Region:Asia

Author(s):Geetanshi

Product Code:KRAA3317

Pages:98

Published On:September 2025

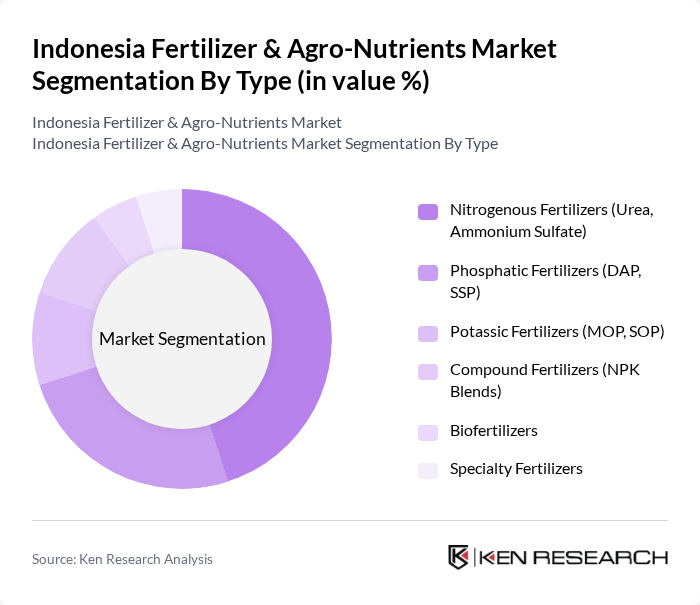

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, compound, biofertilizers, and specialty fertilizers. Among these, nitrogenous fertilizers, particularly urea and ammonium sulfate, dominate the market due to their essential role in enhancing crop growth and yield. The increasing adoption of these fertilizers is driven by their effectiveness in providing the necessary nutrients for various crops .

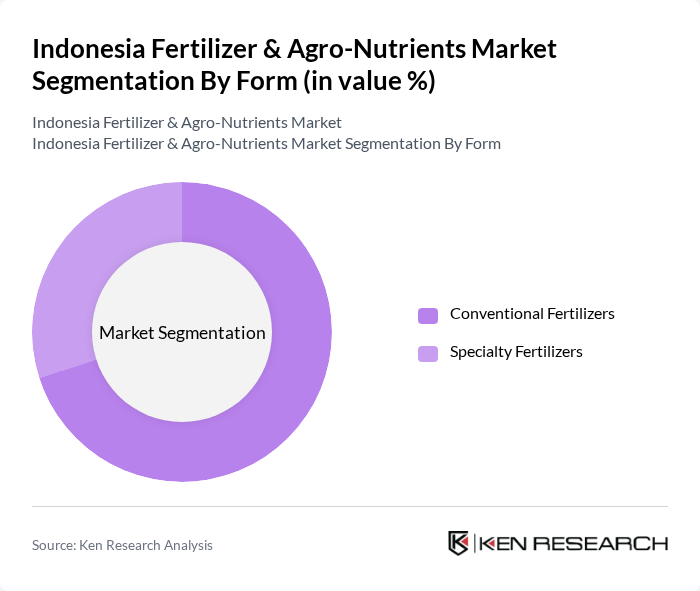

By Form:The market is categorized into conventional and specialty fertilizers. Conventional fertilizers are widely used due to their cost-effectiveness and availability, making them the preferred choice among farmers. Specialty fertilizers, while gaining traction for their targeted nutrient delivery, still represent a smaller segment of the market. The trend towards precision agriculture is gradually increasing the adoption of specialty fertilizers .

The Indonesia Fertilizer & Agro-Nutrients Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pupuk Indonesia (Persero), PT Petrokimia Gresik, PT Pupuk Kalimantan Timur, PT Pupuk Sriwidjaja Palembang, PT Pupuk Iskandar Muda, PT JADI MAS, Haifa Group, Yara International ASA, Grupa Azoty S.A. (Compo Expert), PT Kaltim Parna Industri, PT Mega Eltra, PT Dharma Polimetal, PT Lautan Luas Tbk, PT Multi Sarana Indotani, PT Saraswanti Indo Genetech contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia fertilizer and agro-nutrients market appears promising, driven by technological advancements and a shift towards sustainable agricultural practices. The integration of precision agriculture techniques is expected to enhance fertilizer efficiency, reducing waste and environmental impact. Additionally, the increasing focus on organic farming will likely spur innovation in organic fertilizer production, catering to the rising consumer demand for eco-friendly products. These trends indicate a dynamic market landscape that prioritizes sustainability and efficiency in agricultural practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers (Urea, Ammonium Sulfate) Phosphatic Fertilizers (DAP, SSP) Potassic Fertilizers (MOP, SOP) Compound Fertilizers (NPK Blends) Biofertilizers Specialty Fertilizers |

| By Form | Conventional Fertilizers Specialty Fertilizers |

| By Application Mode | Soil Application Foliar Application Fertigation |

| By Crop Type | Field Crops (Rice, Corn, Soybeans) Horticultural Crops Turf & Ornamental |

| By Region | Java Sumatra Kalimantan Sulawesi Other Islands |

| By Distribution Channel | Direct Sales Retail Outlets Agricultural Cooperatives Online Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Usage by Crop Type | 120 | Farmers, Agronomists |

| Distribution Channels for Agro-Nutrients | 90 | Distributors, Retailers |

| Market Trends in Organic Fertilizers | 60 | Organic Farmers, Agricultural Consultants |

| Impact of Government Policies on Fertilizer Use | 50 | Policy Makers, Agricultural Economists |

| Consumer Preferences for Agro-Nutrients | 70 | Farmers, Agricultural Product Retailers |

The Indonesia Fertilizer & Agro-Nutrients Market is valued at approximately USD 2.2 billion, driven by increasing food production demands and agricultural policies aimed at enhancing crop yields. This market is expected to grow further due to rising population and urbanization.