Region:Asia

Author(s):Geetanshi

Product Code:KRAA3648

Pages:92

Published On:September 2025

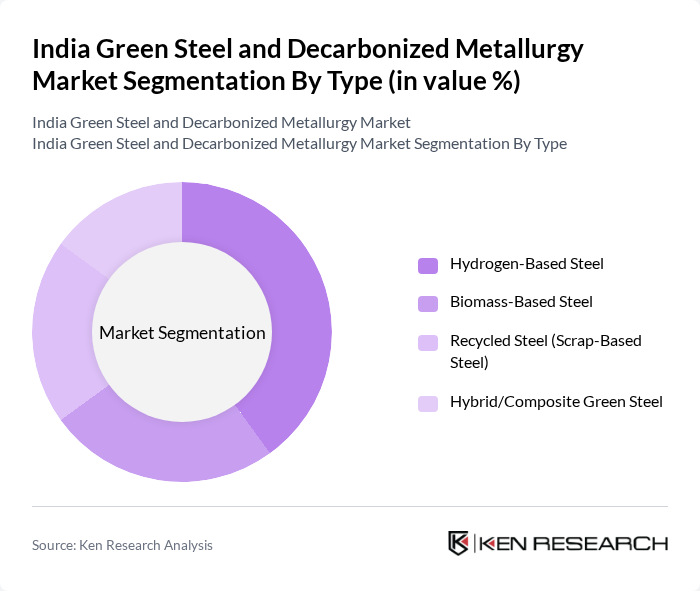

By Type:The market is segmented into various types of green steel production methods, including hydrogen-based steel, biomass-based steel, recycled steel (scrap-based steel), and hybrid/composite green steel. Each of these sub-segments plays a crucial role in the overall market dynamics, with specific advantages and applications in different industries. Hydrogen-based steel is gaining prominence due to its near-zero carbon emissions and suitability for large-scale industrial applications. Biomass-based steel leverages agricultural residues and organic waste, offering a renewable alternative for smaller facilities. Recycled steel (scrap-based steel) supports circular economy models and is widely adopted in secondary steel production. Hybrid/composite green steel integrates multiple low-carbon technologies to optimize efficiency and sustainability across diverse use cases .

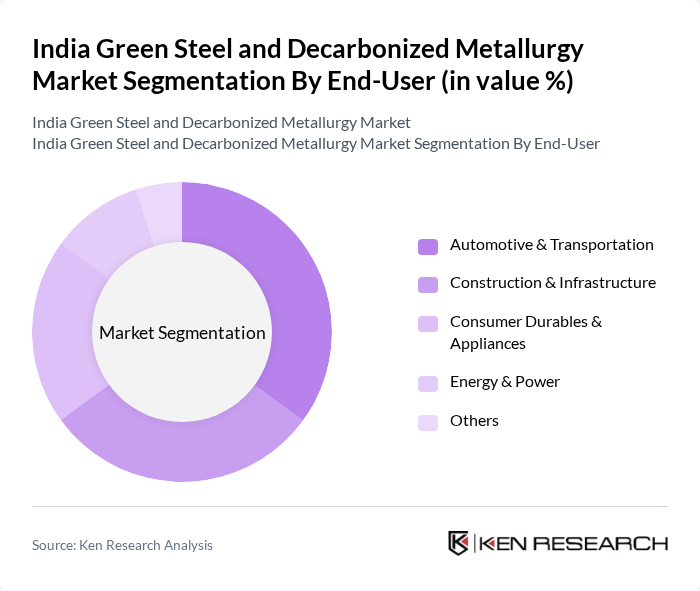

By End-User:The end-user segmentation includes automotive & transportation, construction & infrastructure, consumer durables & appliances, energy & power, and others. Each sector has distinct requirements for green steel, influencing the demand and production strategies of manufacturers. Automotive & transportation prioritize lightweight, high-strength green steel for electric vehicles and sustainable mobility solutions. Construction & infrastructure sectors drive bulk demand for structural steel with reduced embodied carbon. Consumer durables & appliances focus on recycled and hybrid green steel for eco-friendly product lines. Energy & power sectors utilize green steel in renewable energy installations, including wind turbines and solar mounting structures .

The India Green Steel and Decarbonized Metallurgy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Steel Limited, JSW Steel Limited, Steel Authority of India Limited (SAIL), Jindal Steel and Power Limited, Hindalco Industries Limited, Essar Steel India Limited, ArcelorMittal Nippon Steel India Limited, Rashtriya Ispat Nigam Limited (RINL), Kalyani Steels Limited, Welspun Corp Limited, APL Apollo Tubes Limited, Usha Martin Limited, Shyam Steel Industries Limited, Sree Metaliks Limited, Maan Aluminium Limited, Electrosteel Castings Limited, Mukand Limited, Sunflag Iron and Steel Company Limited, Godawari Power & Ispat Limited, Tata Steel Long Products Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Green Steel and Decarbonized Metallurgy Market appears promising, driven by increasing investments in sustainable technologies and a growing emphasis on environmental responsibility. In future, it is anticipated that over 45% of steel production will utilize green methods, significantly reducing carbon footprints. Additionally, the integration of digital technologies in production processes is expected to enhance efficiency and transparency, further supporting the transition towards a more sustainable steel industry in India.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrogen-Based Steel Biomass-Based Steel Recycled Steel (Scrap-Based Steel) Hybrid/Composite Green Steel |

| By End-User | Automotive & Transportation Construction & Infrastructure Consumer Durables & Appliances Energy & Power Others |

| By Region | North India South India East India West India |

| By Technology | Direct Reduced Iron (DRI) – Hydrogen-Based Electric Arc Furnace (EAF) – Renewable Powered Induction Furnace (Green Power) Blast Furnace with Carbon Capture/Utilization Others |

| By Application | Structural Steel Reinforcement Steel (Rebars) Flat Steel Products (Sheets, Plates) Tubes & Pipes Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes & Grants |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Carbon Credits/Offsets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Steel Production Facilities | 100 | Plant Managers, Production Engineers |

| Decarbonization Technology Providers | 60 | Technology Developers, Innovation Managers |

| Regulatory Bodies and Policy Makers | 40 | Government Officials, Environmental Policy Advisors |

| End-User Industries (Automotive, Construction) | 90 | Procurement Managers, Sustainability Officers |

| Research Institutions and Academia | 50 | Researchers, Professors in Metallurgy |

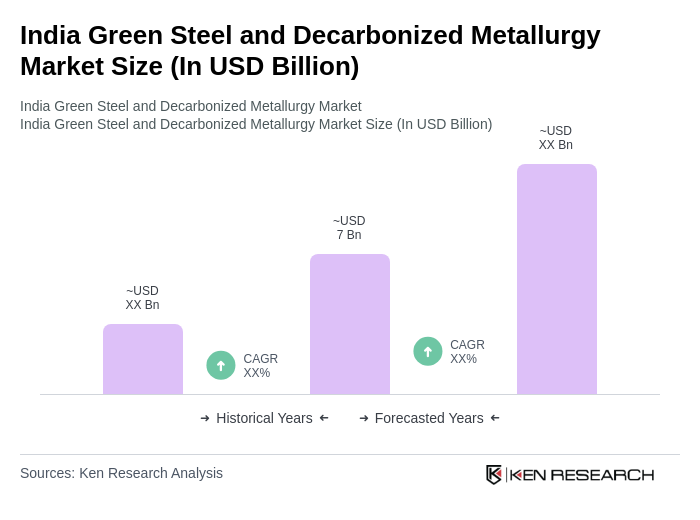

The India Green Steel and Decarbonized Metallurgy Market is valued at approximately USD 7 billion, driven by the increasing demand for sustainable steel production methods and government initiatives promoting decarbonization.