Region:Central and South America

Author(s):Rebecca

Product Code:KRAA3351

Pages:82

Published On:September 2025

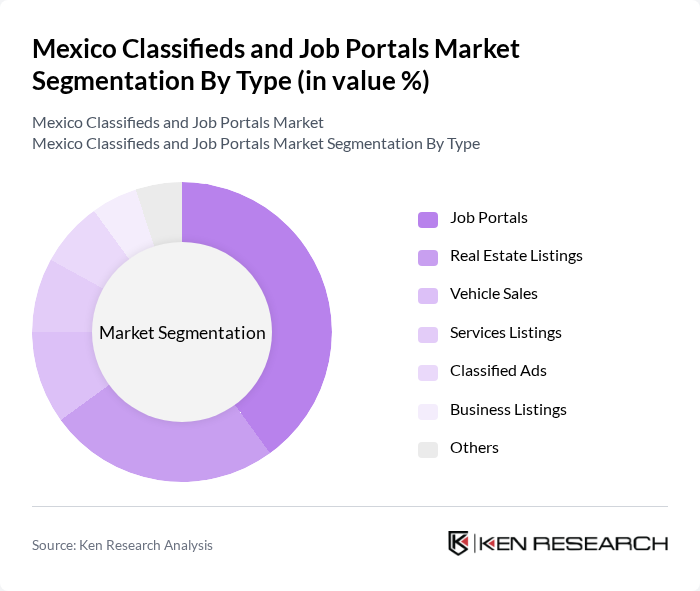

By Type:The market can be segmented into various types, including Job Portals, Real Estate Listings, Vehicle Sales, Services Listings, Classified Ads, Business Listings, and Others. Among these, Job Portals are the most dominant segment, driven by the increasing number of job seekers and the convenience of online applications. Real Estate Listings also hold a significant share, fueled by the growing urban population and demand for housing. The market is witnessing a trend toward more specialized platforms, with dedicated sites for real estate, automotive, and services gaining traction alongside general classifieds.

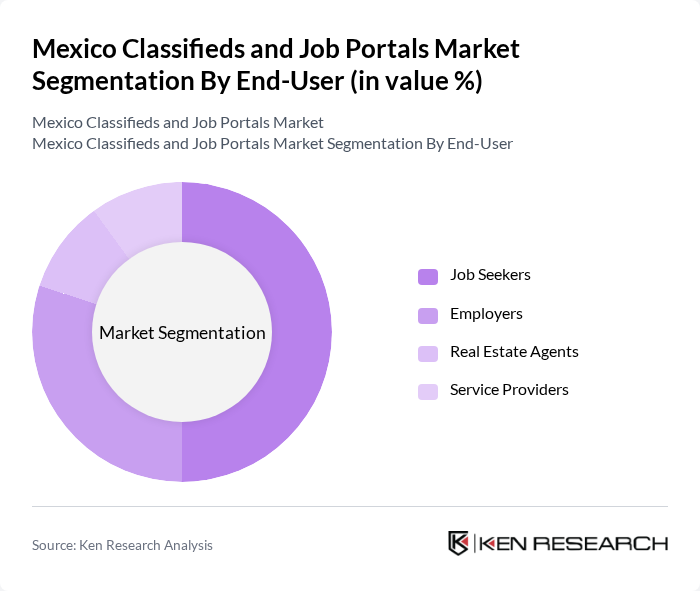

By End-User:The end-user segmentation includes Job Seekers, Employers, Real Estate Agents, and Service Providers. Job Seekers represent the largest segment, driven by the increasing unemployment rate and the need for job placements. Employers also play a crucial role, as they seek efficient platforms to find suitable candidates for their vacancies. The growing middle class and rising disposable income are expanding the pool of active users across all segments.

The Mexico Classifieds and Job Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as OCC Mundial, Computrabajo, Indeed México, Vivanuncios, Segundamano, ZonaJobs, Bumeran, Trabajando.com, Empleos.com.mx, Jobomas, InfoJobs México, Trovit México, OLX México, Mercado Libre, LinkedIn México contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico classifieds and job portals market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms that leverage AI and machine learning for personalized user experiences are likely to thrive. Additionally, the increasing acceptance of remote work will further expand the market, encouraging job portals to innovate and adapt to meet the needs of a diverse workforce seeking flexible employment opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Job Portals Real Estate Listings Vehicle Sales Services Listings Classified Ads Business Listings Others |

| By End-User | Job Seekers Employers Real Estate Agents Service Providers |

| By Sales Channel | Online Platforms Mobile Applications Social Media |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Pricing Model | Free Listings Paid Listings Subscription Models |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Service Type | Full-time Jobs Part-time Jobs Freelance Opportunities Internship Listings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Job Seekers in Urban Areas | 150 | Recent Graduates, Mid-Career Professionals |

| Employers in Technology Sector | 100 | HR Managers, Talent Acquisition Specialists |

| Recruitment Agencies | 60 | Agency Owners, Senior Recruiters |

| Small Business Owners | 50 | Entrepreneurs, Business Development Managers |

| Freelancers and Gig Workers | 70 | Freelance Professionals, Gig Platform Users |

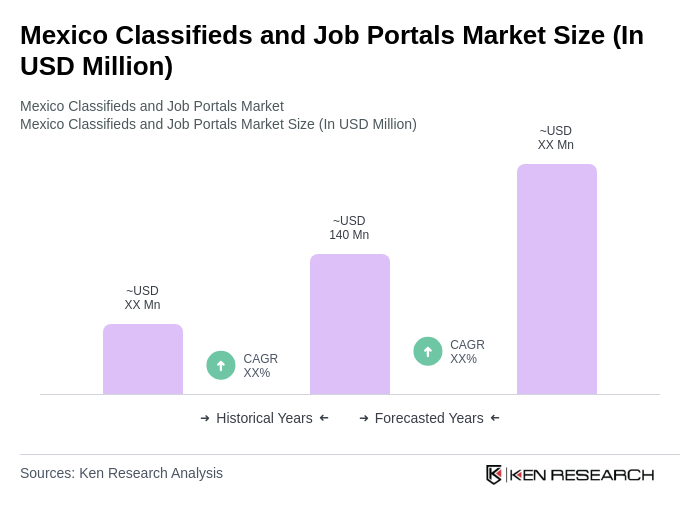

The Mexico Classifieds and Job Portals Market is valued at approximately USD 140 million, reflecting growth driven by increased internet and mobile device penetration, as well as a rising trend in online job searching and classifieds.