Region:Europe

Author(s):Shubham

Product Code:KRAA3606

Pages:97

Published On:September 2025

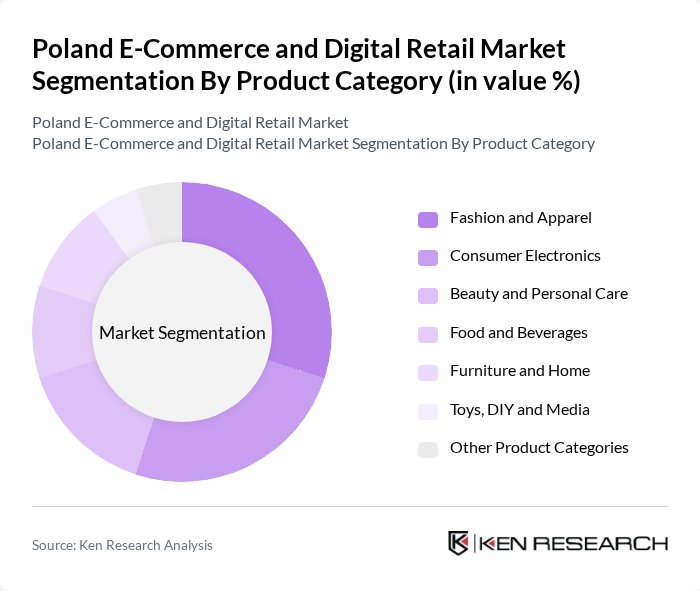

By Product Category:The product categories in the e-commerce market are diverse, with fashion and apparel consistently leading due to the popularity of online shopping for clothing and accessories. Consumer electronics hold a substantial share, driven by demand for gadgets, smartphones, and home appliances. Beauty and personal care products are gaining momentum as consumers seek convenience and a wide assortment online. Food and beverages have experienced notable growth, supported by the rise of ultra-fast grocery fulfillment and increased online grocery adoption. Furniture and home goods are also increasingly purchased online as consumers invest in home improvement. Toys, DIY, and media products remain popular, catering to a broad range of consumer interests .

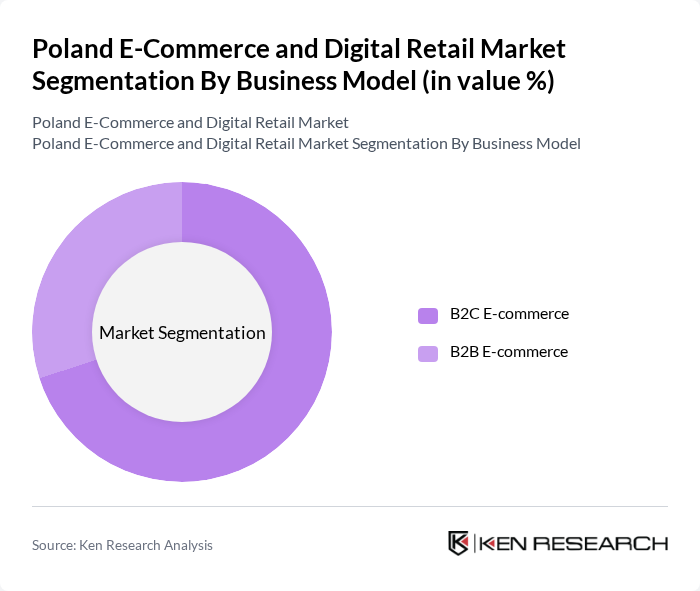

By Business Model:The e-commerce market in Poland is primarily segmented into B2C and B2B models. The B2C e-commerce segment is the most dominant, fueled by the growing number of online shoppers, the convenience of direct-to-consumer retail, and the proliferation of digital payment solutions. B2B e-commerce is also significant, as businesses increasingly leverage online platforms for procurement and supply chain management. Both segments benefit from technological advancements and improved logistics infrastructure, making digital transactions more efficient and reliable .

The Poland E-Commerce and Digital Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allegro S.A., Amazon Poland, OLX Group, Ceneo.pl, Empik S.A., Zalando SE, MediaMarkt Poland, Euro RTV AGD, eMAG Poland, Morele.net, x-kom S.A., Notino, PayPo (BNPL provider), Shoplo, Shoper S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Polish e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As digital payment solutions become more integrated, the ease of online transactions will likely enhance shopping experiences. Additionally, the focus on sustainability and personalized shopping experiences will shape consumer preferences, encouraging businesses to innovate. Companies that adapt to these trends will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fashion and Apparel Consumer Electronics Beauty and Personal Care Food and Beverages Furniture and Home Toys, DIY and Media Other Product Categories |

| By Business Model | B2C E-commerce B2B E-commerce |

| By Device Type | Smartphone/Mobile Desktop and Laptop Other Device Types |

| By Payment Method | Credit/Debit Cards Digital Wallets Buy Now, Pay Later (BNPL) Cash on Delivery Other Payment Methods |

| By Region | East West North South |

| By Customer Demographics | Age Groups Income Levels Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General E-commerce Trends | 100 | Online Retailers, E-commerce Managers |

| Consumer Behavior Insights | 120 | Online Shoppers, Market Researchers |

| Digital Payment Preferences | 80 | Finance Managers, Payment Solution Providers |

| Logistics and Delivery Challenges | 60 | Logistics Coordinators, Supply Chain Analysts |

| Marketing Strategies in E-commerce | 90 | Marketing Directors, Brand Managers |

The Poland E-Commerce and Digital Retail Market is valued at approximately USD 25 billion, driven by factors such as rising digital literacy, smartphone penetration, and a shift in consumer behavior towards online shopping.