Region:Central and South America

Author(s):Shubham

Product Code:KRAA3614

Pages:83

Published On:September 2025

By Technology:The technology segment encompasses various innovative solutions that enhance the efficiency and reliability of energy distribution. Key subsegments include Smart Grid Systems, Microgrids, Energy Storage Systems, IoT and AI Integration, and Renewable Energy Sources. Among these, Smart Grid Systems are leading due to their ability to optimize energy management and integrate renewable sources effectively. The growing adoption of IoT and AI technologies further enhances operational efficiency and predictive maintenance capabilities.

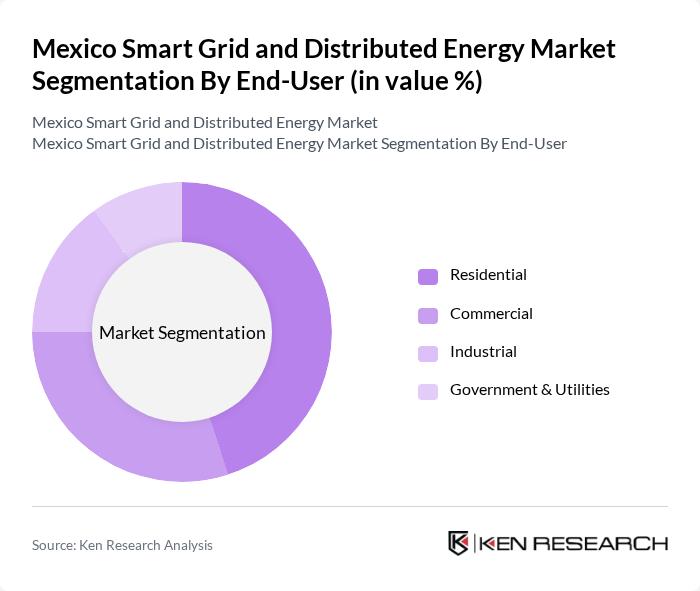

By End-User:The end-user segment includes various categories such as Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently the most significant contributor, driven by increasing consumer awareness of energy efficiency and the adoption of solar energy solutions. Commercial and Industrial sectors are also growing, as businesses seek to reduce energy costs and enhance sustainability practices.

The Mexico Smart Grid and Distributed Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as CFE (Comisión Federal de Electricidad), Enel Green Power México, Acciona Energy México, Siemens México, Schneider Electric México, Iberdrola México, Vestas Wind Systems A/S, First Solar, Inc., Canadian Solar Inc., Trina Solar Limited, SunPower Corporation, EDP Renewables, TotalEnergies, Brookfield Renewable Partners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico Smart Grid and Distributed Energy Market appears promising, driven by increasing investments in renewable energy and technological innovations. The integration of smart grid technologies is expected to enhance energy efficiency and reliability, with a focus on decentralized energy systems. As consumer awareness grows, the demand for energy-efficient solutions will likely rise, prompting further advancements in energy management systems and smart metering technologies, ultimately transforming the energy landscape in Mexico.

| Segment | Sub-Segments |

|---|---|

| By Technology | Smart Grid Systems Microgrids Energy Storage Systems IoT and AI Integration Renewable Energy Sources |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Credits (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 65 | Energy Managers, Operations Directors |

| Distributed Energy Resource Providers | 55 | Business Development Managers, Technical Leads |

| Smart Grid Technology Vendors | 50 | Product Managers, Sales Executives |

| Regulatory Bodies | 45 | Policy Analysts, Regulatory Affairs Managers |

| Research Institutions | 40 | Energy Researchers, Academic Professors |

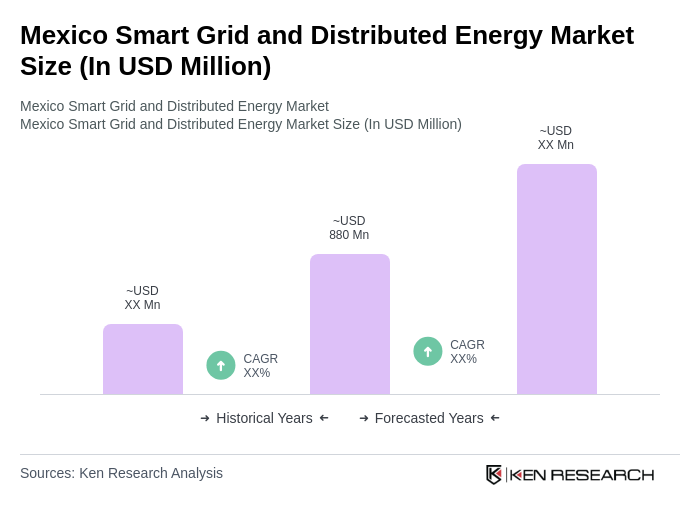

The Mexico Smart Grid Market is valued at approximately USD 880 million, driven by the increasing demand for renewable energy, government initiatives for energy efficiency, and advancements in smart grid technologies.