Region:Europe

Author(s):Rebecca

Product Code:KRAA3335

Pages:81

Published On:September 2025

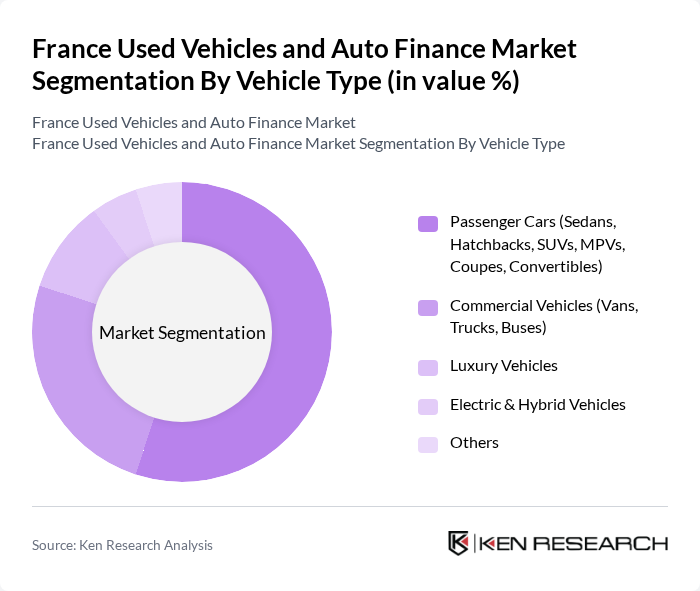

By Vehicle Type:

The vehicle type segmentation reveals that passenger cars dominate the market, accounting for a significant portion of sales. This preference is driven by consumer behavior favoring affordability, variety, and practicality. SUVs, in particular, have shown the fastest growth within the passenger car segment, reflecting evolving consumer preferences. The increasing trend of urbanization and the need for personal mobility solutions have led to a higher demand for sedans, hatchbacks, and SUVs. Additionally, the rise in online platforms has made it easier for consumers to access a wide range of options, further solidifying the dominance of passenger cars in the used vehicle market .

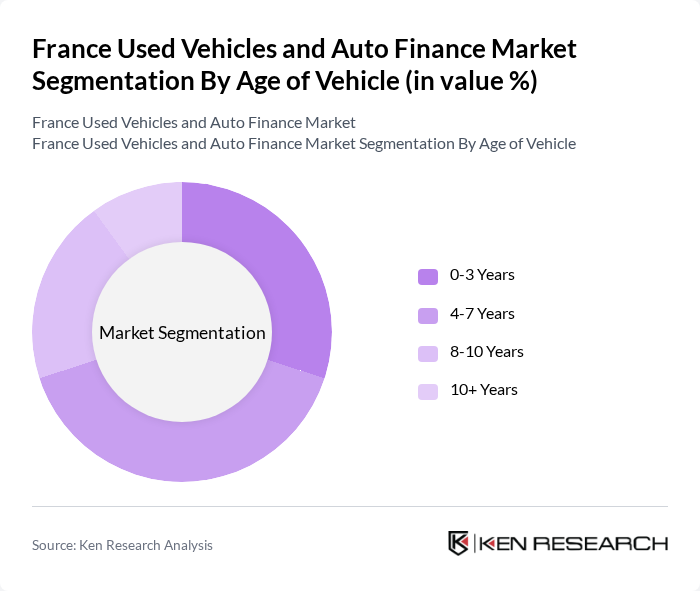

By Age of Vehicle:

The age of vehicle segmentation indicates that vehicles aged 4-7 years are the most popular among consumers. This preference is largely due to the balance they offer between cost and reliability, as these vehicles are often still in good condition while being significantly cheaper than new models. Buyers are increasingly aware of the depreciation rates of vehicles, making slightly older models an attractive option for budget-conscious consumers. The trend towards purchasing newer used vehicles is also supported by the availability of financing options and the influx of low-mileage vehicles from short-term leases and fleet returns .

The France Used Vehicles and Auto Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Renault Group, Stellantis (Peugeot, Citroën, DS Automobiles, Opel), Volkswagen Group France, BMW Group France, Mercedes-Benz France, Ford France, Toyota France, Dacia, Audi France, Nissan West Europe, Skoda France, Kia France, Hyundai Motor France, Fiat France, Aramis Group, Leboncoin (Adevinta France), AutoScout24 France, ALD Automotive, BNP Paribas Personal Finance (Cetelem Auto), Crédit Agricole Consumer Finance (Sofinco) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the used vehicles and auto finance market in France appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for affordable and sustainable transportation options will likely increase. Additionally, the integration of digital financing solutions is expected to enhance accessibility for consumers, making it easier to purchase used vehicles. The market will also benefit from innovations in vehicle subscription services, catering to a growing segment of consumers seeking flexibility in vehicle ownership.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars (Sedans, Hatchbacks, SUVs, MPVs, Coupes, Convertibles) Commercial Vehicles (Vans, Trucks, Buses) Luxury Vehicles Electric & Hybrid Vehicles Others |

| By Age of Vehicle | 3 Years 7 Years 10 Years + Years |

| By Financing Type | Loans Leases Hire Purchase Subscription Services Others |

| By Sales Channel | Dealerships (Organized/Franchise) Online Platforms/Marketplaces Auctions Private Sales |

| By Customer Segment | Individual Buyers Corporate Buyers Government Agencies Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| By Condition | Certified Pre-Owned Non-Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Vehicle Dealerships | 80 | Dealership Owners, Sales Managers |

| Consumer Auto Finance Users | 120 | Recent Used Vehicle Buyers, Finance Managers |

| Financial Institutions Offering Auto Loans | 60 | Loan Officers, Product Managers |

| Automotive Market Analysts | 40 | Market Researchers, Industry Analysts |

| Consumer Behavior Experts | 40 | Behavioral Economists, Consumer Insights Managers |

The France Used Vehicles and Auto Finance Market is valued at approximately USD 68 billion, reflecting a significant growth driven by consumer demand for affordable transportation and the expansion of online platforms facilitating transactions and financing.