Region:Africa

Author(s):Shubham

Product Code:KRAA3611

Pages:80

Published On:September 2025

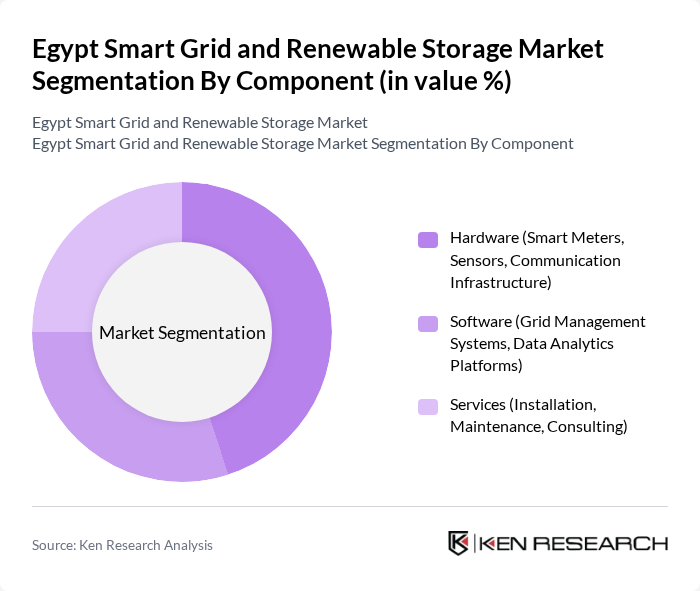

By Component:The components of the market include hardware, software, and services. Hardware encompasses smart meters, sensors, and communication infrastructure, while software includes grid management systems and data analytics platforms. Services cover installation, maintenance, and consulting, which are essential for the effective deployment and operation of smart grid technologies .

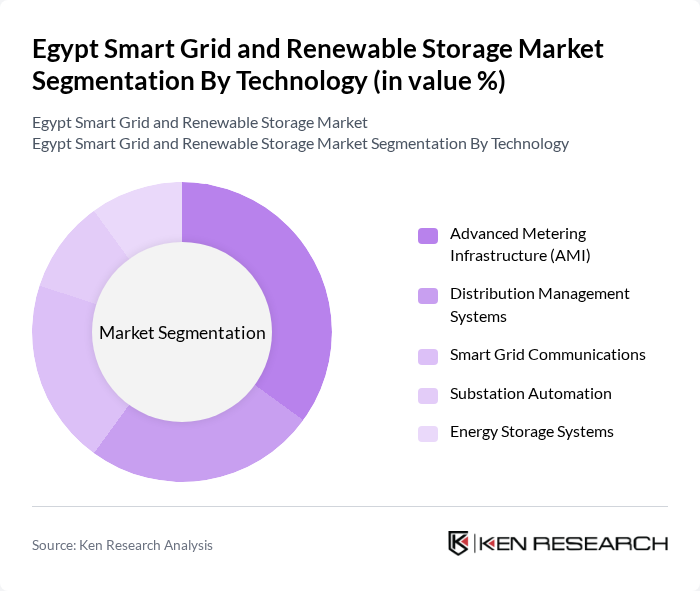

By Technology:The technology segment includes advanced metering infrastructure (AMI), distribution management systems, smart grid communications, substation automation, and energy storage systems. These technologies are crucial for enhancing grid reliability, efficiency, and the integration of renewable energy sources .

The Egypt Smart Grid and Renewable Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Egyptian Electricity Holding Company (EEHC), Siemens Energy, Schneider Electric, ABB Ltd., General Electric (GE Digital Energy), Hitachi Energy, Honeywell International Inc., Landis+Gyr, Itron Inc., Oracle Corporation (Utilities Solutions), IBM Corporation (Smart Grid Solutions), Cisco Systems Inc., Enel X, KEPCO (Korea Electric Power Corporation), Toshiba Energy Systems & Solutions contribute to innovation, geographic expansion, and service delivery in this space .

The future of Egypt's smart grid and renewable storage market appears promising, driven by increasing investments and technological advancements. The government’s commitment to achieving 20% renewable energy in future will likely stimulate further growth in the sector. Additionally, the integration of energy storage solutions is expected to enhance grid stability and reliability. As international collaborations expand, Egypt may attract more foreign investments, fostering innovation and accelerating the transition to a sustainable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (Smart Meters, Sensors, Communication Infrastructure) Software (Grid Management Systems, Data Analytics Platforms) Services (Installation, Maintenance, Consulting) |

| By Technology | Advanced Metering Infrastructure (AMI) Distribution Management Systems Smart Grid Communications Substation Automation Energy Storage Systems |

| By Application | Generation Transmission Distribution Consumption |

| By End-User | Utilities Independent Power Producers (IPPs) Government and Municipalities Residential Commercial Industrial |

| By Geography | Cairo Alexandria Suez Canal Region Upper Egypt |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Renewable Energy Integration | Solar Integration Wind Integration Hybrid Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies' Smart Grid Initiatives | 100 | Energy Managers, Project Directors |

| Renewable Energy Storage Solutions | 80 | Product Managers, Technical Directors |

| Government Policy Makers in Energy Sector | 50 | Regulatory Officials, Policy Advisors |

| Technology Providers for Smart Grids | 70 | Sales Directors, R&D Managers |

| Consultants in Renewable Energy | 40 | Energy Analysts, Sustainability Consultants |

The Egypt Smart Grid and Renewable Storage Market is valued at approximately USD 160 million, driven by increasing electricity demand, government initiatives under Egypt Vision 2030, and the integration of renewable energy sources like solar and wind.