Region:Africa

Author(s):Rebecca

Product Code:KRAA3342

Pages:95

Published On:September 2025

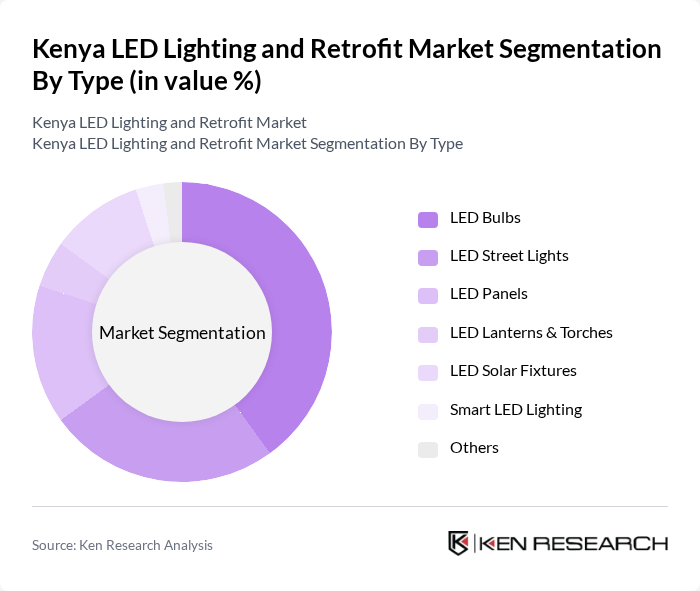

By Type:The market is segmented into various types of LED lighting products, including LED bulbs, LED street lights, LED panels, LED lanterns & torches, LED solar fixtures, smart LED lighting, and others. Among these,LED bulbsare the most widely adopted due to their affordability and energy efficiency, making them a preferred choice for residential and commercial applications.LED street lightsare also gaining traction as municipalities seek to enhance public safety and reduce energy costs. The market is also witnessing increased demand for smart LED lighting and solar-powered fixtures, reflecting a shift toward integrated and off-grid solutions .

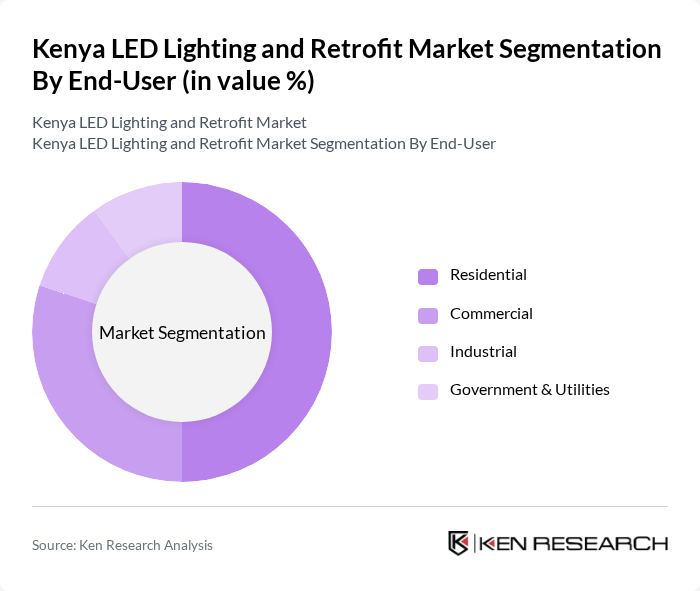

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. Theresidential segmentdominates the market, driven by increasing consumer awareness of energy efficiency and the affordability of LED products. The commercial sector is also significant, as businesses seek to reduce operational costs through energy-efficient lighting solutions. There is also notable adoption in government and utility projects, particularly for street lighting and public infrastructure .

The Kenya LED Lighting and Retrofit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting Kenya, General Electric East Africa, Osram Kenya, Schneider Electric Kenya, East African Cables, M-KOPA Solar, Greenlight Planet, D.light Design, SunCulture, SolarNow, Solar Africa, Luminaire Technologies, Kenya Power and Lighting Company, Jumia Kenya, EcoZoom, Azuri Technologies, BBOXX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kenya LED lighting and retrofit market appears promising, driven by increasing urbanization and government support for renewable energy initiatives. As infrastructure projects expand, the demand for energy-efficient lighting solutions is expected to rise significantly. Additionally, advancements in smart lighting technologies and IoT integration will likely enhance the appeal of LED solutions, making them more attractive to consumers and businesses alike. This evolving landscape presents a unique opportunity for market players to innovate and capture a larger share of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Bulbs LED Street Lights LED Panels LED Lanterns & Torches LED Solar Fixtures Smart LED Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Indoor Lighting Outdoor Lighting Street Lighting Architectural Lighting |

| By Distribution Channel | Direct Sales Retail Stores Supermarkets/Hypermarkets Specialty Stores Online Sales |

| By Price Range | Low-End Mid-Range High-End |

| By Installation Type | New Installations Retrofits |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential LED Adoption | 120 | Homeowners, Property Managers |

| Commercial Lighting Solutions | 85 | Facility Managers, Business Owners |

| Industrial Retrofit Projects | 65 | Operations Managers, Energy Efficiency Consultants |

| Government Energy Initiatives | 45 | Policy Makers, Energy Regulators |

| Lighting Technology Innovators | 55 | R&D Managers, Product Development Leads |

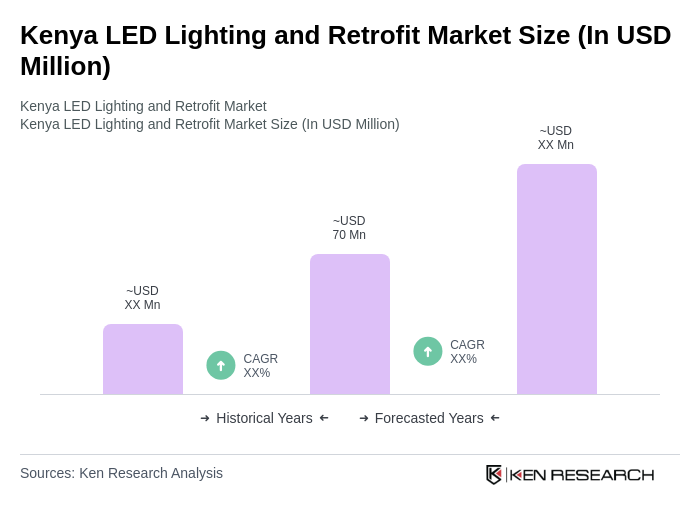

The Kenya LED lighting and retrofit market is valued at approximately USD 70 million, driven by increasing energy efficiency awareness, government initiatives promoting renewable energy, and a growing demand for sustainable lighting solutions across urban and rural areas.