Region:Europe

Author(s):Shubham

Product Code:KRAA3608

Pages:90

Published On:September 2025

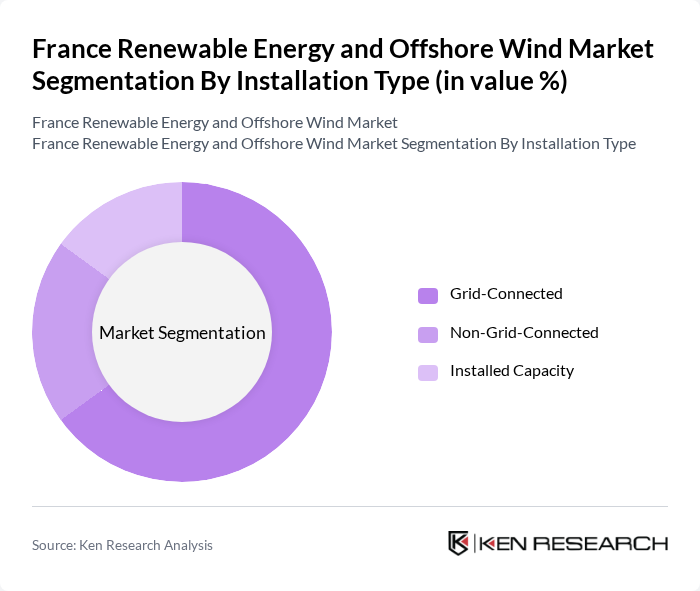

By Installation Type:The installation type segmentation includes Grid-Connected, Non-Grid-Connected, and Installed Capacity. The Grid-Connected segment is currently leading the market due to the increasing integration of renewable energy sources into the national grid, driven by government policies and technological advancements. Non-Grid-Connected systems are gaining traction in remote areas, while Installed Capacity reflects the total energy output potential of existing and planned projects.

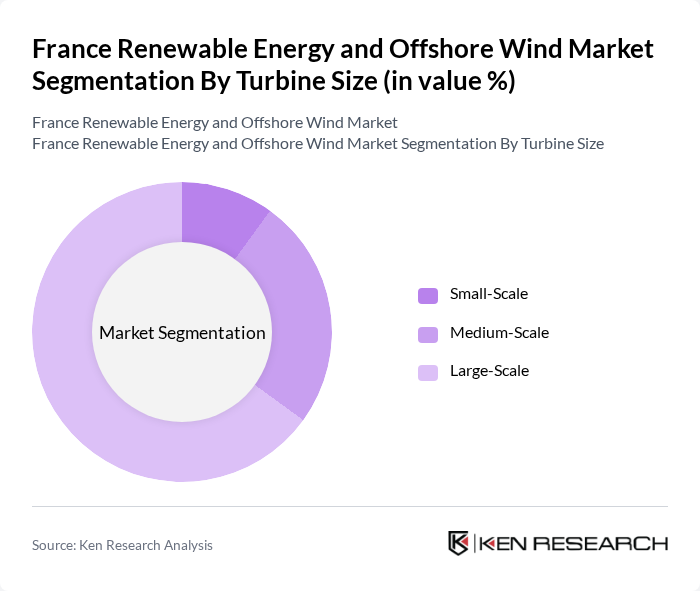

By Turbine Size:The turbine size segmentation encompasses Small-Scale, Medium-Scale, and Large-Scale turbines. The Large-Scale segment dominates the market, driven by the demand for higher energy output and efficiency. Medium-Scale turbines are also significant, particularly in urban areas where space is limited. Small-Scale turbines are primarily used for residential applications, contributing to the diversification of energy sources.

The France Renewable Energy and Offshore Wind Market is characterized by a dynamic mix of regional and international players. Leading participants such as EDF Renewables, Engie SA, TotalEnergies, Siemens Gamesa Renewable Energy S.A., General Electric Company, Vestas Wind Systems A/S, RWE Renewables, Vattenfall AB, Ørsted A/S, Iberdrola S.A., EDP Renewables, Enel Green Power, Nordex SE, Acciona Energía, Mainstream Renewable Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable energy and offshore wind market in France appears promising, driven by increasing investments and a strong commitment to sustainability. In the future, the focus on hybrid energy systems and energy storage solutions is expected to enhance grid stability and efficiency. Additionally, international collaborations will likely facilitate technology transfer and investment, further accelerating the growth of the sector. As the market evolves, the integration of innovative solutions will play a crucial role in meeting France's ambitious renewable energy targets.

| Segment | Sub-Segments |

|---|---|

| By Installation Type | Grid-Connected Non-Grid-Connected Installed Capacity |

| By Turbine Size | Small-Scale Medium-Scale Large-Scale |

| By Location | Onshore Wind Offshore Wind |

| By Technology | Fixed-Bottom Offshore Wind Floating Offshore Wind Advanced Turbine Technology Energy Storage Integration |

| By Coastal Region | Atlantic Coast English Channel Mediterranean Coast Normandy Region |

| By End-User | Utilities Industrial Commercial Residential |

| By Investment Source | Public-Private Partnerships Foreign Direct Investment Government Funding Private Investment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Wind Project Developers | 40 | Project Managers, Business Development Directors |

| Energy Policy Experts | 40 | Regulatory Affairs Specialists, Policy Analysts |

| Environmental Consultants | 40 | Sustainability Consultants, Environmental Impact Assessors |

| Local Community Stakeholders | 40 | Community Leaders, Local Government Officials |

| Energy Market Analysts | 40 | Market Researchers, Financial Analysts |

The France Renewable Energy and Offshore Wind Market is valued at approximately USD 15 billion, reflecting significant growth driven by the demand for clean energy, government initiatives, and advancements in offshore wind technology.