Region:Asia

Author(s):Shubham

Product Code:KRAA3627

Pages:99

Published On:September 2025

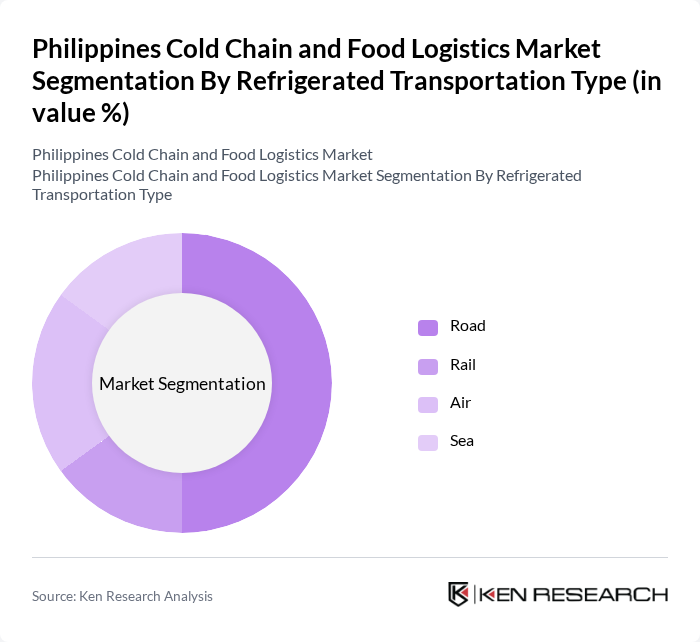

By Refrigerated Transportation Type:The refrigerated transportation segment includes road, rail, air, and sea. Road transport is the most widely used due to its flexibility and ability to reach diverse locations, supporting both urban and rural distribution. Rail transport is emerging for bulk shipments, especially for agricultural products. Air transport is preferred for high-value and time-sensitive goods, such as pharmaceuticals and premium seafood. Sea transport remains essential for international trade and inter-island movement of perishable goods, particularly for large-volume shipments .

By Temperature Control System:The temperature control system segment is divided into active and passive systems. Active systems use mechanical or electrical means to maintain precise temperature control, making them suitable for long-distance and high-value shipments, including pharmaceuticals and export-grade seafood. Passive systems rely on insulation and phase change materials, offering cost-effective solutions for shorter routes and less sensitive goods. The choice between these systems is influenced by the nature of the cargo, required temperature stability, and duration of transit .

The Philippines Cold Chain and Food Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jentec Storage Inc., Glacier Megafridge Inc., Royal Cargo Inc., Big Blue Logistics Inc., Mets Logistics Inc., Koldstor Centre Philippines Inc., Thermo King Philippines, LBC Express Holdings, Inc., DHL Supply Chain Philippines, San Miguel Corporation, Universal Robina Corporation, Del Monte Pacific Limited, AgriNurture, Inc., Foodpanda Philippines, and Grab Philippines contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain and food logistics market in the Philippines appears promising, driven by technological advancements and increasing consumer demand for quality food products. The integration of IoT and automation technologies is expected to enhance operational efficiency, while sustainability initiatives will likely shape logistics practices. As the government continues to support infrastructure development, the market is poised for significant growth, with a focus on improving food safety and reducing waste in the supply chain.

| Segment | Sub-Segments |

|---|---|

| By Refrigerated Transportation Type | Road Rail Air Sea |

| By Temperature Control System | Active Systems Passive Systems |

| By Service Type | Pre-Cooling Cold Storage Refrigerated Transport Value-Added Services (e.g., packaging, labeling) |

| By End-User Industry | Food & Beverage Pharmaceuticals & Biotech Agriculture & Seafood Retail & E-commerce Others |

| By Application | Fresh Produce Frozen Foods Dairy Products Meat & Seafood Pharmaceuticals Others |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Food Manufacturers | 60 | Production Managers, Supply Chain Coordinators |

| Retail Distribution Centers | 70 | Logistics Managers, Inventory Control Specialists |

| Transport Service Providers | 50 | Fleet Managers, Business Development Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The Philippines Cold Chain and Food Logistics Market is valued at approximately USD 1.6 billion, driven by the increasing demand for perishable goods, the expansion of the food and beverage sector, and advancements in logistics technology.