Region:Asia

Author(s):Geetanshi

Product Code:KRAA3810

Pages:94

Published On:September 2025

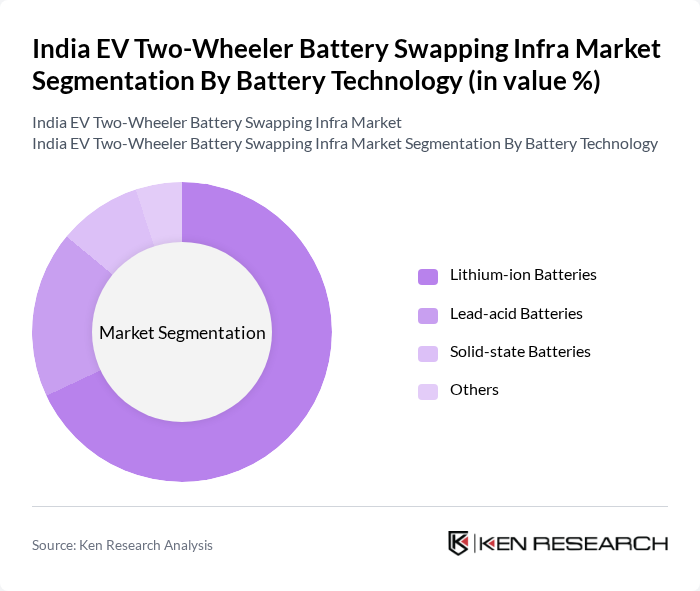

By Battery Technology:The battery technology segment is a critical determinant of efficiency and performance in battery swapping solutions. The main subsegments include Lithium-ion Batteries, Lead-acid Batteries, Solid-state Batteries, and Others. Lithium-ion Batteries maintain a dominant share due to their high energy density, long cycle life, and rapidly falling costs, making them the preferred technology for electric two-wheelers in India. Lead-acid batteries are declining in market share as fleet operators and consumers increasingly opt for lithium-ion solutions, while solid-state batteries remain in the early adoption phase .

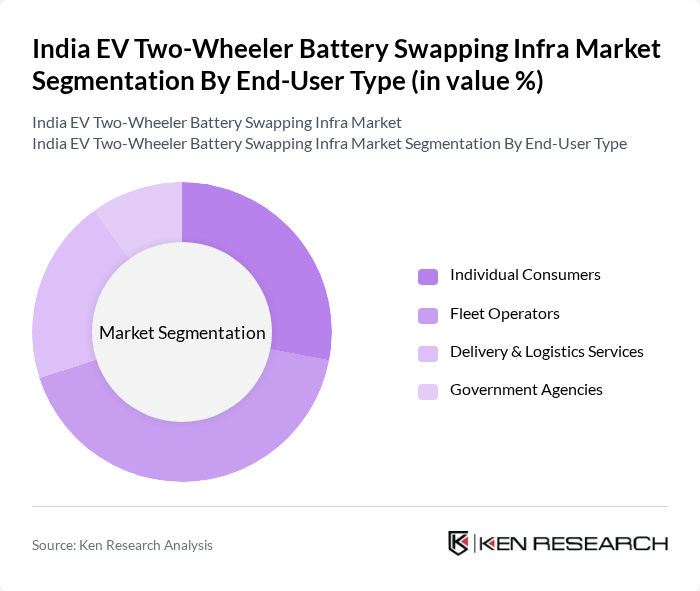

By End-User Type:The end-user segmentation includes Individual Consumers, Fleet Operators, Delivery & Logistics Services, and Government Agencies. Fleet Operators are the leading segment, propelled by the rapid growth of e-commerce, food delivery, and shared mobility services, all of which require high vehicle utilization and minimal downtime. Battery swapping offers these operators a scalable, cost-effective solution for managing large electric two-wheeler fleets .

The India EV Two-Wheeler Battery Swapping Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as Battery Smart, Lithion Power, Sun Mobility, Hero MotoCorp (Vida), Ola Electric, Bounce Infinity, Gogoro, Gravton Motors, Indian Oil Corporation, Ampere Vehicles, TVS Motor Company, Mahindra Electric, Revolt Motors, Yulu Bikes, Reliance Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India EV two-wheeler battery swapping infrastructure market appears promising, driven by increasing urbanization and a growing emphasis on sustainable transportation. In future, advancements in battery technology and government support are expected to facilitate the establishment of a comprehensive battery swapping network. Additionally, the integration of smart technologies will enhance user experience, making battery swapping more efficient and accessible, thereby attracting a broader consumer base and fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Battery Technology | Lithium-ion Batteries Lead-acid Batteries Solid-state Batteries Others |

| By End-User Type | Individual Consumers Fleet Operators Delivery & Logistics Services Government Agencies |

| By Region | North India South India East India West India |

| By Application | Urban Commuting Last-Mile Delivery Shared Mobility Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| By Distribution Mode | Direct Sales Online Platforms Retail Outlets Battery Swapping Stations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Swapping Operators | 60 | Operations Managers, Business Development Heads |

| EV Two-Wheeler Manufacturers | 50 | Product Managers, R&D Directors |

| Government Policy Makers | 40 | Regulatory Affairs Officers, Policy Analysts |

| Consumer Insights on EV Usage | 100 | EV Owners, Potential Buyers |

| Infrastructure Development Firms | 45 | Project Managers, Technical Leads |

The India EV Two-Wheeler Battery Swapping Infra Market is valued at approximately USD 1.4 billion, reflecting significant growth driven by the increasing adoption of electric two- and three-wheelers and government incentives for sustainable mobility.