Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3636

Pages:98

Published On:September 2025

By Solution Type:The solution type segmentation includes various technologies that enhance operational efficiency in oilfield services. The subsegments are predictive maintenance solutions, data analytics platforms, AI-driven drilling optimization, automated reservoir characterization, production forecasting tools, remote monitoring & control systems, asset integrity management, and others. Among these, predictive maintenance solutions are leading due to their ability to minimize downtime and reduce operational costs. This reflects the broader Middle East trend, where predictive maintenance and AI-enabled analytics are prioritized for operational efficiency and reliability .

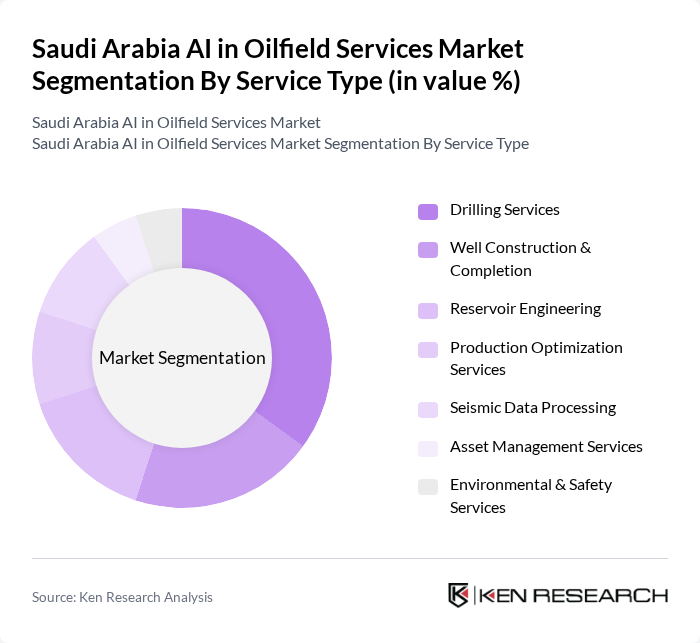

By Service Type:The service type segmentation encompasses various services provided in the oilfield sector. This includes drilling services, well construction & completion, reservoir engineering, production optimization services, seismic data processing, asset management services, and environmental & safety services. Drilling services are currently the most dominant segment due to ongoing exploration and production activities, as well as the integration of AI for drilling optimization and real-time monitoring .

The Saudi Arabia AI in Oilfield Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, National Oilwell Varco, Inc., KBR, Inc., Aker Solutions ASA, TechnipFMC plc, Wood PLC, Saipem S.p.A., Petrofac Limited, Eni S.p.A., CGG S.A., DNV GL Group, TAQA (Industrialization & Energy Services Company), Arabian Drilling Company, Sinopec Oilfield Service Corporation, ABB Ltd., Siemens Energy AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in Saudi Arabia's oilfield services market appears promising, driven by technological advancements and government support. By 2025, the integration of AI is expected to enhance operational efficiency significantly, with a projected 40% increase in productivity. Companies are likely to focus on developing AI-driven exploration tools and predictive maintenance systems. Furthermore, collaborations with tech startups will foster innovation, ensuring that the sector remains competitive and responsive to global energy demands.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Predictive Maintenance Solutions Data Analytics Platforms AI-Driven Drilling Optimization Automated Reservoir Characterization Production Forecasting Tools Remote Monitoring & Control Systems Asset Integrity Management Others |

| By Service Type | Drilling Services Well Construction & Completion Reservoir Engineering Production Optimization Services Seismic Data Processing Asset Management Services Environmental & Safety Services |

| By Application | Exploration & Appraisal Drilling Optimization Production Optimization Maintenance & Asset Integrity Health, Safety & Environment (HSE) |

| By Deployment Mode | On-Premises Cloud-Based |

| By End-User | National Oil Companies (e.g., Saudi Aramco) International Oil Companies Oilfield Service Providers Technology Vendors Government & Regulatory Agencies |

| By Region | Eastern Province Western Province Central Region Southern Region |

| By Investment Source | Domestic Investments Foreign Direct Investments Public-Private Partnerships Government Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Implementation in Drilling Operations | 100 | Drilling Engineers, Operations Managers |

| Predictive Maintenance Solutions | 60 | Maintenance Supervisors, Data Analysts |

| AI in Reservoir Management | 50 | Reservoir Engineers, Geoscientists |

| AI-Driven Exploration Technologies | 40 | Exploration Managers, Technology Officers |

| AI in Supply Chain Optimization | 70 | Supply Chain Managers, Procurement Specialists |

The Saudi Arabia AI in Oilfield Services Market is valued at approximately USD 80 million, reflecting a significant trend towards the adoption of advanced technologies like AI, IoT, and data analytics in oil extraction and management.