Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3647

Pages:91

Published On:September 2025

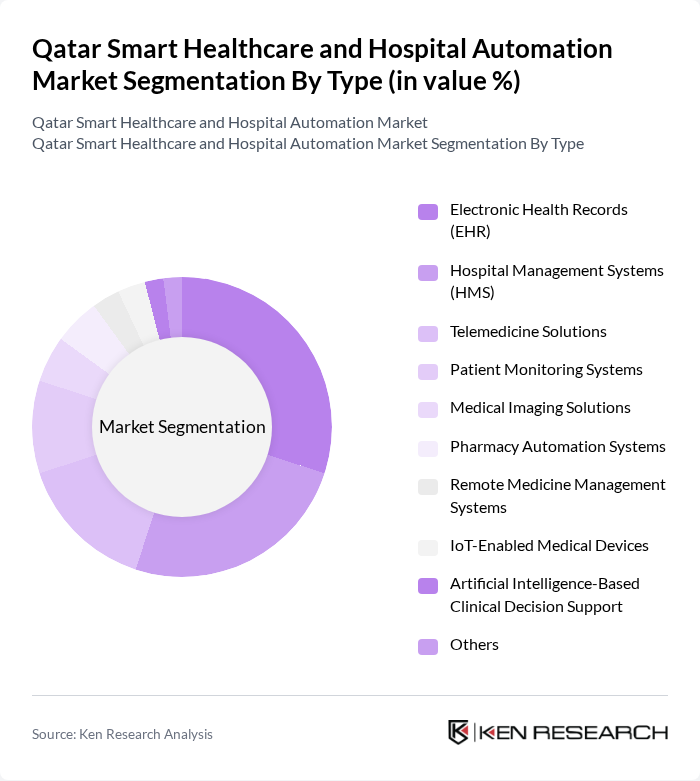

By Type:The market is segmented into various types, including Electronic Health Records (EHR), Hospital Management Systems (HMS), Telemedicine Solutions, Patient Monitoring Systems, Medical Imaging Solutions, Pharmacy Automation Systems, Remote Medicine Management Systems, IoT-Enabled Medical Devices, Artificial Intelligence-Based Clinical Decision Support, and Others. Among these, Electronic Health Records (EHR) is the leading sub-segment, driven by the increasing need for efficient patient data management and regulatory compliance.

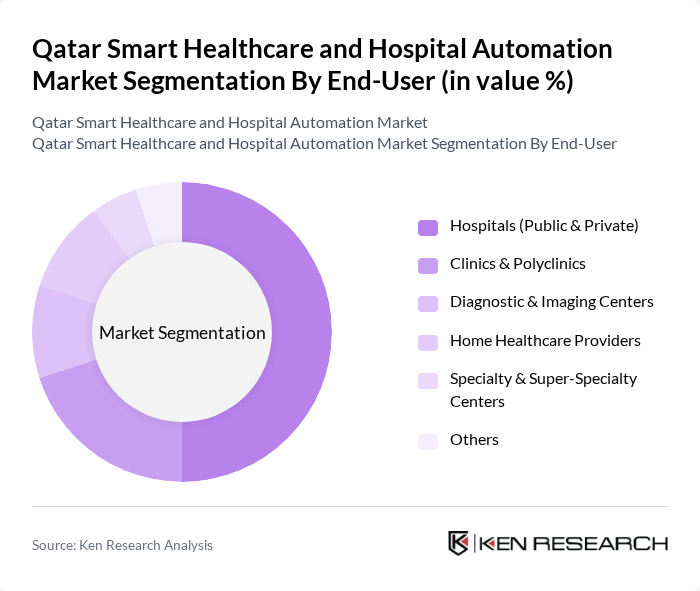

By End-User:The end-user segmentation includes Hospitals (Public & Private), Clinics & Polyclinics, Diagnostic & Imaging Centers, Home Healthcare Providers, Specialty & Super-Specialty Centers, and Others. Hospitals, both public and private, dominate this segment due to their extensive need for automation and management solutions to enhance operational efficiency and patient care.

The Qatar Smart Healthcare and Hospital Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Philips Healthcare, GE Healthcare, Cerner Corporation (Oracle Health), Hamad Medical Corporation, Sidra Medicine, Medtronic, IBM Watson Health, Oracle Health Sciences, Epic Systems Corporation, NextGen Healthcare, eClinicalWorks, Infor Healthcare, Nuance Communications, Zynx Health, Malaffi (Abu Dhabi Health Data Services), Cerner Middle East (Oracle Health Middle East), Tamer Group, Alfardan Medical with Northwestern Medicine, Ooredoo (Healthcare ICT Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar smart healthcare and hospital automation market appears promising, driven by technological advancements and a focus on patient-centric care. As the government continues to invest in digital health initiatives, the integration of AI and IoT technologies is expected to enhance operational efficiency. Furthermore, the increasing prevalence of chronic diseases will necessitate innovative healthcare solutions, fostering a shift towards personalized medicine and home healthcare services, ultimately improving patient outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Health Records (EHR) Hospital Management Systems (HMS) Telemedicine Solutions Patient Monitoring Systems Medical Imaging Solutions Pharmacy Automation Systems Remote Medicine Management Systems IoT-Enabled Medical Devices Artificial Intelligence-Based Clinical Decision Support Others |

| By End-User | Hospitals (Public & Private) Clinics & Polyclinics Diagnostic & Imaging Centers Home Healthcare Providers Specialty & Super-Specialty Centers Others |

| By Application | Administrative Applications (Scheduling, Billing, Resource Management) Clinical Applications (Diagnostics, Treatment Planning, Patient Monitoring) Financial Applications (Claims Management, Revenue Cycle) Operational Applications (Asset Tracking, Facility Automation) Remote Patient Care & Telehealth Others |

| By Component | Software Hardware Services (Implementation, Consulting, Support) |

| By Sales Channel | Direct Sales Distributors/Value-Added Resellers Online Sales |

| By Distribution Mode | Retail Distribution Wholesale Distribution Direct Distribution |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Hospital Management Systems | 60 | IT Directors, Hospital Administrators |

| Telemedicine Solutions | 50 | Healthcare Providers, Telehealth Coordinators |

| Patient Engagement Technologies | 40 | Patient Experience Managers, Healthcare Marketers |

| Healthcare Data Analytics | 45 | Data Analysts, Clinical Informatics Specialists |

| Robotic Process Automation in Healthcare | 40 | Operations Managers, Automation Specialists |

The Qatar Smart Healthcare and Hospital Automation Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of digital health technologies and government investments in healthcare infrastructure.