Japan Industrial Automation & IoT Sensors Market Overview

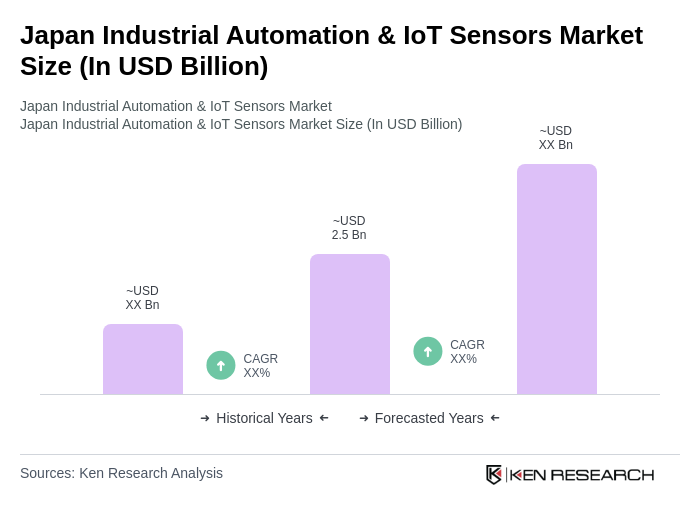

- The Japan Industrial Automation & IoT Sensors Market is valued at USD 2.5 billion, based on a five-year historical analysis. This figure reflects the combined market size of industrial sensors (USD 1.4 billion) and IoT sensors (USD 1.08 billion) in 2024, as reported by authoritative industry analysts. Growth is primarily driven by the increasing adoption of automation technologies across manufacturing, healthcare, and automotive sectors, coupled with rising demand for IoT-enabled sensors that enhance operational efficiency, real-time data analytics, and predictive maintenance. The market is further supported by rapid advancements in sensor miniaturization, energy efficiency, and the integration of AI and machine learning into industrial processes, enabling smarter decision-making and autonomous operations.

- Key players in this market are concentrated in major cities such as Tokyo, Osaka, and Nagoya. These cities dominate due to their robust industrial base, advanced technological infrastructure, and proximity to leading research institutions and corporate R&D centers. The presence of numerous manufacturing facilities, a highly skilled workforce, and clusters of electronics and automotive companies further contribute to the market's growth in these regions, making them hubs for innovation and development in industrial automation and IoT sensors.

- The Japanese government’s "Society 5.0" initiative, formally launched by the Cabinet Office in 2016 and continuously updated, aims to integrate advanced technologies—including IoT, AI, robotics, and big data—across all sectors of society and industry. The initiative provides funding for R&D, supports public-private partnerships, and offers tax incentives and subsidies for companies adopting smart manufacturing and digital transformation practices. Compliance with the "Society 5.0" framework involves meeting specific technology adoption benchmarks, participating in government-led pilot projects, and aligning with national standards for cybersecurity and data interoperability in industrial systems. This policy environment fosters a conducive ecosystem for the growth of industrial automation and IoT sensors, with measurable impacts on market expansion and technological innovation.

Japan Industrial Automation & IoT Sensors Market Segmentation

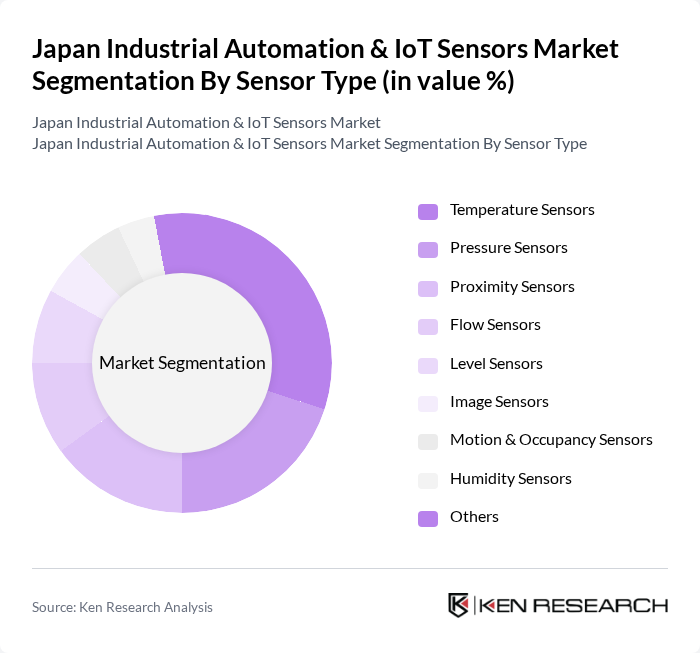

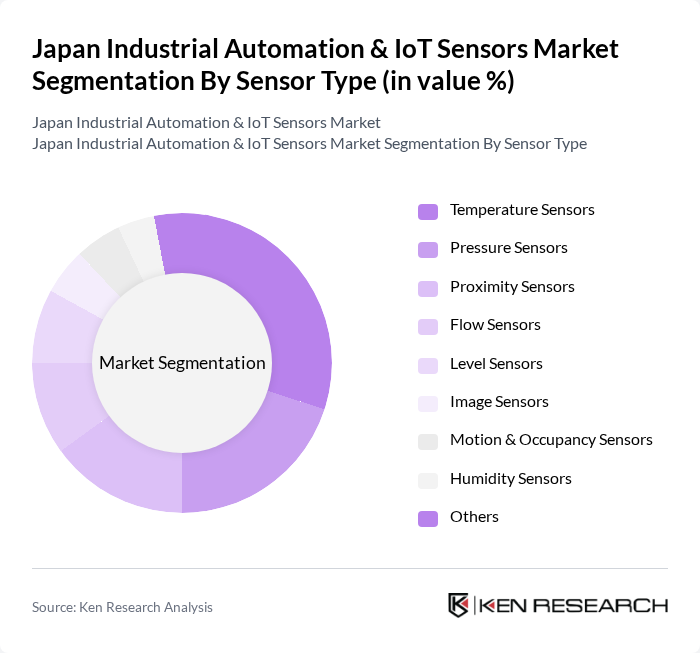

By Sensor Type:The sensor type segmentation includes temperature sensors, pressure sensors, proximity sensors, flow sensors, level sensors, image sensors, motion & occupancy sensors, humidity sensors, and others. Temperature sensors lead the market due to their critical role in monitoring and controlling industrial processes, particularly in manufacturing, food processing, and energy management. The focus on energy efficiency, process optimization, and regulatory compliance drives sustained demand for these sensors. Pressure, proximity, and flow sensors are also widely used across automation and control systems, while image and motion sensors are gaining traction in quality inspection and safety applications. The segmentation reflects the diverse applications of sensors in Japan’s industrial ecosystem, with continuous innovation expanding their use cases.

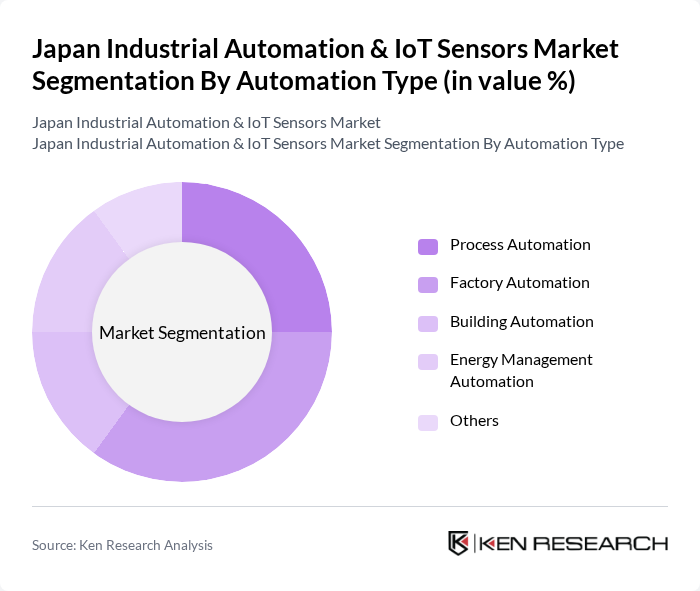

By Automation Type:The automation type segmentation encompasses process automation, factory automation, building automation, energy management automation, and others. Factory automation is the dominant segment, driven by the need for increased productivity, reduced operational costs, and enhanced quality control in manufacturing. The integration of IoT technologies—such as real-time monitoring, predictive maintenance, and adaptive control—is accelerating the adoption of smart factory solutions. Process automation remains significant in chemicals, oil & gas, and pharmaceuticals, while building and energy management automation are growing due to sustainability mandates and smart city initiatives. This segmentation highlights the broad applicability of automation technologies across Japan’s industrial landscape, with factory automation at the forefront of market growth.

Japan Industrial Automation & IoT Sensors Market Competitive Landscape

The Japan Industrial Automation & IoT Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation, Inc., Yokogawa Electric Corporation, Schneider Electric SE, Honeywell International Inc., Bosch Rexroth AG, ABB Ltd., National Instruments Corporation, Endress+Hauser AG, Emerson Electric Co., Fuji Electric Co., Ltd., Keyence Corporation, Panasonic Corporation, SICK AG, Banner Engineering Corp., Azbil Corporation, Fanuc Corporation, Hitachi, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Japan Industrial Automation & IoT Sensors Market Industry Analysis

Growth Drivers

- Increased Demand for Automation in Manufacturing:The Japanese manufacturing sector, valued at approximately ¥80 trillion, is increasingly adopting automation technologies to enhance productivity. With labor shortages projected to reach 1.5 million, companies are investing in automation solutions to maintain output levels. This shift is supported by a 15% increase in automation-related investments, reflecting a strong trend towards integrating advanced technologies in production processes to remain competitive in the global market.

- Rising Adoption of IoT Technologies:The IoT market in Japan is expected to reach ¥6 trillion, driven by the need for interconnected devices in industrial settings. This growth is fueled by the increasing demand for real-time monitoring and data analytics, which enhance operational efficiency. As of recent years, over 60% of manufacturers have implemented IoT solutions, indicating a robust trend towards digital transformation that supports predictive maintenance and operational insights, crucial for optimizing production lines.

- Government Initiatives for Smart Manufacturing:The Japanese government has allocated ¥1 trillion for initiatives aimed at promoting smart manufacturing. This includes funding for research and development in automation technologies and IoT applications. The "Society 5.0" initiative emphasizes integrating advanced technologies into manufacturing, aiming to increase productivity by 30% in future. Such government support is pivotal in driving industry adoption of innovative solutions, ensuring Japan remains a leader in industrial automation.

Market Challenges

- High Initial Investment Costs:The upfront costs associated with implementing industrial automation and IoT systems can be prohibitive, often exceeding ¥100 million for large-scale projects. Many small to medium-sized enterprises (SMEs) struggle to justify these expenses, especially when faced with tight budgets. This financial barrier limits the widespread adoption of advanced technologies, hindering overall market growth and innovation in the sector.

- Integration Issues with Legacy Systems:A significant challenge for Japanese manufacturers is the integration of new automation technologies with existing legacy systems. Approximately 70% of factories still rely on outdated machinery, which complicates the implementation of IoT solutions. This lack of compatibility can lead to increased downtime and operational inefficiencies, as companies face difficulties in achieving seamless data flow and interoperability between new and old systems.

Japan Industrial Automation & IoT Sensors Market Future Outlook

The future of the Japan Industrial Automation and IoT Sensors market appears promising, driven by technological advancements and increasing investments in smart manufacturing. As companies prioritize operational efficiency and data-driven decision-making, the integration of AI and machine learning into automation solutions is expected to gain traction. Additionally, the expansion of 5G technology will facilitate faster data transmission, enhancing real-time analytics capabilities and further driving the adoption of IoT solutions across various industries.

Market Opportunities

- Expansion of Smart Factories:The trend towards smart factories presents a significant opportunity, with an estimated 20% of manufacturing facilities expected to adopt smart technologies in future. This shift will enhance operational efficiency and reduce costs, making it a lucrative area for investment and innovation in automation solutions.

- Growth in Predictive Maintenance Solutions:The predictive maintenance market is projected to grow to ¥1.5 trillion, driven by the need for reducing downtime and maintenance costs. Companies are increasingly investing in IoT sensors that provide real-time data, enabling proactive maintenance strategies that enhance equipment reliability and operational efficiency.