Region:Africa

Author(s):Rebecca

Product Code:KRAA3356

Pages:96

Published On:September 2025

By Type:

The Kenya Cybersecurity and MSSP market is segmented by type into Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Threat Intelligence & Monitoring, Security Operations Center (SOC) Services, and Others.Network Securityis the leading sub-segment, driven by the urgent need to protect organizational networks from unauthorized access and cyber threats. The rise in remote work, cloud adoption, and mobile connectivity has further amplified demand for robust network security solutions, making it a top priority for businesses across sectors. The market is also seeing increased investment in cloud security and AI-powered threat intelligence solutions to address emerging risks .

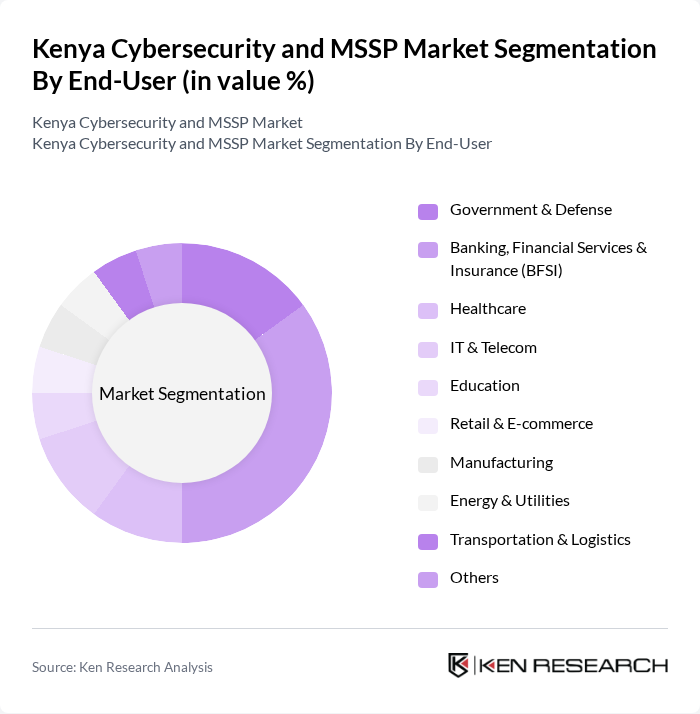

By End-User:

This market is also segmented by end-user, including Government & Defense, Banking, Financial Services & Insurance (BFSI), Healthcare, IT & Telecom, Education, Retail & E-commerce, Manufacturing, Energy & Utilities, Transportation & Logistics, and Others.BFSIis the dominant end-user, as financial institutions face stringent regulatory requirements and are prime targets for cyberattacks. The increasing digitization of banking services, expansion of mobile banking, and the need for secure transactions further drive demand for cybersecurity solutions in this sector. Healthcare and government sectors are also accelerating adoption due to rising threats and compliance needs .

The Kenya Cybersecurity and MSSP Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safaricom PLC, East African Data Centre, Cyber Security Africa, Securex Agencies Ltd, Dimension Data Kenya, IBM Kenya, Kaspersky Lab, Fortinet Kenya, Check Point Software Technologies Kenya, Cisco Systems Kenya, Trend Micro Kenya, Palo Alto Networks Kenya, Microsoft Kenya, Orange CyberDefense Kenya, CyberGuard Africa, Serianu Limited, Silensec Kenya, Africa Cybersecurity Consortium, Liquid Intelligent Technologies Kenya, and Africa Data Centres contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kenya cybersecurity market appears promising, driven by increasing awareness of cyber threats and the necessity for compliance with data protection regulations. As organizations continue to embrace digital transformation, the demand for advanced cybersecurity solutions will likely rise. Additionally, the government's commitment to enhancing cybersecurity infrastructure will foster a more secure environment, encouraging investments in innovative technologies and services that address evolving cyber threats effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Threat Intelligence & Monitoring Security Operations Center (SOC) Services Others |

| By End-User | Government & Defense Banking, Financial Services & Insurance (BFSI) Healthcare IT & Telecom Education Retail & E-commerce Manufacturing Energy & Utilities Transportation & Logistics Others |

| By Industry Vertical | Banking and Financial Services Insurance Manufacturing Energy and Utilities Transportation and Logistics Public Administration Information Services Others |

| By Service Type | Consulting Services Managed Security Services Incident Response Services Training and Awareness Services Vulnerability Assessment & Penetration Testing Compliance & Risk Management Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time Payment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 100 | CIOs, IT Security Managers |

| Healthcare Cybersecurity Solutions | 60 | Healthcare IT Managers, Compliance Officers |

| Telecommunications MSSP Adoption | 50 | Network Security Engineers, Operations Managers |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Analysts |

| SME Cybersecurity Awareness | 70 | Business Owners, IT Consultants |

The Kenya Cybersecurity and MSSP market is valued at approximately USD 60 million, driven by increasing cyber threats, digital transformation, and heightened awareness of cybersecurity among businesses and government entities.