The $300 Billion Pivot: How APAC Telcos Are Reinventing Themselves in the Enterprise Era

As connectivity growth slows and enterprise tech demand surges, APAC telcos are evolving fast. Early movers shapes the region’s next growth wave.

Built for Leaders Across

This report is for decision-makers responsible for redefiningtelecom businessmodels, capturing B2B market share, and leading digital platform transitions across Asia-Pacific.

Ideal for:

- CXOs & Strategy Officers at telecom, cloud, and ICT firms

- Heads of Digital Transformation & Enterprise Services

- Platform Leaders in IoT, Edge, Cloud, and Cybersecurity

- Investors & M&A Professionals seeking the next telco-to-techco breakout stories

If you're rethinking your role in tomorrow’s telecom economy—start here

Executive Summary

The B2C chapter of telecom is nearing its end in APAC. With subscriber growth flattening at under 4% and voice/data ARPU falling across major economies, telcos can no longer rely on legacy connectivity models.

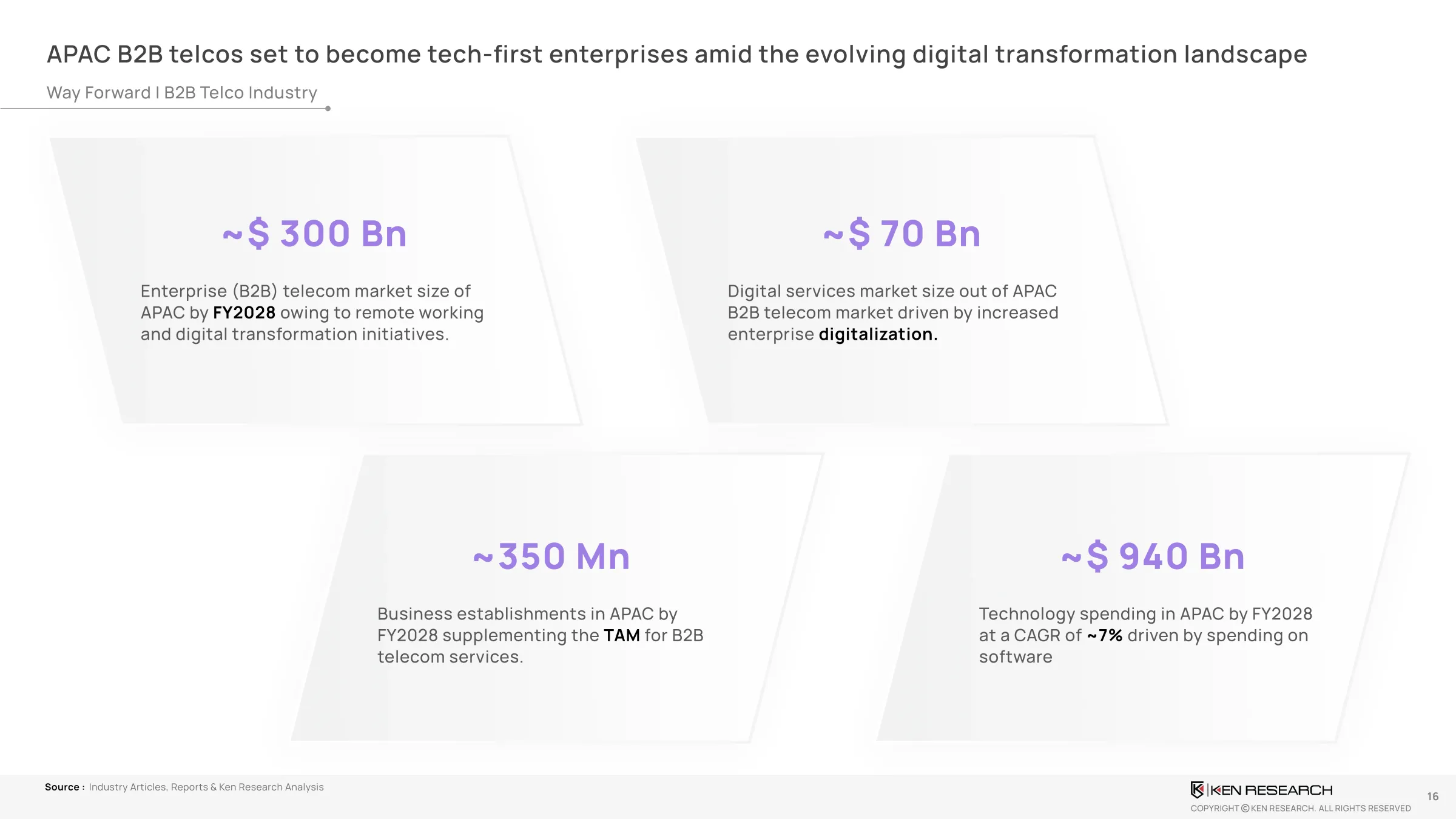

What’s rising in its place is a$300 billion enterprise market, with a core$70 billiondigital services sub-segment fueled by demand for cloud, IoT, and security. APAC is uniquely positioned:67%of enterprises in the region expect to increase their telecom-tech spending, surpassing global intent (62%).

The opportunity is not just large—it’s urgent. Telcos that realign now toward enterprise-first growth will benefit from6–8x higher ARPU, stickier multi-year contracts, and relevance in a tech-first enterprise world.

Want a customized blueprint to transition from telco to techco?

Market Snapshot: Enterprise Is The New Core

With B2C revenues stalling,theAPAC telecom enterprise marketis projected to reach USD 300 billion by FY2028. At the center of this evolution is digital enablement:

- Cloud, Cybersecurity, IoT, and Managed Servicesare driving aUSD 70 billionopportunity, with CAGR rates between 12%.

- Meanwhile, legacy mobile internet and broadband have dipped below4% annual growth, with many markets reaching >90% penetration.

What’s the shift? Telcos are transforming from bandwidth providers into trusted IT service orchestrators. This POV explores how you can lead—not follow—that transition.

Request the regional playbook to redirect growth investments into digital services

The Digital Services Breakout: Where The Money Is Moving

APAC enterprise clients are now bundling network + cloud + security in a single SLA, triggering a reshuffle in revenue streams:

- Cloud & Managed Servicesnow contributeone-third of enterprise revenuefor APAC leaders like Singtel and NTT.

- Cybersecurityis expanding at20–25% YoY, with BFSI and government leading the charge.

- IoT marketin APAC are poised to hitUSD 545 B by 2027, driven by manufacturing and smart cities.

If your product portfolio hasn’t shifted accordingly, your margins will.

Explore how to position your services to capture this 3-in-1 digital demand

Product Strategy: From Pipe To Platform

Top-performing telcos in the region are shifting from static bandwidth sales to modular enterprise services:

- Instead of “speed + data” plans, they offer Private 5G, Edge Compute, SASE, Managed SOCs, and Multi-cloud Orchestration.

- These services drive multi-year B2B contracts, increase cross-sell rates by 2.8x, and improve EBITDA margins by5–8%.

Success is no longer about coverage—it’s about capability packaging.

Get the framework to repurpose legacy infrastructure into enterprise value blocks

APAC Telco Case Studies

Real examples show the transformation is already underway:

- Singtel: 50%+ of enterprise segment revenue now from digital services; leading in 5G MEC rollouts and hyperscaler marketplaces.

- NTT: Operating as a full digital integrator, offering cybersecurity + cloud + IoT across ASEAN.

- PLDT: Doubled cybersecurity services revenue in 2 years with new secure access and CPaaS bundles.

These players didn’t wait—they invested, restructured, and won new share.

Get the framework to repurpose legacy infrastructure into enterprise value blocks

FAQ's

Still Got Questions? Connect Via Mail

What is the size of the APAC telecom enterprise market?

It is projected to reach USD 300B by FY2028, including USD 70B in high-growth digital services.

Why are telcos shifting toward enterprise services in APAC?

B2C saturation, sub-4% growth, and lower ARPUs have pushed telcos to pursue higher-margin, long-cycle enterprise contracts.

What are the key digital services telcos are investing in?

Cloud, cybersecurity, IoT platforms, CPaaS/UCaaS, and data center integration—all of which provide cross-sell and bundled SLAs.

Which telcos are already leading the shift?

Singtel, NTT, PLDT, and Telkomsel—all reporting double-digit growth in digital enterprise revenues and strategic realignment with cloud and security partners.

How does this transformation affect telco business models?

Business models are moving toward modular, SLA-backed bundles with managed services, driving higher retention, ARPU, and EBITDA uplift.