Region:Europe

Author(s):Geetanshi

Product Code:KRAA3638

Pages:87

Published On:September 2025

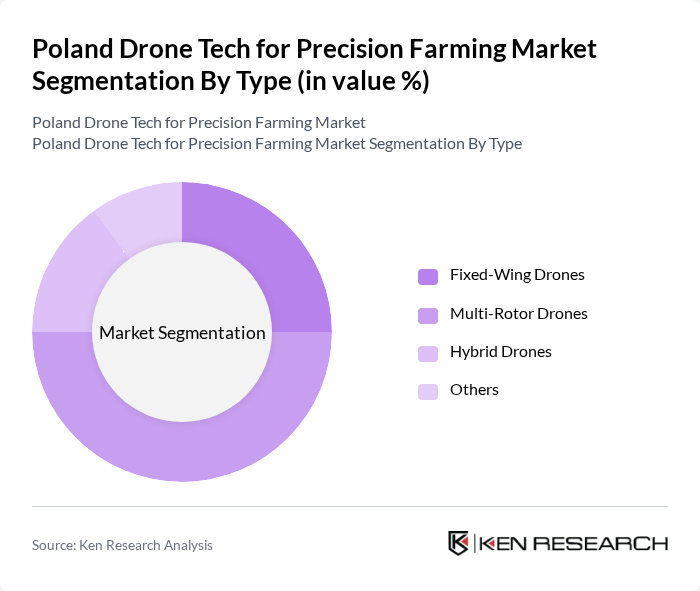

By Type:The market is segmented into Fixed-Wing Drones, Multi-Rotor Drones, Hybrid Drones, and Others. Among these, Multi-Rotor Drones are leading the market due to their versatility and ease of use, making them ideal for various agricultural applications such as crop monitoring and spraying. Fixed-Wing Drones, while less common, are preferred for larger fields due to their longer flight times and coverage capabilities. Hybrid Drones combine the advantages of both types, catering to specific needs in precision farming.

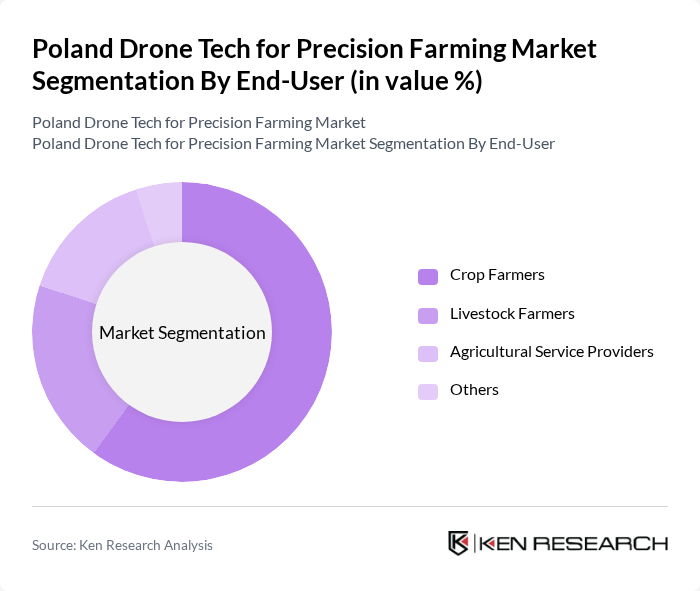

By End-User:The end-user segmentation includes Crop Farmers, Livestock Farmers, Agricultural Service Providers, and Others. Crop Farmers dominate the market as they increasingly adopt drone technology for precision agriculture, enabling them to monitor crop health, optimize irrigation, and manage pests effectively. Livestock Farmers are also beginning to utilize drones for monitoring livestock and managing pasture, while Agricultural Service Providers offer drone services to multiple farmers, further driving market growth.

The Poland Drone Tech for Precision Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot Drones S.A., senseFly SA, AgEagle Aerial Systems Inc., PrecisionHawk Inc., Delair Tech SAS, Yuneec International Co., Ltd., Skydio Inc., AeroVironment, Inc., Quantum Systems GmbH, Wingtra AG, DroneDeploy, Inc., Sentera, Inc., Raptor Maps, Inc., AgJunction Inc., AgroDrone Polska Sp. z o.o., Dronehub Sp. z o.o., FlyTech UAV Sp. z o.o., DroneRadar Sp. z o.o., AgriEye Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland drone tech for precision farming market appears promising, driven by ongoing technological advancements and increasing government support. As farmers become more aware of the benefits of drone technology, adoption rates are expected to rise significantly. Additionally, the integration of drones with IoT and AI technologies will enhance data collection and analysis, leading to more informed decision-making in agriculture. This trend will likely foster a more sustainable and efficient farming landscape in Poland.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Drones Multi-Rotor Drones Hybrid Drones Others |

| By End-User | Crop Farmers Livestock Farmers Agricultural Service Providers Others |

| By Application | Crop Monitoring Soil Analysis Pest and Disease Management Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | Northern Poland Southern Poland Eastern Poland Western Poland |

| By Investment Source | Private Investments Government Grants Venture Capital Others |

| By Policy Support | Subsidies for Drone Purchases Tax Incentives for Agricultural Technology Research and Development Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drone Adoption in Crop Monitoring | 120 | Farm Owners, Agronomists |

| Precision Agriculture Technology Usage | 90 | Agricultural Technologists, Farm Managers |

| Drone Service Providers | 60 | Business Development Managers, Operations Directors |

| Government Policy Impact on Drone Usage | 50 | Policy Makers, Agricultural Advisors |

| Research Institutions Focused on Agriculture | 50 | Researchers, Academic Professors |

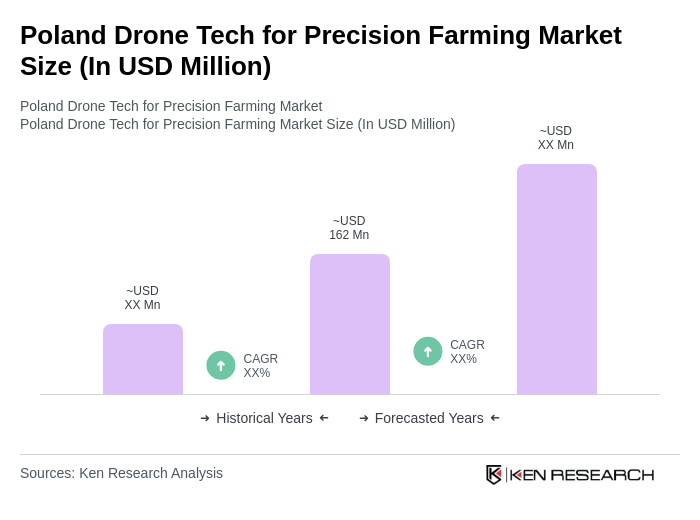

The Poland Drone Tech for Precision Farming Market is valued at approximately USD 162 million, reflecting a significant growth driven by the increasing adoption of advanced agricultural technologies and the demand for precision farming solutions.