Region:Africa

Author(s):Shubham

Product Code:KRAA3600

Pages:89

Published On:September 2025

By Type:The market is segmented into various types of electronic security and surveillance solutions, including CCTV Cameras, Access Control Systems, Intrusion Detection Systems, Alarm Systems, Video Surveillance as a Service (VSaaS), Biometrics & Facial Recognition Systems, Perimeter Security Solutions, Fire & Safety Systems, and Others. Among these, CCTV Cameras and Access Control Systems are the most prominent due to their widespread adoption in both residential and commercial sectors. The integration of AI-powered surveillance, cloud-based access control, and biometric technologies is becoming increasingly common as organizations seek to enhance security and operational efficiency.

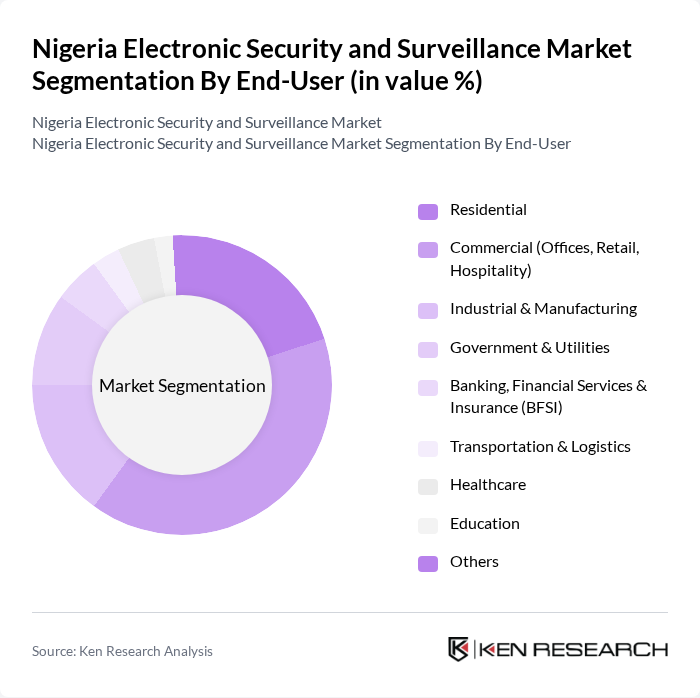

By End-User:The end-user segmentation includes Residential, Commercial (Offices, Retail, Hospitality), Industrial & Manufacturing, Government & Utilities, Banking, Financial Services & Insurance (BFSI), Transportation & Logistics, Healthcare, Education, and Others. The Commercial sector is the largest end-user, driven by the need for enhanced security in retail and office environments, while the Residential sector is also growing as homeowners invest in security solutions. The BFSI and healthcare sectors are experiencing accelerated adoption due to regulatory pressures and the digitization of sensitive data.

The Nigeria Electronic Security and Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell Security Group, Axis Communications, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Bosch Security Systems, Tyco Integrated Security, ADT Security Services, Genetec Inc., Avigilon Corporation, FLIR Systems, Inc., Panasonic Corporation, Hanwha Vision (formerly Samsung Techwin), Johnson Controls International plc, SecureTech Nigeria Limited, ZKTeco, Schneider Electric Nigeria, Assa Abloy, Suprema Inc., Halogen Group, Afrisec Distribution & Consulting Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic security and surveillance market in Nigeria appears promising, driven by increasing investments in technology and infrastructure. As urbanization accelerates, the demand for integrated security solutions will rise, particularly in commercial and residential sectors. Furthermore, the collaboration between government and private entities is expected to enhance regulatory frameworks, fostering innovation. The market is likely to witness a surge in smart surveillance technologies, positioning Nigeria as a key player in the African security landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | CCTV Cameras Access Control Systems Intrusion Detection Systems Alarm Systems Video Surveillance as a Service (VSaaS) Biometrics & Facial Recognition Systems Perimeter Security Solutions Fire & Safety Systems Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Industrial & Manufacturing Government & Utilities Banking, Financial Services & Insurance (BFSI) Transportation & Logistics Healthcare Education Others |

| By Application | Retail Security Transportation Security Banking and Financial Services Critical Infrastructure Protection Event Security Data Center Security Public Safety & City Surveillance Others |

| By Distribution Channel | Direct Sales Online Retail Distributors System Integrators |

| By Component | Hardware Software Services (Installation, Maintenance, Consulting) |

| By Pricing Model | Subscription-Based One-Time Purchase Pay-Per-Use |

| By Region | Northern Nigeria Southern Nigeria Eastern Nigeria Western Nigeria |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Security Systems | 120 | Facility Managers, Security Directors |

| Residential Surveillance Solutions | 100 | Homeowners, Property Managers |

| Government Security Initiatives | 80 | Policy Makers, Law Enforcement Officials |

| Industrial Security Applications | 70 | Operations Managers, Safety Officers |

| Retail Security Systems | 90 | Store Managers, Loss Prevention Specialists |

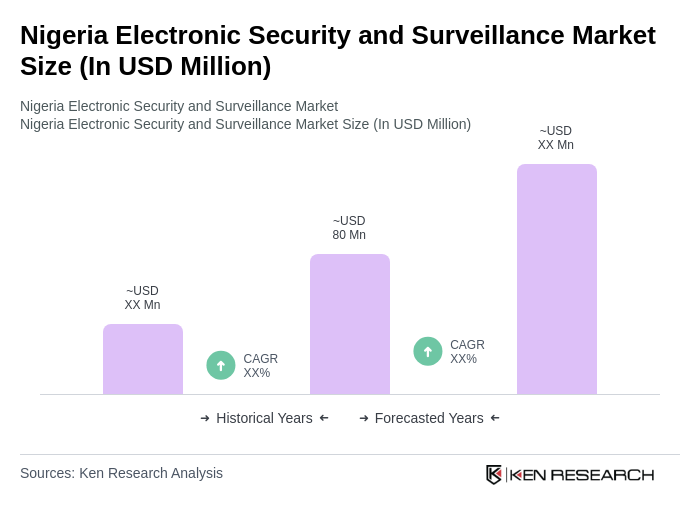

The Nigeria Electronic Security and Surveillance Market is valued at approximately USD 80 million, reflecting a significant growth driven by urbanization, rising crime rates, and the increasing demand for advanced security technologies across various sectors.