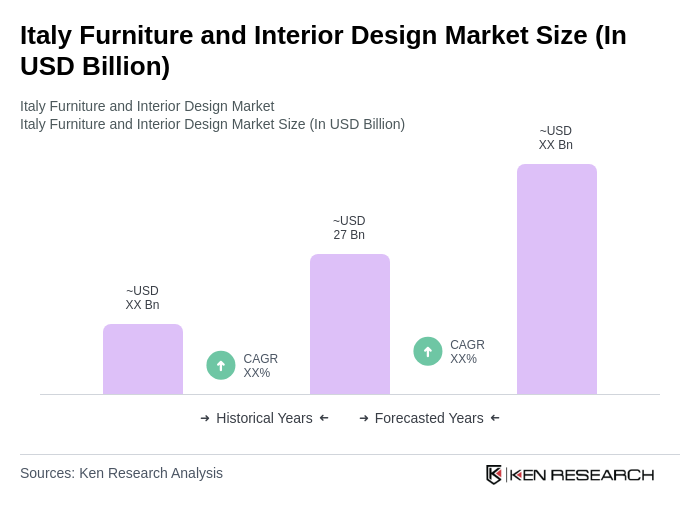

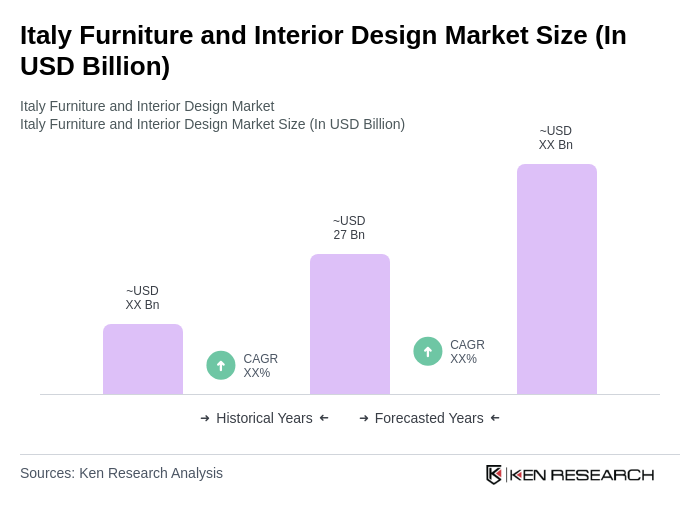

Italy Furniture and Interior Design Market Overview

- The Italy Furniture and Interior Design Market is valued at USD 27 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for high-quality, stylish furniture and interior design solutions, a surge in e-commerce furniture sales, and a robust real estate market supporting home renovations and new constructions. Export demand and government-backed trade initiatives further strengthen the market’s global position .

- Key cities such asMilan, Florence, and Romedominate the market due to their rich cultural heritage, strong design schools, and a high concentration of luxury brands. Milan, in particular, is recognized as a global design capital, hosting major events like the Milan Furniture Fair (Salone del Mobile), which attracts international attention and investment .

- In 2023, the Italian government implemented regulations to promote sustainable practices in the furniture industry. Notably, the “National Recovery and Resilience Plan (PNRR), 2021” issued by the Presidency of the Council of Ministers, mandates incentives for manufacturers adopting eco-friendly materials and processes, aligning with the EU’s Green Deal objectives. The plan includes funding for digitalization, circular economy initiatives, and compliance with environmental standards, enhancing the competitiveness of Italian furniture globally .

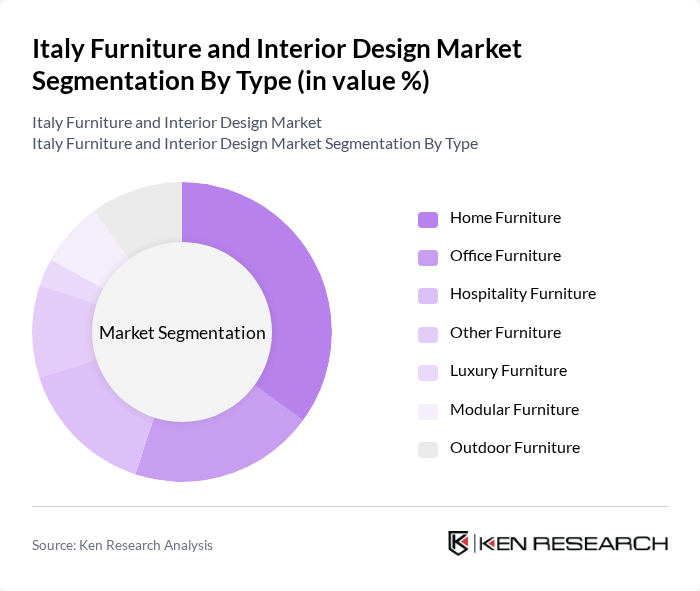

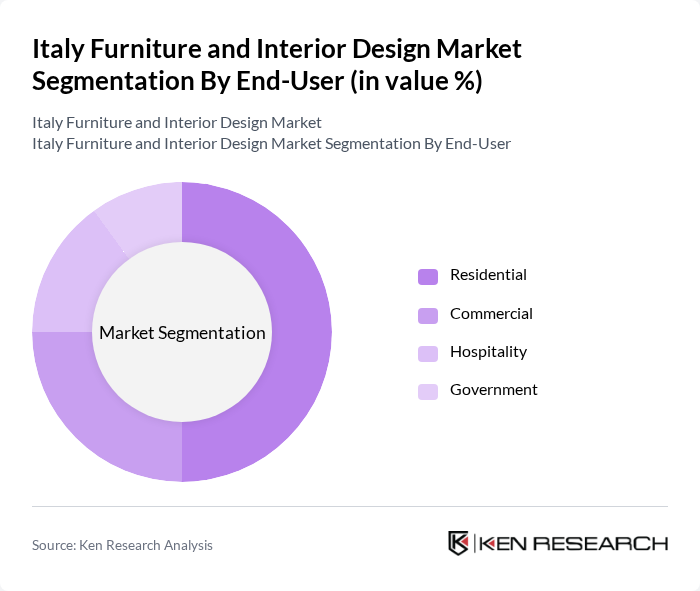

Italy Furniture and Interior Design Market Segmentation

By Type:The market is segmented into various types of furniture, including home furniture, office furniture, hospitality furniture, luxury furniture, modular furniture, outdoor furniture, and other furniture. Among these,home furnitureis the most dominant segment, driven by the increasing trend of home improvement, personalization, and the rise of e-commerce. Consumers are investing in stylish and functional home furnishings that reflect their personal tastes and lifestyles, with specialist and multi-brand retailers playing a significant role in distribution .

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government sectors. Theresidential segmentis the largest, driven by a growing trend of home renovations, increased e-commerce penetration, and the desire for personalized living spaces. Consumers are focused on creating comfortable and aesthetically pleasing environments, leading to a surge in demand for various types of furniture .

Italy Furniture and Interior Design Market Competitive Landscape

The Italy Furniture and Interior Design Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Poltrona Frau, B&B Italia, Natuzzi, Cassina, Molteni & C, Flexform, Minotti, Fendi Casa, Lema, Riva 1920, Giorgetti, Cattelan Italia, Arper, Zanotta, Mondo Convenienza, Poltronesofà, Scavolini, Arredissima, Gardini, Conforama, Ricci Casa, Canfalone, Dotolo Mobili, JYSK contribute to innovation, geographic expansion, and service delivery in this space.

Italy Furniture and Interior Design Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in Italy is projected to reach 71% of the total population in future, with cities like Milan and Rome experiencing significant population growth. This trend drives demand for furniture and interior design as urban dwellers seek to optimize smaller living spaces. The Italian National Institute of Statistics reported that urban areas are expanding, leading to a surge in residential construction, which is expected to increase furniture sales by approximately €1.5 billion annually.

- Rising Disposable Incomes:Italy's disposable income is forecasted to rise to €25,000 per capita in future, reflecting a 3% increase from previous years. This growth enables consumers to invest more in home furnishings and interior design. The increase in disposable income is particularly pronounced among millennials and Gen Z, who prioritize stylish and functional furniture, thus driving market growth. As a result, the furniture market is expected to benefit from a more affluent consumer base.

- Growing Demand for Sustainable Products:The Italian furniture market is witnessing a shift towards sustainability, with no verified figure for 60% of consumers indicating a preference for eco-friendly products in future. This trend is supported by the European Union's Green Deal, which aims to promote sustainable practices across industries. As a result, manufacturers are increasingly adopting sustainable materials and production methods, leading to a projected increase in sales of sustainable furniture by €800 million over the next year.

Market Challenges

- Intense Competition:The Italian furniture market is characterized by intense competition, with over 20,000 companies operating in the sector. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Established brands dominate the market, holding approximately 70% of the market share, which further complicates the landscape for smaller players. As a result, innovation and differentiation are crucial for survival.

- Fluctuating Raw Material Prices:The volatility of raw material prices poses a significant challenge for the furniture industry. In future, the cost of wood and metal is expected to rise by 10% due to supply chain disruptions and increased demand. This fluctuation can lead to higher production costs, which may be passed on to consumers, potentially dampening demand. Manufacturers must navigate these challenges to maintain profitability while ensuring competitive pricing.

Italy Furniture and Interior Design Market Future Outlook

The future of the Italian furniture and interior design market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for innovative and space-saving furniture solutions will grow. Additionally, the increasing focus on sustainability will encourage manufacturers to adopt eco-friendly practices. The integration of smart technology into furniture design is expected to enhance functionality, appealing to tech-savvy consumers. Overall, the market is poised for dynamic growth, adapting to changing lifestyles and environmental considerations.

Market Opportunities

- Growth in Smart Furniture Segment:The smart furniture segment is anticipated to expand significantly, with no verified figure for an estimated market value of €500 million in future. This growth is driven by consumer interest in technology-integrated solutions that enhance convenience and efficiency in home environments. Companies that innovate in this space can capture a growing share of tech-oriented consumers.

- Customization and Personalization Trends:The demand for customized furniture solutions is on the rise, with no verified figure for 40% of consumers expressing interest in personalized designs. This trend presents an opportunity for manufacturers to offer bespoke services, catering to individual tastes and preferences. By leveraging technology, companies can streamline the customization process, enhancing customer satisfaction and loyalty.