Region:Asia

Author(s):Geetanshi

Product Code:KRAA3639

Pages:99

Published On:September 2025

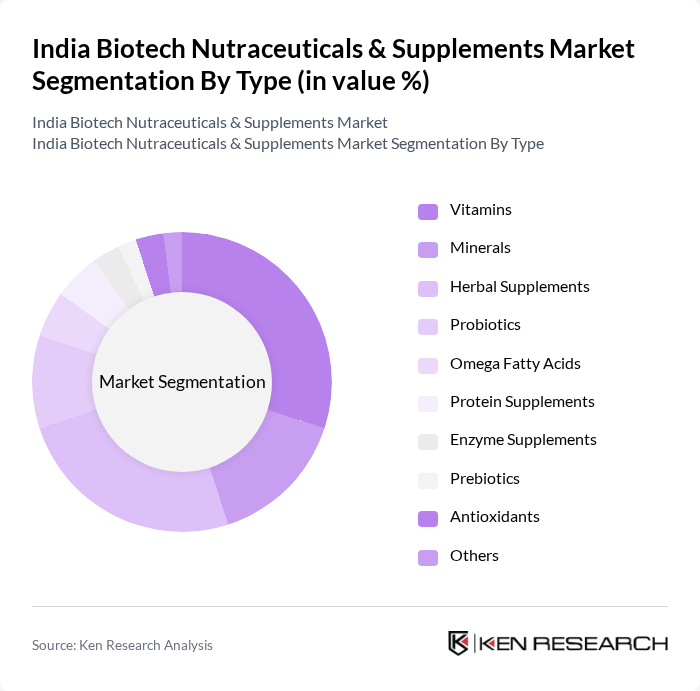

By Type:The market is segmented into various types of nutraceuticals and supplements, including vitamins, minerals, herbal supplements, probiotics, omega fatty acids, protein supplements, enzyme supplements, prebiotics, antioxidants, and others. Among these, vitamins and herbal supplements remain particularly popular due to their perceived health benefits, natural origins, and strong consumer trust in Ayurveda and plant-based remedies. The increasing awareness of the importance of vitamins in daily nutrition and the growing trend toward herbal and clean-label products have significantly contributed to the dominance of these segments .

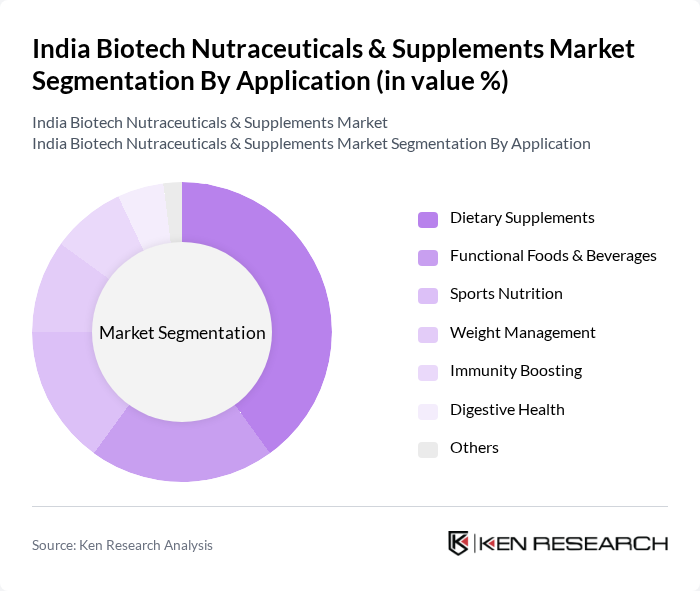

By Application:The applications of nutraceuticals and supplements include dietary supplements, functional foods & beverages, sports nutrition, weight management, immunity boosting, digestive health, and others. The dietary supplements segment leads the market, driven by rising consumer focus on health and wellness, especially post-pandemic, and a growing preference for products supporting immunity and overall health. Functional foods & beverages also hold a significant share, reflecting increased consumer interest in convenient nutrition solutions and digestive health .

The India Biotech Nutraceuticals & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway India Enterprises Pvt. Ltd., Himalaya Wellness Company, Dabur India Ltd., Patanjali Ayurved Ltd., GNC Holdings, Inc., Nestlé Health Science, Abbott Laboratories, GlaxoSmithKline Consumer Healthcare (now Haleon plc), Sun Pharmaceutical Industries Ltd., Zandu Realty Ltd. (Emami Group), Unilever (Hindustan Unilever Limited), Pfizer Limited (India), Reckitt Benckiser Group plc, Cipla Health Limited, MuscleBlaze (Bright Lifecare Pvt. Ltd.), Nutrabay, Britannia Industries Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India biotech nutraceuticals and supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. Innovations in product formulations, particularly personalized nutraceuticals, are expected to gain traction, catering to individual health needs. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, particularly in rural areas, enhancing market penetration and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Probiotics Omega Fatty Acids Protein Supplements Enzyme Supplements Prebiotics Antioxidants Others |

| By Application | Dietary Supplements Functional Foods & Beverages Sports Nutrition Weight Management Immunity Boosting Digestive Health Others |

| By End-User | Adults Children Elderly Athletes Pregnant & Lactating Women Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Pharmacies/Drug Stores Health & Wellness Stores Direct Sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies & Chewables Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bottles Sachets Blister Packs Pouches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutraceuticals Sales | 150 | Store Managers, Retail Buyers |

| Online Supplement Purchases | 100 | E-commerce Managers, Digital Marketing Specialists |

| Health and Wellness Professionals | 80 | Nutritionists, Dieticians |

| Consumer Preferences in Supplements | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Manufacturers of Nutraceuticals | 70 | Production Managers, Quality Assurance Officers |

The India Biotech Nutraceuticals & Supplements Market is valued at approximately USD 32 billion, reflecting significant growth driven by increasing health consciousness, lifestyle-related diseases, and a preference for preventive healthcare solutions.