Region:Middle East

Author(s):Rebecca

Product Code:KRAA3353

Pages:93

Published On:September 2025

Market.png)

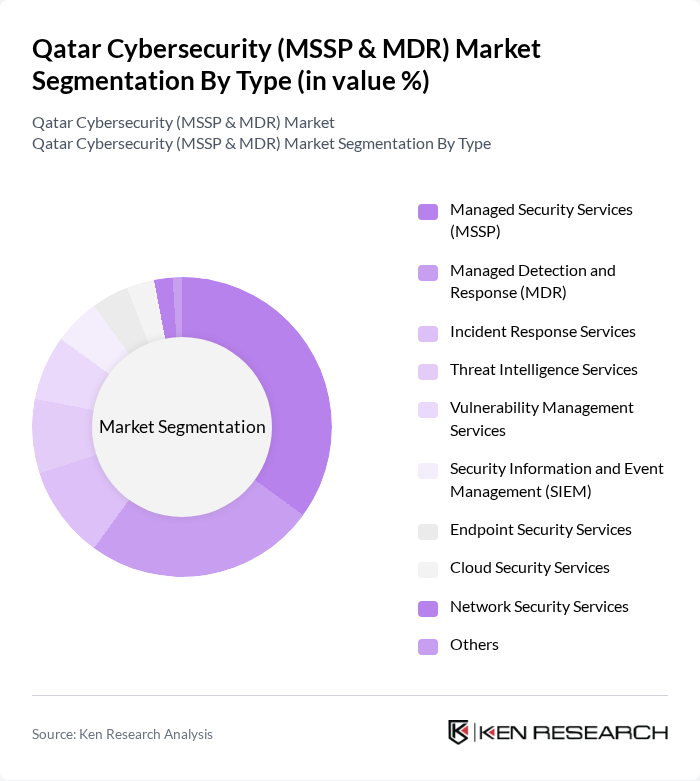

By Type:The market is segmented into a comprehensive range of managed and specialized cybersecurity services. Subsegments include Managed Security Services (MSSP), Managed Detection and Response (MDR), Incident Response Services, Threat Intelligence Services, Vulnerability Management Services, Security Information and Event Management (SIEM), Endpoint Security Services, Cloud Security Services, Network Security Services, and Others. Among these, Managed Security Services (MSSP) is the leading subsegment, reflecting the strong demand for continuous monitoring, threat detection, and proactive management of security infrastructure by organizations seeking to address complex and evolving cyber risks .

By End-User:The end-user segmentation reflects the diverse sectors investing in cybersecurity services. These sectors include Government & Public Sector, Banking, Financial Services & Insurance (BFSI), Healthcare, Telecommunications, Energy and Utilities, Retail & E-Commerce, Oil & Gas, Education, and Others. The BFSI sector is the dominant end-user, driven by stringent regulatory compliance requirements, the criticality of financial data protection, and the sector’s high exposure to cyber threats. Other verticals, such as government, healthcare, and energy, are also increasing their cybersecurity investments due to the sensitivity of data and the need to protect critical infrastructure .

The Qatar Cybersecurity (MSSP & MDR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as MEEZA QSTP LLC, Gulf Business Machines Qatar W.L.L., Ooredoo Q.P.S.C., Mannai Corporation QPSC, Paramount Computer Systems FZ-LLC, Diyar Group, Navlink Inc., Malomatia, Barikat Cyber Security, Fortinet Qatar, Cisco Systems Qatar, Trend Micro Qatar, Help AG (Etisalat Digital), Tata Communications Qatar, IBM Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar cybersecurity market is poised for significant growth, driven by increasing digital transformation initiatives and the adoption of advanced technologies. As organizations prioritize cybersecurity, the integration of artificial intelligence and machine learning into security frameworks will enhance threat detection capabilities. Additionally, the shift towards cloud-based security solutions will facilitate scalability and flexibility, enabling businesses to respond effectively to evolving cyber threats while maintaining compliance with regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed Security Services (MSSP) Managed Detection and Response (MDR) Incident Response Services Threat Intelligence Services Vulnerability Management Services Security Information and Event Management (SIEM) Endpoint Security Services Cloud Security Services Network Security Services Others |

| By End-User | Government & Public Sector Banking, Financial Services & Insurance (BFSI) Healthcare Telecommunications Energy and Utilities Retail & E-Commerce Oil & Gas Education Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Model | Subscription-Based Pay-As-You-Go Managed Services |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor Others |

| By Compliance Standards | ISO 27001 NIST Cybersecurity Framework PCI DSS GDPR Qatar Data Protection Law |

| By Pricing Model | Tiered Pricing Flat Rate Pricing Usage-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 50 | CIOs, IT Security Managers |

| Healthcare Sector Cybersecurity | 40 | Compliance Officers, IT Directors |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Analysts |

| Telecommunications Security Services | 40 | Network Security Engineers, Operations Managers |

| Retail Sector Cybersecurity Solutions | 40 | IT Managers, Risk Management Officers |

The Qatar Cybersecurity (MSSP & MDR) Market is valued at approximately USD 650 million, reflecting significant growth driven by increasing cyber threats, regulatory requirements, and the adoption of digital transformation initiatives across various sectors.