Farm Managers |

| Commercial Farms Implementing Advanced Irrigation | 80 | Farm Owners, Agricultural Engineers |

| Agricultural Technology Providers | 60 | Product Managers, Sales Directors |

| Government Agricultural Policy Makers | 45 | Policy Analysts, Agricultural Advisors |

| Research Institutions Focused on Agriculture | 55 | Researchers, Academic Professors |

The Egypt Smart Agriculture Irrigation Systems Market is valued at approximately USD 95 million, reflecting a growing demand for efficient water management solutions in agriculture, particularly in arid regions like Egypt.