Region:Asia

Author(s):Shubham

Product Code:KRAA3613

Pages:85

Published On:September 2025

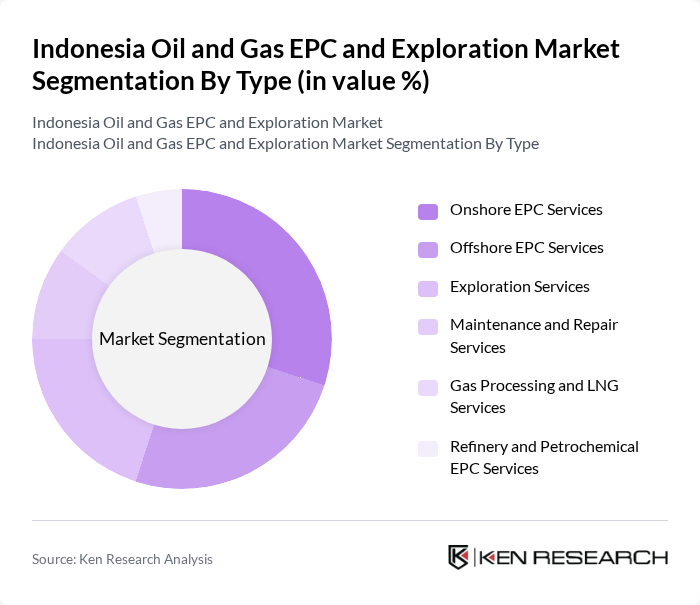

By Type:The market is segmented into Onshore EPC Services, Offshore EPC Services, Exploration Services, Maintenance and Repair Services, Gas Processing and LNG Services, and Refinery and Petrochemical EPC Services. Indonesia’s diverse geography, including 60 sedimentary basins—36 of which are in Western Indonesia and already explored—supports robust upstream and exploration activities, while downstream expansion focuses on refinery and petrochemical complexes under the Refinery Development Master Plan and New Grass Root Refinery programs. The country’s push for self-reliance in petroleum product manufacturing and energy diversification is driving investments across all segments, with particular emphasis on integrated energy solutions and technological advancement.

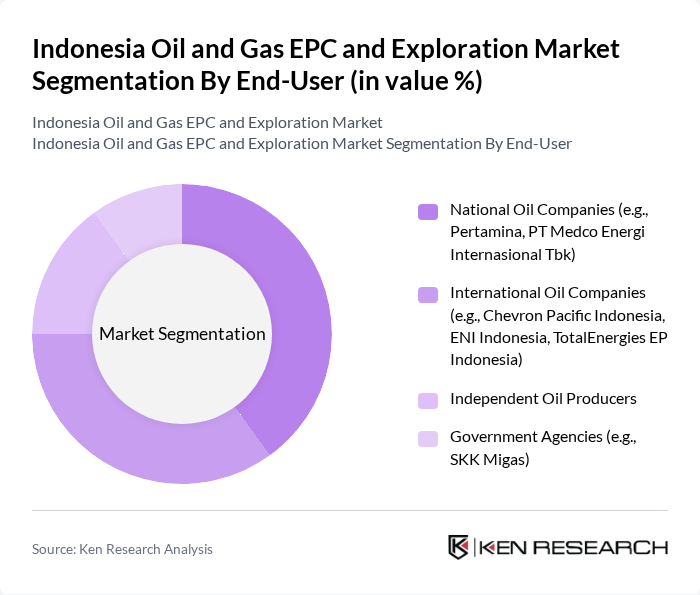

By End-User:The end-user segmentation includes National Oil Companies, International Oil Companies, Independent Oil Producers, and Government Agencies. Each of these end-users has distinct requirements and influences the market's operational landscape. National Oil Companies, such as Pertamina, play a leading role in both upstream and downstream activities, supported by government policies aimed at increasing domestic capacity and reducing import reliance. International Oil Companies contribute significant technical expertise and capital, while independent producers and government agencies like SKK Migas ensure regulatory compliance and project oversight.

The Indonesia Oil and Gas EPC and Exploration Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pertamina (Persero), TotalEnergies EP Indonesia, PT Chevron Pacific Indonesia, ENI Indonesia Ltd., Schlumberger Indonesia, Halliburton Indonesia, TechnipFMC Indonesia, McDermott Indonesia, Wood Group Indonesia, Saipem Indonesia, Baker Hughes Indonesia, KBR, Inc., JGC Corporation, PT Rekayasa Industri, PT Timas Suplindo, PT Medco Energi Internasional Tbk, PT Tripatra Engineers and Constructors, PT Chiyoda International Indonesia, PT AROHERA, Danantara (Indonesia Investment Authority) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia oil and gas EPC and exploration market appears promising, driven by increasing energy demands and government initiatives. In future, the integration of renewable energy sources alongside traditional oil and gas operations is expected to gain momentum, fostering a more sustainable energy landscape. Additionally, advancements in technology will continue to enhance exploration efficiency, enabling access to untapped reserves. Strategic partnerships with local firms will also play a crucial role in navigating regulatory challenges and optimizing resource management.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore EPC Services Offshore EPC Services Exploration Services Maintenance and Repair Services Gas Processing and LNG Services Refinery and Petrochemical EPC Services |

| By End-User | National Oil Companies (e.g., Pertamina, PT Medco Energi Internasional Tbk) International Oil Companies (e.g., Chevron Pacific Indonesia, ENI Indonesia, TotalEnergies EP Indonesia) Independent Oil Producers Government Agencies (e.g., SKK Migas) |

| By Application | Upstream Operations (Exploration, Drilling, Production) Midstream Operations (Pipelines, Storage, LNG Terminals) Downstream Operations (Refining, Petrochemicals, Distribution) Decommissioning and Rehabilitation |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Project Size | Small Scale Projects ( |

| By Contract Type | Lump Sum Turnkey (LSTK) Contracts Engineering, Procurement, and Construction Management (EPCM) Contracts Build-Operate-Transfer (BOT) Contracts Time and Material Contracts |

| By Policy Support | Subsidies for Exploration Tax Exemptions Regulatory Support Local Content Incentives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Exploration Projects | 100 | Geologists, Exploration Managers |

| Midstream Infrastructure Development | 70 | Project Engineers, Operations Managers |

| Downstream Refinery Operations | 60 | Refinery Managers, Supply Chain Directors |

| EPC Contract Management | 50 | Contract Managers, Legal Advisors |

| Regulatory Compliance in Oil & Gas | 40 | Compliance Officers, Regulatory Affairs Managers |

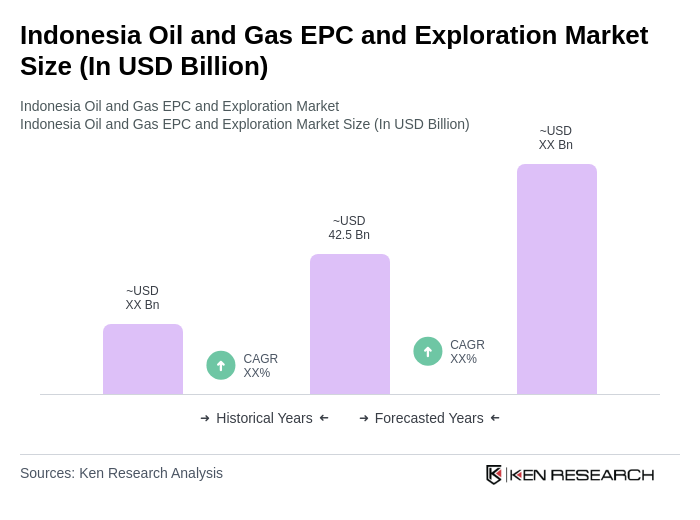

The Indonesia Oil and Gas EPC and Exploration Market is valued at approximately USD 42.5 billion, driven by increasing energy demand, government initiatives, and foreign investments in exploration and production activities.