Region:Europe

Author(s):Geetanshi

Product Code:KRAA3644

Pages:94

Published On:September 2025

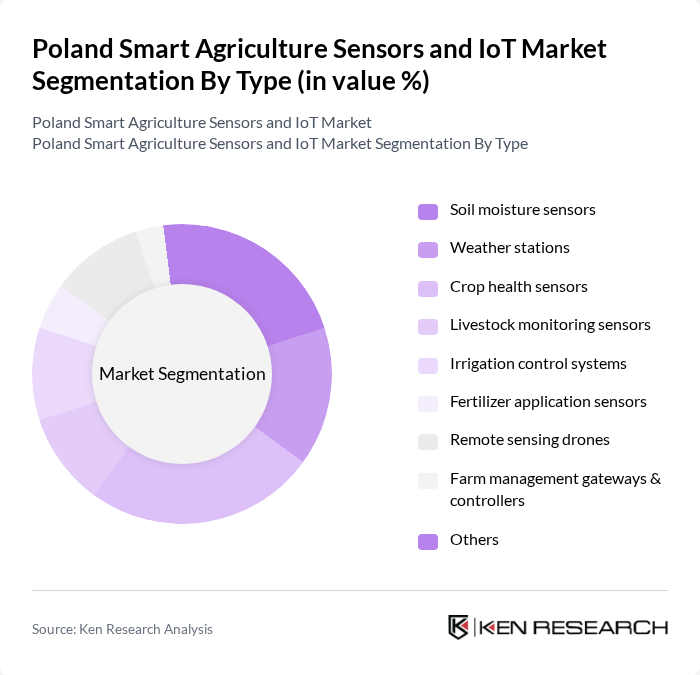

By Type:The market can be segmented into various types of smart agriculture sensors and IoT devices. The key subsegments includesoil moisture sensors, weather stations, crop health sensors, livestock monitoring sensors, irrigation control systems, fertilizer application sensors, remote sensing drones, farm management gateways & controllers, and others. Each of these subsegments plays a crucial role in enhancing agricultural productivity and efficiency. Soil moisture sensors and crop health sensors are particularly important for precision farming, enabling real-time monitoring of field conditions and supporting data-driven decision-making. Weather stations and remote sensing drones are increasingly used for climate adaptation and yield optimization.

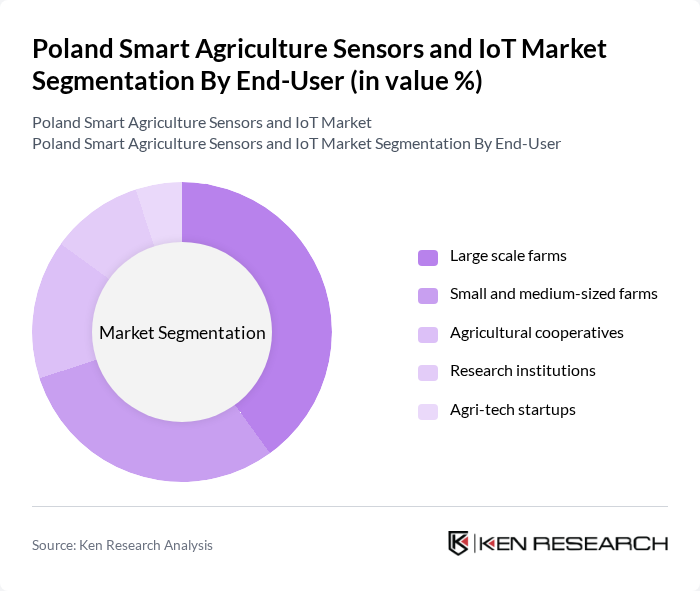

By End-User:The end-user segmentation includeslarge scale farms, small and medium-sized farms, agricultural cooperatives, research institutions, and agri-tech startups. Each of these segments has unique needs and requirements for smart agriculture solutions, influencing their adoption rates and market dynamics. Large scale farms are the primary adopters, leveraging advanced sensor networks and IoT platforms for efficiency and yield maximization. Small and medium-sized farms are increasingly adopting modular and scalable solutions, often supported by government incentives and cooperative programs. Agri-tech startups and research institutions drive innovation and pilot new technologies.

The Poland Smart Agriculture Sensors and IoT Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, Trimble Inc., AG Leader Technology, Taranis, CropX, Raven Industries, Bosch, Sentera, SoilOptix, Decagon Devices (now METER Group), Sencrop, AgriSens, SatAgro, AgriTechHub, AgriData (Poland) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart agriculture sensors and IoT market in Poland appears promising, driven by technological advancements and increasing government support. As farmers become more aware of the benefits of precision agriculture, the adoption of smart technologies is expected to rise significantly. Additionally, the integration of AI and machine learning into farming practices will enhance decision-making processes, leading to improved crop management and resource efficiency. The focus on sustainability will further propel the market, aligning with global agricultural trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Soil moisture sensors Weather stations Crop health sensors Livestock monitoring sensors Irrigation control systems Fertilizer application sensors Remote sensing drones Farm management gateways & controllers Others |

| By End-User | Large scale farms Small and medium-sized farms Agricultural cooperatives Research institutions Agri-tech startups |

| By Application | Crop monitoring Livestock management Irrigation management Pest control Farm equipment monitoring |

| By Sales Channel | Direct sales Distributors Online platforms System integrators |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-range Premium |

| By Policy Support | Subsidies Tax incentives Grants for technology adoption EU digital agriculture programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Monitoring Solutions | 100 | Farm Owners, Agronomists |

| Livestock Management Sensors | 80 | Livestock Farmers, Veterinary Technicians |

| Irrigation Automation Systems | 60 | Agricultural Engineers, Irrigation Specialists |

| Soil Health Monitoring Technologies | 90 | Soil Scientists, Environmental Consultants |

| Data Analytics for Precision Farming | 70 | Data Analysts, Farm Management Software Users |

The Poland Smart Agriculture Sensors and IoT Market is valued at approximately USD 1.1 billion, reflecting its significant role within the broader European smart agriculture sector, which was valued at USD 6.3 billion in 2024.