Region:Global

Author(s):Geetanshi

Product Code:KRAA2826

Pages:100

Published On:August 2025

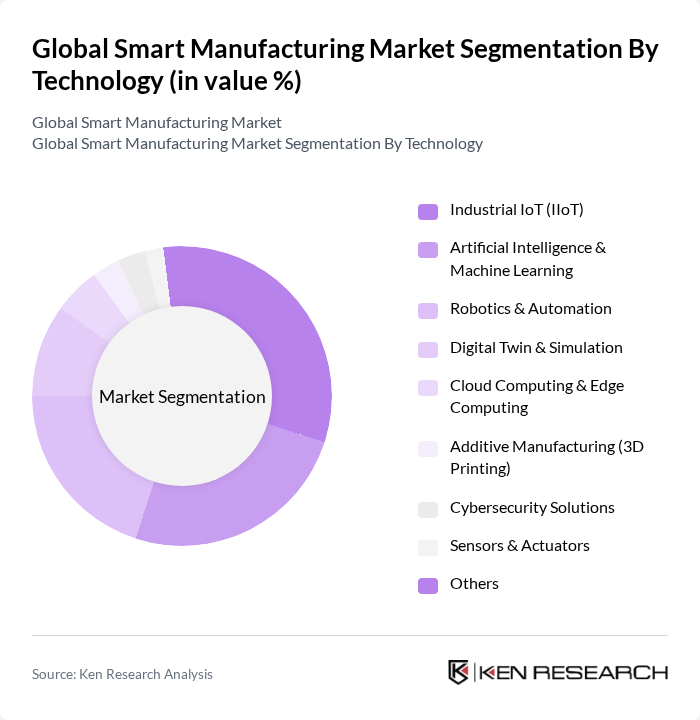

By Technology:The technology segment of the smart manufacturing market includes various advanced technologies that enhance manufacturing processes. The subsegments are Industrial IoT (IIoT), Artificial Intelligence & Machine Learning, Robotics & Automation, Digital Twin & Simulation, Cloud Computing & Edge Computing, Additive Manufacturing (3D Printing), Cybersecurity Solutions, Sensors & Actuators, and Others. Among these, Industrial IoT (IIoT) is leading the market due to its ability to connect machines and devices, enabling real-time data collection and analysis, which is crucial for optimizing manufacturing operations. The adoption of digital twins and cloud-based simulation is also accelerating, allowing manufacturers to virtually optimize processes and reduce implementation risks .

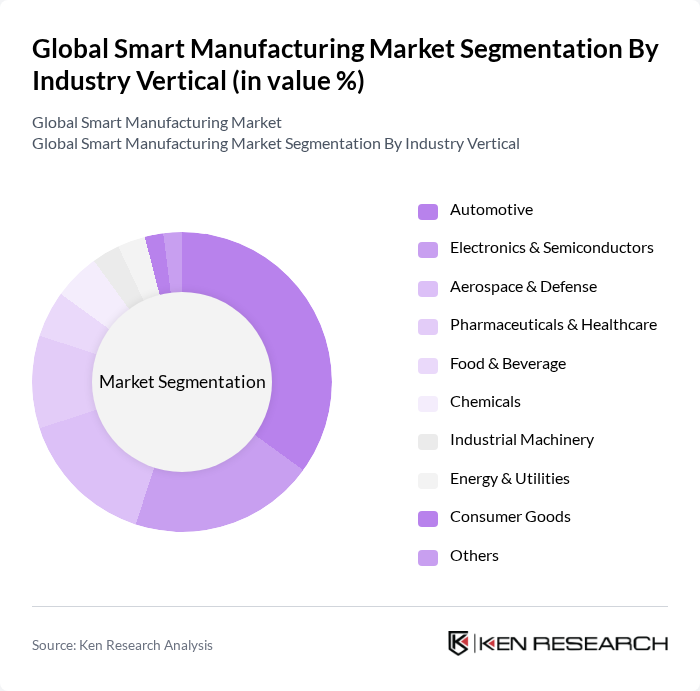

By Industry Vertical:The industry vertical segment encompasses various sectors that utilize smart manufacturing technologies. The subsegments include Automotive, Electronics & Semiconductors, Aerospace & Defense, Pharmaceuticals & Healthcare, Food & Beverage, Chemicals, Industrial Machinery, Energy & Utilities, Consumer Goods, and Others. The automotive industry is the leading sector in adopting smart manufacturing solutions, driven by the need for enhanced production efficiency, quality control, and the integration of electric and autonomous vehicles. Electronics and semiconductors are also rapidly adopting smart manufacturing for precision and agility in production .

The Global Smart Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Rockwell Automation, Inc., Honeywell International Inc., ABB Ltd., General Electric Company, Mitsubishi Electric Corporation, Schneider Electric SE, Bosch Rexroth AG, Emerson Electric Co., Fanuc Corporation, PTC Inc., Dassault Systèmes SE, Oracle Corporation, SAP SE, Cisco Systems, Inc., Yokogawa Electric Corporation, Schneider Electric SE, Fuji Electric Co., Ltd., Keyence Corporation, Panasonic Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of smart manufacturing in None is poised for significant transformation, driven by technological advancements and evolving consumer demands. As companies increasingly adopt digital twins and predictive maintenance strategies, operational efficiencies are expected to improve markedly. Furthermore, the integration of augmented reality and collaborative robotics will enhance workforce capabilities, enabling manufacturers to respond swiftly to market changes. This dynamic environment will foster innovation and create new business models, positioning the region as a leader in smart manufacturing solutions.

| Segment | Sub-Segments |

|---|---|

| By Technology | Industrial IoT (IIoT) Artificial Intelligence & Machine Learning Robotics & Automation Digital Twin & Simulation Cloud Computing & Edge Computing Additive Manufacturing (3D Printing) Cybersecurity Solutions Sensors & Actuators Others |

| By Industry Vertical | Automotive Electronics & Semiconductors Aerospace & Defense Pharmaceuticals & Healthcare Food & Beverage Chemicals Industrial Machinery Energy & Utilities Consumer Goods Others |

| By Application | Predictive Maintenance Quality Control & Inspection Supply Chain & Logistics Management Production Planning & Scheduling Inventory & Asset Management Energy Management Remote Monitoring & Control Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Retail |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Smart Manufacturing | 100 | Manufacturing Engineers, Production Managers |

| Electronics Manufacturing Automation | 80 | Operations Directors, Quality Assurance Managers |

| Consumer Goods Smart Factory Solutions | 70 | Supply Chain Managers, IT Directors |

| Pharmaceutical Manufacturing Technologies | 60 | Regulatory Affairs Specialists, Process Engineers |

| Smart Manufacturing in Aerospace | 40 | Project Managers, R&D Directors |

The Global Smart Manufacturing Market is valued at approximately USD 350 billion, driven by the adoption of advanced technologies such as IoT, AI, and automation, which enhance operational efficiency and reduce costs.