Region:Europe

Author(s):Geetanshi

Product Code:KRAA3697

Pages:85

Published On:September 2025

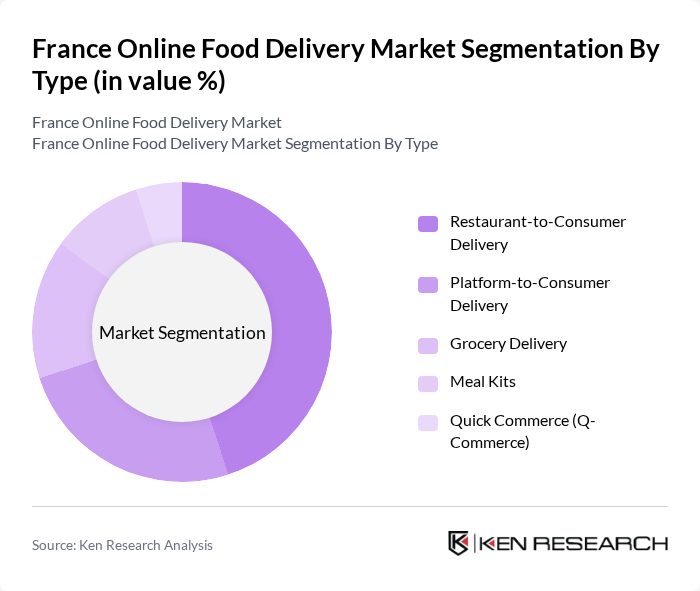

By Type:The market is segmented into various types, including Restaurant-to-Consumer Delivery, Platform-to-Consumer Delivery, Grocery Delivery, Meal Kits, Specialty Foods, and Others. Among these,Restaurant-to-Consumer Deliveryis the most dominant segment, driven by the increasing number of restaurants partnering with delivery platforms and the growing consumer preference for convenience. The rise of mobile applications has also facilitated easy access to a variety of dining options, making this segment particularly appealing to consumers. The rapid expansion of grocery delivery and the emergence of quick commerce players have also diversified the market landscape, with drive-thru and home delivery services gaining significant traction among urban consumers .

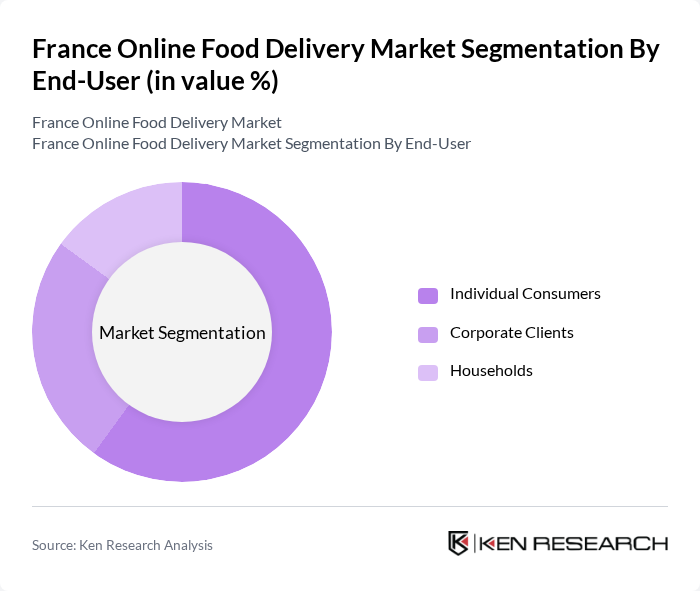

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, and Event Catering.Individual Consumersrepresent the largest segment, as the convenience of food delivery appeals to busy lifestyles and the growing trend of online shopping. The rise in remote working has also contributed to increased demand from corporate clients, while event catering is gaining traction for special occasions and corporate events. The adoption of digital payment methods and loyalty programs has further encouraged repeat purchases among individual consumers .

The France Online Food Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deliveroo, Uber Eats, Just Eat, Frichti, Stuart, Carrefour, E.Leclerc Drive, Monoprix, Auchan, Casino, Glovo, Nestor, Popchef, Resto-In, La Belle Assiette contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online food delivery market in France appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, companies are likely to enhance their service offerings through innovative solutions, such as AI-driven recommendations and improved delivery logistics. Additionally, the growing emphasis on sustainability will push businesses to adopt eco-friendly practices, aligning with consumer values. Overall, the market is set to evolve, presenting new opportunities for growth and differentiation in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Restaurant-to-Consumer Delivery Platform-to-Consumer Delivery Grocery Delivery Meal Kits Specialty Foods Others |

| By End-User | Individual Consumers Corporate Clients Event Catering |

| By Sales Channel | Mobile Applications Websites Third-Party Platforms Supermarket/Hypermarket Online Platforms |

| By Delivery Mode | Home Delivery Pick-Up Services Drive-Thru |

| By Cuisine Type | Italian Asian Fast Food Vegetarian/Vegan French Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Customer Demographics | Age Groups Income Levels Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Food Delivery | 120 | Regular Users, Occasional Users, Non-Users |

| Restaurant Partnerships and Collaborations | 60 | Restaurant Owners, Managers, Franchise Operators |

| Delivery Driver Insights | 50 | Full-time Drivers, Part-time Drivers, Delivery Coordinators |

| Market Trends and Innovations | 40 | Industry Analysts, Food Tech Entrepreneurs, Marketing Executives |

| Impact of COVID-19 on Delivery Services | 45 | Health and Safety Officers, Business Continuity Managers |

The France Online Food Delivery Market is valued at approximately USD 11.5 billion, reflecting significant growth driven by digital platform adoption and changing consumer preferences towards convenience, especially during the pandemic.