Region:Europe

Author(s):Geetanshi

Product Code:KRAA3731

Pages:93

Published On:September 2025

By Type:The market is segmented into various platform types addressing diverse mental health needs.Individual therapy platformsare prominent for delivering personalized care, whilegroup therapy platformsfacilitate community support.Self-help applicationsandcrisis intervention servicesaddress immediate mental health concerns.Wellness coaching platformsandpeer support networksare emerging as valuable resources, andAI-driven mental health appsleverage technology for enhanced engagement.Employee assistance program (EAP) platformsare increasingly adopted by corporates to support workforce mental wellness. These segments reflect Poland’s growing preference for flexible, technology-enabled, and niche-focused teletherapy solutions .

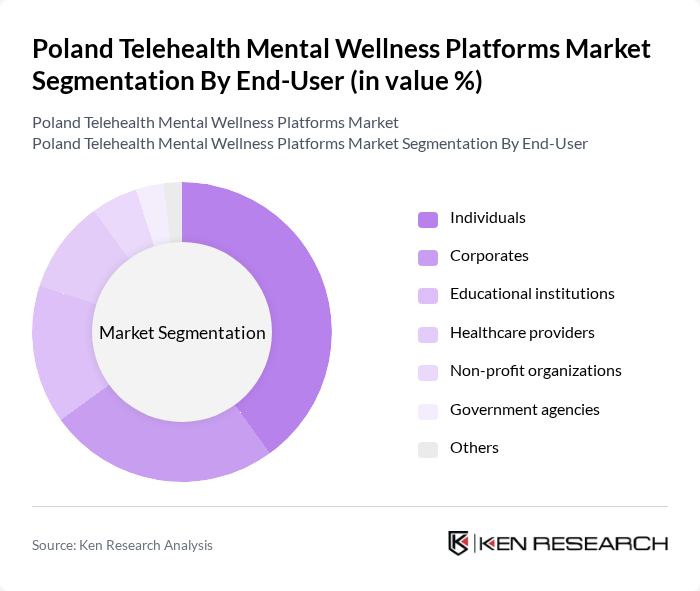

By End-User:The end-user segmentation includes individuals, corporates, educational institutions, healthcare providers, non-profit organizations, and government agencies.Individualsrepresent the largest segment, driven by growing awareness and the convenience of online access.Corporatesare rapidly adopting telehealth platforms for employee wellness, whileeducational institutionsintegrate mental health resources for students.Healthcare providersandnon-profitsleverage these platforms to expand outreach and improve service delivery.Government agenciesutilize telehealth for public mental health initiatives, reflecting the sector’s broadening institutional adoption .

The Poland Telehealth Mental Wellness Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mindgram, Wellbee, Moja Psychiatria, Telemedi.co, Psychoterapia Online, Zdalna Psychoterapia, Medicover, Luxmed, ePsychiatry, NEST, Krajowy O?rodek Wsparcia Psychologicznego, Psycholog Online, Terapia Online, Zaufana Psychoterapia, Telemedycyna Polska contribute to innovation, geographic expansion, and service delivery in this space.

The future of telehealth mental wellness platforms in Poland appears promising, driven by technological advancements and increasing societal acceptance. As the government continues to invest in mental health initiatives, the integration of telehealth into primary care is expected to enhance service accessibility. Furthermore, the development of AI-driven solutions will likely improve user experience and engagement, making mental health support more personalized and effective. These trends indicate a robust growth trajectory for the sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual therapy platforms Group therapy platforms Self-help applications Crisis intervention services Wellness coaching platforms Peer support networks AI-driven mental health apps Employee assistance program (EAP) platforms Others |

| By End-User | Individuals Corporates Educational institutions Healthcare providers Non-profit organizations Government agencies Others |

| By Service Model | Subscription-based services Pay-per-session services Freemium models Bundled services Hybrid (online/offline) services Others |

| By Demographics | Age groups (children, adults, seniors) Gender-specific services Socioeconomic status Others |

| By Payment Method | Credit/debit cards Insurance reimbursements Direct bank transfers Mobile payments Employer-sponsored payments Others |

| By Geographic Focus | Urban areas Suburban areas Rural areas Others |

| By User Engagement Level | Active users Occasional users Inactive users High-frequency users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telehealth Platform Users | 120 | Individuals aged 18-65 using mental wellness services |

| Mental Health Professionals | 80 | Psychologists, Psychiatrists, and Counselors |

| Healthcare Policy Makers | 40 | Government officials and health department representatives |

| Insurance Providers | 60 | Executives and product managers from health insurance companies |

| Telehealth Platform Developers | 50 | Product managers and technical leads from telehealth companies |

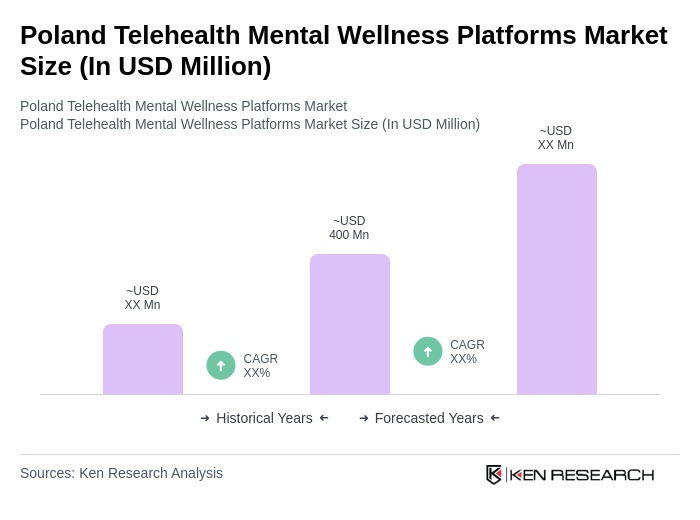

The Poland Telehealth Mental Wellness Platforms Market is valued at approximately USD 400 million, reflecting significant growth driven by increased demand for mental health services and the convenience of digital access to therapy and counseling.