Region:Asia

Author(s):Rebecca

Product Code:KRAA3336

Pages:96

Published On:September 2025

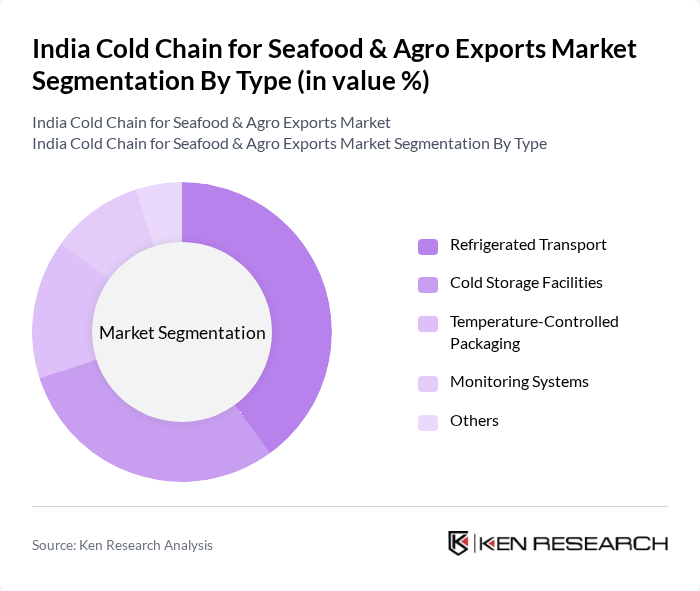

By Type:The cold chain market can be segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, and Others. Each of these segments plays a crucial role in ensuring the integrity and quality of seafood and agro products during transit and storage. The demand for these services is driven by the need for efficient logistics solutions that can maintain optimal temperature conditions throughout the supply chain.

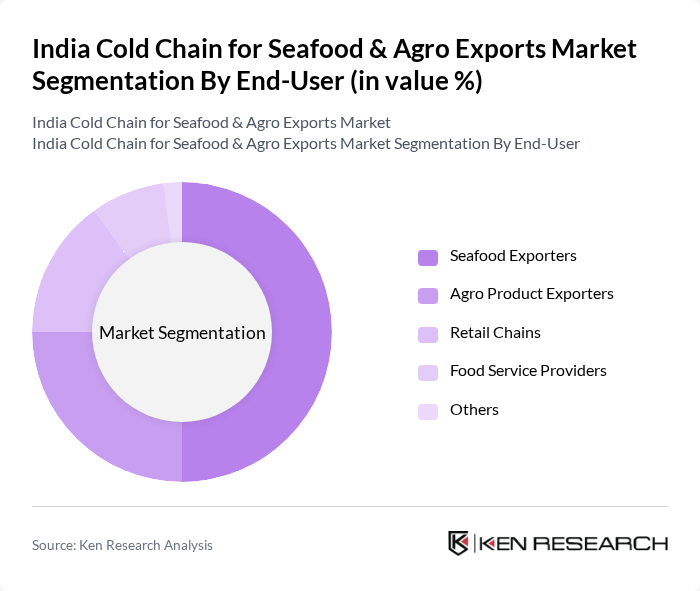

By End-User:The end-user segmentation includes Seafood Exporters, Agro Product Exporters, Retail Chains, Food Service Providers, and Others. Each of these segments has unique requirements for cold chain logistics, driven by the nature of the products being transported and the specific needs of the end consumers. The seafood exporters segment is particularly significant due to the perishable nature of seafood products, necessitating robust cold chain solutions.

The India Cold Chain for Seafood & Agro Exports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Snowman Logistics Ltd., ColdEx Logistics Pvt. Ltd., Gubba Cold Storage Ltd., Dev Bhumi Cold Chain, MJ Logistics, Coldman Logistics, Mahindra Logistics Ltd., TCI Cold Chain Solutions, Blue Star Ltd., Aegis Logistics Ltd., SRS Logistics, Axiom Cold Chain Solutions, Gati Ltd., APL Logistics, Kool-ex Logistics Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cold chain for seafood and agro exports market appears promising, driven by increasing global demand and supportive government policies. The integration of advanced technologies, such as blockchain for traceability and AI for inventory management, is expected to enhance operational efficiency. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly practices, positioning Indian seafood as a preferred choice in international markets, thereby boosting export potential significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Others |

| By End-User | Seafood Exporters Agro Product Exporters Retail Chains Food Service Providers Others |

| By Region | North India (Uttar Pradesh, Punjab, Haryana) South India (Karnataka, Tamil Nadu, Andhra Pradesh, Telangana) East India (West Bengal, Bihar, Odisha) West India (Maharashtra, Gujarat) Others |

| By Application | Fresh Seafood Distribution Processed Seafood Distribution Agro Product Distribution Export Compliance Others |

| By Investment Source | Domestic Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Exporters | 75 | Export Managers, Operations Directors |

| Cold Chain Logistics Providers | 60 | Logistics Coordinators, Supply Chain Managers |

| Agricultural Product Exporters | 65 | Procurement Managers, Quality Assurance Heads |

| Cold Storage Facility Operators | 55 | Facility Managers, Technical Supervisors |

| Regulatory Bodies and Associations | 45 | Policy Makers, Industry Analysts |

The India Cold Chain for Seafood & Agro Exports Market is valued at approximately USD 2.3 billion, driven by increasing demand for seafood and agro products in international markets and the need for efficient logistics solutions to maintain product quality during transportation.