India AI-Powered Agri Credit & Financing Market Overview

- The India AI-Powered Agri Credit & Financing Market is valued at USD 70 million, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of technology in agriculture, the need for financial inclusion among farmers, and the rising demand for efficient credit solutions. The integration of AI in credit assessment and risk management has significantly enhanced lending processes, making them more accessible and efficient for the agricultural sector. Recent trends include the use of satellite imagery, AI-based credit scoring, and blockchain for transparent loan disbursal and risk management, which are rapidly transforming the accessibility and speed of agricultural finance.

- Key players in this market include major cities like Bengaluru, Hyderabad, and Pune, which are at the forefront of agritech innovation. These cities dominate due to their robust startup ecosystems, availability of skilled talent, and supportive government policies that foster technological advancements in agriculture. Additionally, the presence of numerous financial institutions and venture capitalists in these regions further accelerates market growth.

- The Pradhan Mantri Kisan Credit Card (PM-KCC) scheme, implemented by the Government of India, provides timely credit support to farmers at concessional interest rates for meeting their cultivation needs, post-harvest expenses, and investment credit requirements. The scheme is governed by the “Operational Guidelines for Kisan Credit Card (KCC) Scheme” issued by the Reserve Bank of India and National Bank for Agriculture and Rural Development (NABARD), with periodic updates to expand coverage and streamline processes. Compliance involves adherence to prescribed interest subvention, timely disbursement, and integration with digital platforms for seamless access. The scheme has been instrumental in promoting the adoption of AI-driven financial solutions in agriculture by linking credit access to digital and data-driven platforms.

India AI-Powered Agri Credit & Financing Market Segmentation

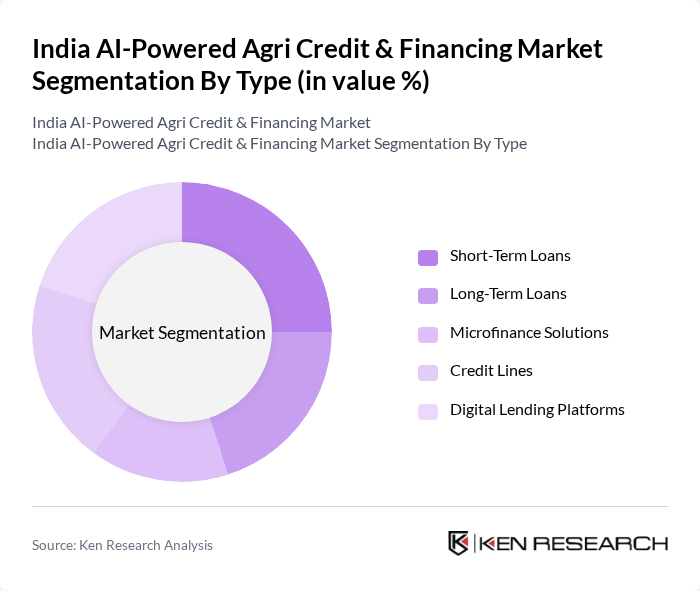

By Type:The market is segmented into various types of financing solutions, including Short-Term Loans, Long-Term Loans, Microfinance Solutions, Credit Lines, and Digital Lending Platforms. Each of these sub-segments caters to different financial needs of farmers and agribusinesses, with digital lending platforms gaining significant traction due to their convenience, speed, and integration of AI for instant credit decisions and risk assessment.

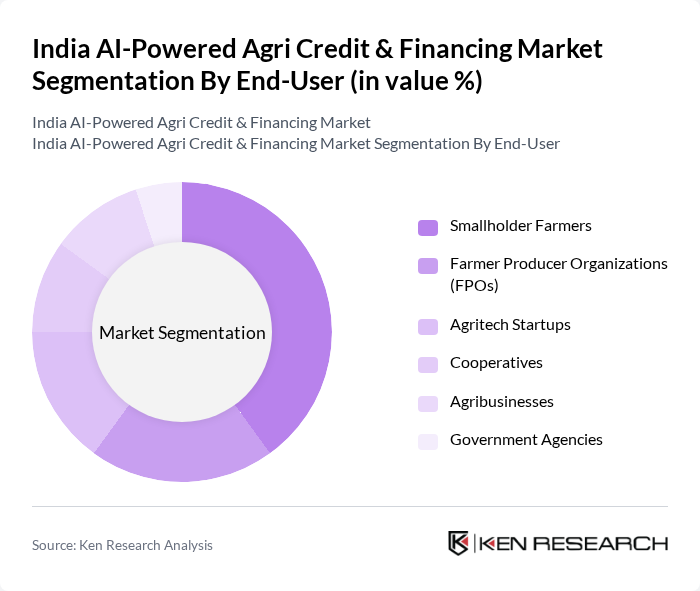

By End-User:The end-users of the market include Smallholder Farmers, Farmer Producer Organizations (FPOs), Agritech Startups, Cooperatives, Agribusinesses, and Government Agencies. Smallholder farmers represent a significant portion of the market, as they often require tailored financial solutions to meet their unique agricultural needs. The rise of digital platforms and AI-driven advisory services is enabling more personalized and accessible credit products for this segment.

India AI-Powered Agri Credit & Financing Market Competitive Landscape

The India AI-Powered Agri Credit & Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as NABARD, State Bank of India, HDFC Bank, ICICI Bank, Axis Bank, RBL Bank, Mahindra Finance, Aditya Birla Finance, Ujjivan Small Finance Bank, Bandhan Bank, IDFC First Bank, Kotak Mahindra Bank, Yes Bank, IndusInd Bank, Samunnati, Jai Kisan, Avanti Finance, Arya.ag, GramCover, eVerse.AI, Harvested Robotics, SatSure, CropIn, AgriBazaar, Stellapps contribute to innovation, geographic expansion, and service delivery in this space.

India AI-Powered Agri Credit & Financing Market Industry Analysis

Growth Drivers

- Increased Access to Technology:The proliferation of smartphones in India, with over 800 million users in future, has significantly enhanced farmers' access to technology. This access enables them to utilize AI-driven platforms for credit assessment and financial management. Additionally, the Indian government's push for digital literacy has led to a 35% increase in tech adoption among rural farmers, facilitating better financial decision-making and improving their creditworthiness.

- Government Initiatives and Subsidies:The Indian government allocated approximately ?2 trillion (around $24 billion) in future for agricultural subsidies and credit schemes. These initiatives aim to enhance financial access for farmers, particularly through AI-powered platforms that streamline loan applications. Furthermore, the introduction of the Pradhan Mantri Kisan Samman Nidhi scheme has provided direct income support to over 120 million farmers, fostering a more robust credit environment.

- Rising Demand for Sustainable Practices:With the global organic food market projected to reach $300 billion in future, Indian farmers are increasingly adopting sustainable agricultural practices. This shift is supported by AI technologies that optimize resource use and reduce waste. As a result, the demand for financing options tailored to sustainable practices has surged, with a reported 50% increase in loans for eco-friendly farming initiatives in the past year, reflecting a growing trend towards sustainability in agriculture.

Market Challenges

- Lack of Awareness Among Farmers:Despite technological advancements, approximately 65% of Indian farmers remain unaware of AI-powered financing options. This lack of awareness hinders their ability to leverage available resources effectively. The digital divide, particularly in rural areas, exacerbates this issue, as only 40% of farmers have received training on digital tools, limiting their engagement with innovative financial solutions and perpetuating reliance on traditional lending methods.

- High Default Rates:The agricultural sector in India faces a default rate of around 15% on loans, primarily due to unpredictable weather patterns and market fluctuations. In future, the Indian Meteorological Department reported a 25% increase in erratic rainfall, impacting crop yields. This volatility creates a challenging environment for lenders, who are often hesitant to extend credit to farmers, further complicating access to necessary financing for agricultural development.

India AI-Powered Agri Credit & Financing Market Future Outlook

The future of the AI-powered agri credit and financing market in India appears promising, driven by technological advancements and increasing government support. As digital literacy improves, more farmers are expected to engage with AI tools, enhancing their financial management capabilities. Additionally, the integration of climate-resilient practices into agricultural financing will likely attract investments, fostering a more sustainable agricultural ecosystem. This evolving landscape presents significant opportunities for innovation and growth in the sector.

Market Opportunities

- Expansion of Digital Payment Systems:The rapid growth of digital payment systems, with over 2 billion transactions recorded in future, presents a significant opportunity for agri-financing. Enhanced payment infrastructure can facilitate quicker loan disbursements and repayments, improving cash flow for farmers. This shift towards digital transactions is expected to streamline financial processes, making credit more accessible and efficient for the agricultural community.

- Collaborations with Fintech Companies:Partnerships between traditional banks and fintech firms are on the rise, with over 300 collaborations reported in future. These alliances leverage technology to create tailored financial products for farmers, addressing their unique needs. By combining resources and expertise, these collaborations can enhance credit accessibility, reduce costs, and foster innovation in agricultural financing solutions, ultimately benefiting the farming sector.