Region:Asia

Author(s):Shubham

Product Code:KRAA3620

Pages:93

Published On:September 2025

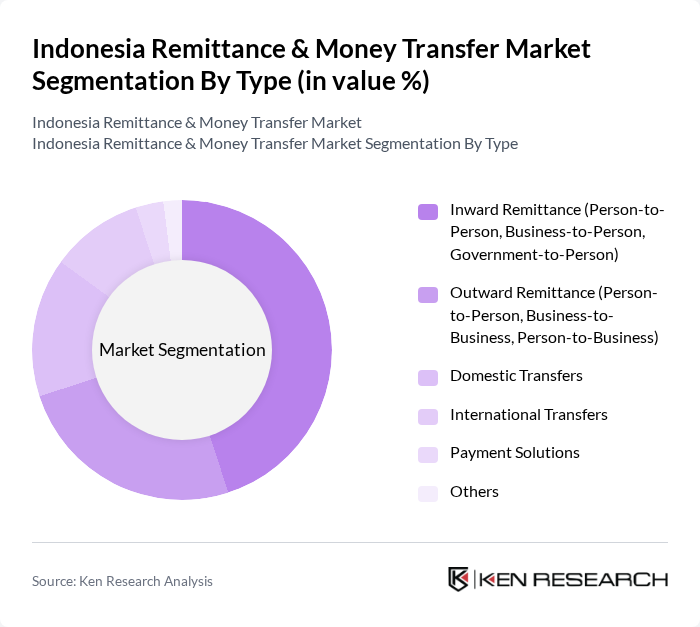

By Type:The remittance and money transfer market can be segmented into various types, including Inward Remittance, Outward Remittance, Domestic Transfers, International Transfers, Payment Solutions, and Others. Among these, Inward Remittance is the most significant segment, driven by the large number of Indonesian workers abroad sending money home. This segment includes Person-to-Person, Business-to-Person, and Government-to-Person transfers, which cater to different needs of the recipients. The segmentation reflects the dominance of funds flowing into Indonesia from overseas workers, with digital and mobile channels increasingly capturing market share as consumers prioritize convenience and security.

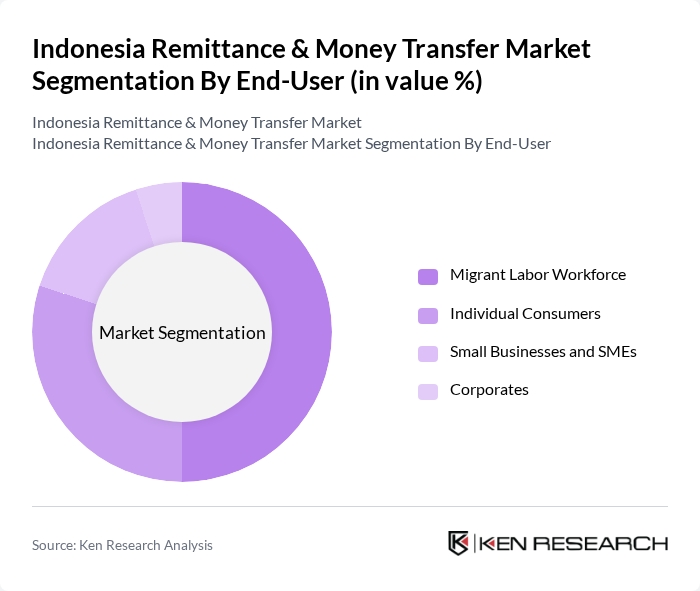

By End-User:The end-user segmentation includes Migrant Labor Workforce, Individual Consumers, Small Businesses and SMEs, and Corporates. The Migrant Labor Workforce is the leading segment, as a significant portion of remittances comes from overseas workers sending money back to their families. This demographic is characterized by a high frequency of transactions, often driven by the need to support daily living expenses and education costs for their dependents. The growing adoption of digital remittance platforms is also expanding access for individual consumers and small businesses, further diversifying the end-user base.

The Indonesia Remittance & Money Transfer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Wise (formerly TransferWise), PayPal, DANA, OVO, GoPay, Xendit, PT Bank Negara Indonesia (Persero) Tbk (BNI), PT Bank CIMB Niaga Tbk, PT Bank Central Asia Tbk (BCA), PT Bank Mandiri (Persero) Tbk, Jenius (by BTPN), LinkAja, Indomaret contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia remittance and money transfer market appears promising, driven by technological advancements and increasing financial literacy among the population. As digital solutions become more prevalent, the market is likely to witness a surge in user adoption, particularly among younger demographics. Additionally, ongoing government support for fintech innovations will further enhance the efficiency of remittance services, making them more accessible and cost-effective for users across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Remittance (Person-to-Person, Business-to-Person, Government-to-Person) Outward Remittance (Person-to-Person, Business-to-Business, Person-to-Business) Domestic Transfers International Transfers Payment Solutions Others |

| By End-User | Migrant Labor Workforce Individual Consumers Small Businesses and SMEs Corporates |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards Online Platforms |

| By Transaction Size | Low Value (Below USD 500) Medium Value (USD 500 - USD 2,000) High Value (Above USD 2,000) |

| By Frequency of Transactions | One-time Transfers Regular Transfers Occasional Transfers |

| By Customer Demographics | Age Group Income Level Employment Status |

| By Region | Urban Areas Rural Areas Remote Locations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 120 | Migrant Workers, International Students |

| Recipient Insights on Remittance Usage | 100 | Family Members of Expatriates, Local Business Owners |

| Service Provider Perspectives | 80 | Money Transfer Operators, Bank Representatives |

| Regulatory Impact Assessment | 50 | Policy Makers, Financial Regulators |

| Technological Adoption in Money Transfers | 70 | Fintech Innovators, IT Managers in Financial Services |

The Indonesia Remittance & Money Transfer Market is valued at approximately USD 18 billion, driven by the increasing number of Indonesian migrant workers abroad and the rise of digital payment solutions facilitating faster transactions.