Vietnam Luggage & Bags Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8564

December 2024

92

About the Report

Vietnam Luggage & Bags Market Overview

- The Vietnam luggage and bags market is valued at USD 2 billion, based on a five-year historical analysis. This growth is primarily driven by a surge in both domestic and international tourism, alongside rising disposable incomes. The market is also influenced by changing consumer preferences towards high-quality, lightweight, and smart luggage products. As travel restrictions ease and international tourism rebounds, the demand for premium and mid-range luggage is on the rise, particularly from business and leisure travelers.

- Major cities like Hanoi and Ho Chi Minh City dominate the market due to their strong economic position and higher purchasing power. These urban centers are hubs for both local consumers and international tourists, which increases the demand for various types of luggage. Additionally, the presence of leading global and local luggage brands in these cities further cements their dominance.

- The Vietnamese government introduced tax incentives in 2023 to support local luggage and bag manufacturers by reducing import duties on raw materials and machinery. This policy is designed to boost the domestic production capacity and competitiveness of Vietnamese manufacturers, encouraging the export of locally-made luggage and bags to international markets, particularly in ASEAN countries.

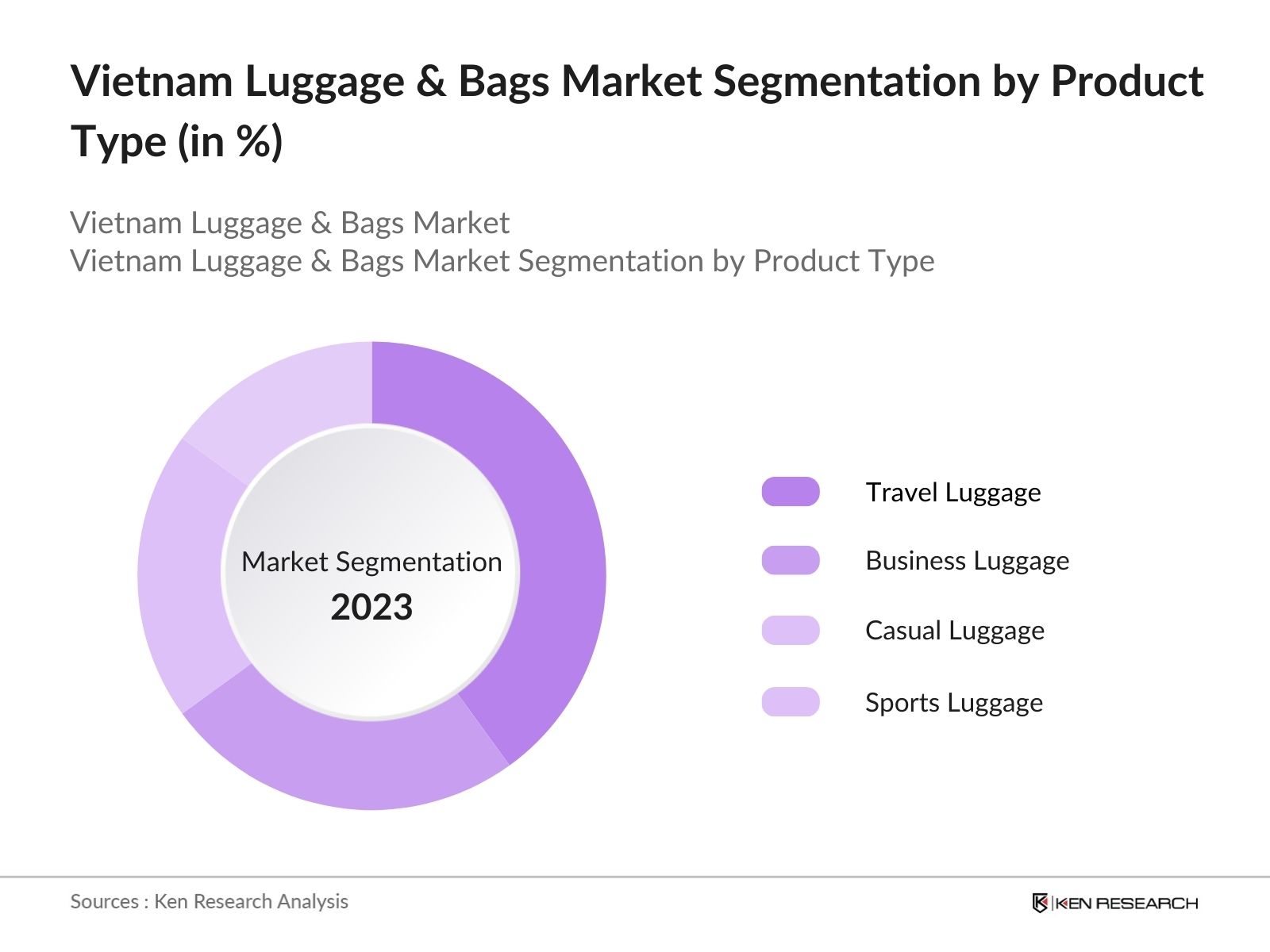

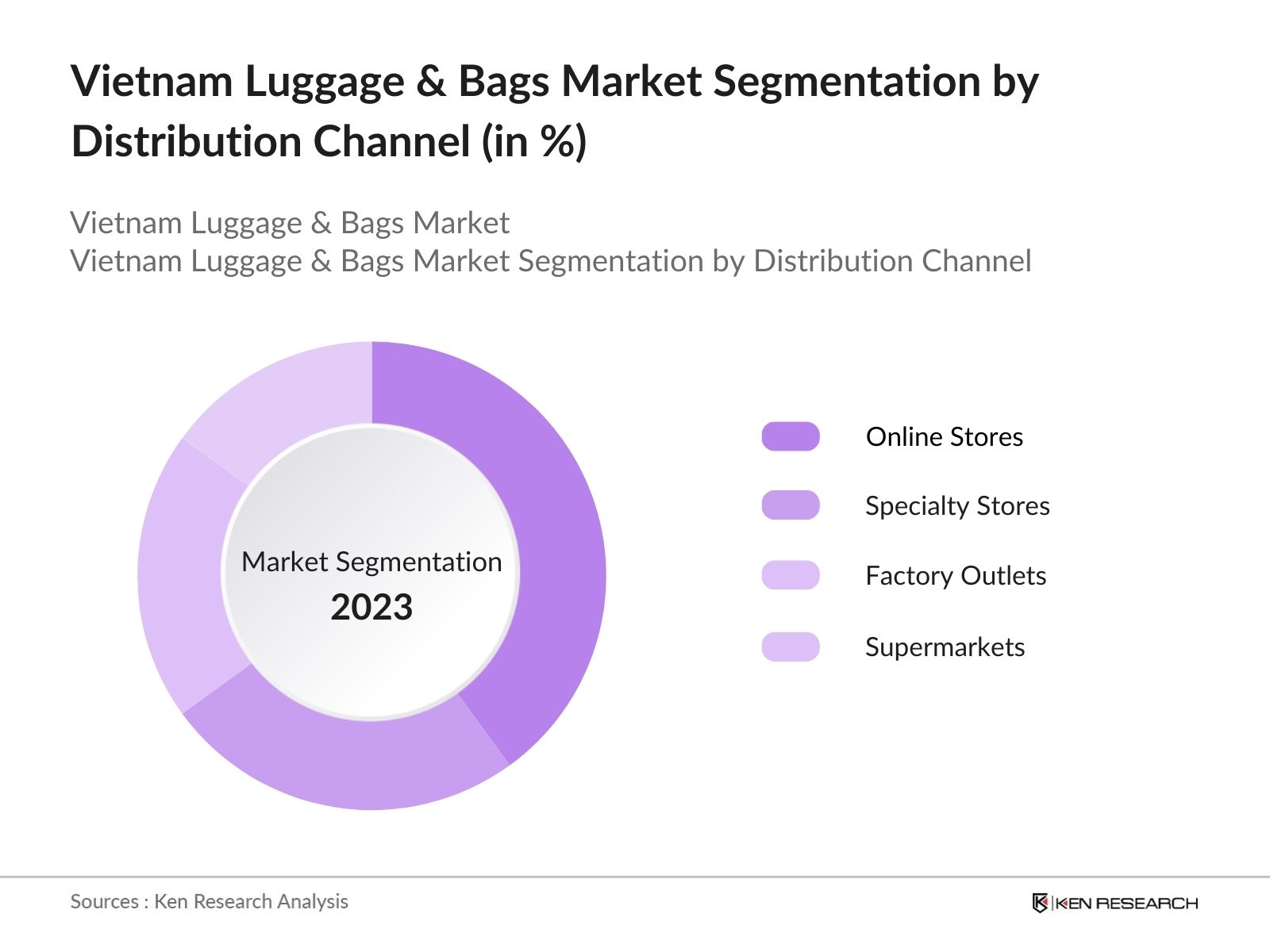

Vietnam Luggage & Bags Market Segmentation

By Product Type: The market is segmented by product type into travel luggage, business luggage, casual luggage, and sports luggage. Among these, travel luggage holds the dominant market share, largely driven by Vietnams growing tourism industry and frequent international travel. Business and leisure travelers are increasingly opting for lightweight and durable travel luggage that meets airline standards. Leading brands like Samsonite and American Tourister have capitalized on this trend by offering innovative products that cater to both functionality and aesthetics.

By Distribution Channel: The market is also segmented by distribution channels into online stores, specialty stores, factory outlets, and supermarkets. Online stores lead the market due to the growing popularity of e-commerce platforms like Shopee, Lazada, and Tiki, which offer consumers convenience, better price comparisons, and access to global brands. The shift to digital shopping has accelerated due to the pandemic, pushing many consumers to purchase luggage online. Specialty stores still hold a significant share, especially for premium and high-end products.

Vietnam Luggage & Bags Market Competitive Landscape

The market is characterized by the presence of both international and local brands. Global players like Samsonite and Tumi compete alongside Vietnamese brands such as Mikkor, which have developed a loyal customer base.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Product Portfolio |

Global Presence |

Sustainability Initiatives |

Innovation Index |

Key Markets |

Online Penetration |

|

Samsonite |

1910 |

Luxembourg |

|||||||

|

Tumi |

1975 |

New Jersey, USA |

|||||||

|

American Tourister |

1933 |

Rhode Island, USA |

|||||||

|

Mikkor |

2010 |

Ho Chi Minh City, VN |

|||||||

|

Adidas |

1949 |

Herzogenaurach, Germany |

Vietnam Luggage & Bags Market Analysis

Market Growth Drivers

- Growing Tourism Industry Boosts Demand for Luggage & Bags: Vietnams tourism sector saw a rise, with 18 million international visitors arriving in 2023, according to the Vietnam National Administration of Tourism. The expanding domestic tourism, with over 100 million local tourists in 2023, is expected to drive the demand for luggage and bags.

- Rising E-commerce Penetration Enhances Market Reach: Vietnam's e-commerce sector saw rapid growth, with online retail sales reaching $16.4 billion in 2023. Online platforms such as Tiki, Lazada, and Shopee are expanding the accessibility of luggage and bags, driving consumer purchases across the country.

- Growing Demand for Eco-friendly and Sustainable Products: With rising awareness of environmental sustainability, there is an increasing demand for eco-friendly luggage and bags made from sustainable materials like recycled plastic and organic fabrics. In 2023, several Vietnamese brands reported a surge in sales of eco-conscious luggage, with an estimated 500,000 units sold in that year alone.

Market Challenges

- Competition from Low-cost, Unbranded Products: The market is facing intense competition from low-cost, unbranded products, particularly from neighboring countries like China. These low-priced alternatives accounted for over 40% of the total market volume in 2023, which is affecting sales for domestic brands.

- Fluctuations in Raw Material Prices: The prices of raw materials like leather, nylon, and aluminum used in the production of luggage and bags saw a 15% increase in 2023 due to global supply chain disruptions. These price hikes directly impact production costs, reducing profit margins for manufacturers in Vietnam.

Vietnam Luggage & Bags Market Future Outlook

Over the next five years, the Vietnam luggage and bags industry is expected to witness growth driven by rising consumer interest in premium and sustainable luggage products. The market is likely to benefit from continuous innovation, such as smart luggage features and eco-friendly materials, alongside a growing emphasis on online sales channels.

Future Market Opportunities

- Expansion of Eco-friendly Product Lines Will Accelerate: In the next five years, there will be a significant shift toward environmentally sustainable luggage and bags in Vietnam, driven by increasing consumer awareness and government regulations. By 2028, it is expected that over 1 million units of eco-friendly luggage products will be sold annually, reflecting the strong demand for sustainable solutions.

- Integration of Smart Technology Will Transform Product Offerings: The adoption of smart luggage technology will accelerate, with companies focusing on integrating advanced features like solar-powered charging systems, real-time tracking, and weight sensors. By 2027, the number of smart luggage products sold is expected to double, surpassing 300,000 units annually.

Scope of the Report

|

Product Type |

Travel Luggage Casual Luggage Business Luggage Sports Luggage Other Luggage |

|

Material Type |

Hard-Side Soft-Side |

|

Distribution Channel |

Online Stores Specialty Stores Factory Outlets Supermarkets Others |

|

Price Range |

Premium Medium Low |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and Venture Capitalist Firms

Luggage Manufacturers

Banks and Financial Institution

Private Equity Firms

Government and Regulatory Bodies (Ministry of Industry and Trade)

E-commerce Platforms (e.g., Shopee, Lazada)

Tourism Companies

Companies

Players Mentioned in the Report:

Samsonite

Tumi

American Tourister

Rimowa

Louis Vuitton

Coach

Nike

Adidas

Mikkor

Charles & Keith

Table of Contents

1. Vietnam Luggage & Bags Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Luggage & Bags Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Luggage & Bags Market Analysis

3.1. Growth Drivers (Driven by Increased Travel & Tourism, Emerging Middle-Class, Rising Domestic Travel)

3.2. Market Challenges (Counterfeit Goods, Price Sensitivity, Supply Chain Disruptions)

3.3. Opportunities (Rise of E-Commerce, Demand for Eco-friendly Products, Growth in Premium Luggage Segment)

3.4. Trends (Lightweight, Sustainable Materials, Smart Luggage Innovations)

3.5. Competitive Landscape (Fragmented Market, Local vs International Brands)

3.6. Porters Five Forces (Competitive Rivalry, Buyer Power, Supplier Power, Threat of Substitutes, New Entrants)

4. Vietnam Luggage & Bags Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Travel Luggage

4.1.2. Casual Luggage

4.1.3. Business Luggage

4.1.4. Sports Luggage

4.1.5. Other Luggage

4.2. By Material Type (In Value %)

4.2.1. Hard-Side

4.2.2. Soft-Side

4.3. By Distribution Channel (In Value %)

4.3.1. Online Stores

4.3.2. Specialty Stores

4.3.3. Factory Outlets

4.3.4. Supermarkets

4.3.5. Others

4.4. By Price Range (In Value %)

4.4.1. Premium Range

4.4.2. Medium Range

4.4.3. Low Range

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. South

4.5.4. East

5. Vietnam Luggage & Bags Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Samsonite

5.1.2. Tumi

5.1.3. Antler

5.1.4. American Tourister

5.1.5. Rimowa

5.1.6. Louis Vuitton

5.1.7. Coach

5.1.8. Nike

5.1.9. Adidas

5.1.10. Charles & Keith

5.1.11. Polo Ralph Lauren

5.1.12. Deuter

5.1.13. Herschel

5.1.14. Anello

5.1.15. Mikkor

5.2 Cross Comparison Parameters (Revenue, Number of Employees, Product Portfolio, Brand Positioning, Online Penetration, Pricing Strategy, Innovation Index, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Market Expansion, Mergers & Acquisitions)

5.5. Investment Analysis

6. Vietnam Luggage & Bags Regulatory Framework

6.1. Import Tariffs and Trade Barriers

6.2. Certification and Compliance Requirements

6.3. Environmental Regulations

7. Vietnam Luggage & Bags Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Luggage & Bags Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Price Range (In Value %)

8.5. By Region (In Value %)

9. Vietnam Luggage & Bags Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Innovation Strategies

9.3. Marketing Initiatives (Branding, Influencer Partnerships, Digital Campaigns)

9.4. Expansion Opportunities (Domestic and International)

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on defining key variables affecting the Vietnam luggage market. We analyze key stakeholders like luggage manufacturers, e-commerce platforms, and retailers using primary and secondary research databases to collect accurate market data.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled, covering the penetration of major luggage types and their distribution channels. Key data points such as sales volume and market share are validated through statistical methods to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through expert interviews using Computer-Assisted Telephone Interviews (CATI) with industry leaders. This provides operational and strategic insights that reinforce the reliability of our findings.

Step 4: Research Synthesis and Final Output

Finally, we engage directly with luggage manufacturers and distributors to gather insights on product sales, consumer behavior, and market trends. This allows us to validate our data and present a comprehensive report on the Vietnam luggage market.

Frequently Asked Questions

01. How big is the Vietnam Luggage Market?

The Vietnam luggage market is valued at USD 2 billion, driven by an increase in both domestic and international travel and a shift towards premium and mid-range luggage products.

02. What are the challenges in the Vietnam Luggage Market?

Challenges in the Vietnam luggage market include rising competition from counterfeit goods, supply chain disruptions due to geopolitical factors, and price sensitivity among local consumers, which can limit market growth.

03. Who are the major players in the Vietnam Luggage Market?

Key players in the Vietnam luggage market include global brands like Samsonite, Tumi, and American Tourister, along with local brands such as Mikkor, which cater to the domestic market.

04. What are the growth drivers of the Vietnam Luggage Market?

Growth in the Vietnam luggage market is driven by the rapid expansion of tourism in Vietnam, the rise of the middle class, and the increasing popularity of e-commerce channels for purchasing luggage products.

05. How are online sales influencing the Vietnam Luggage Market?

Online sales are rapidly gaining traction, accounting for 45% of the market in 2023. E-commerce platforms like Shopee and Lazada offer consumers greater convenience, wider product selection, and competitive pricing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.