Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3816

Pages:83

Published On:September 2025

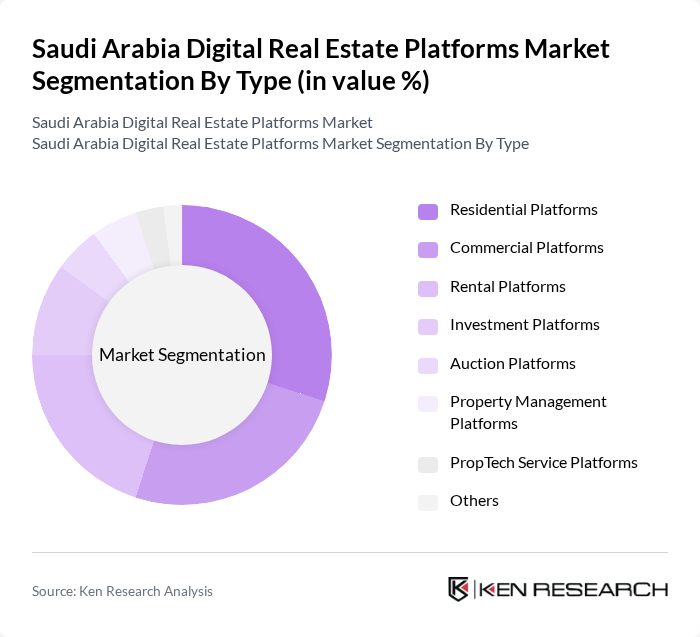

By Type:The market is segmented into various types of digital real estate platforms, including residential, commercial, rental, investment, auction, property management, PropTech service platforms, and others. Each type serves distinct consumer needs and preferences, contributing to the overall market dynamics. Residential platforms are driven by strong demand for homeownership and rentals, while commercial and investment platforms benefit from increased institutional participation and the rise of mixed-use developments. PropTech service platforms are expanding rapidly, offering virtual tours, digital mortgage approvals, and smart property management solutions .

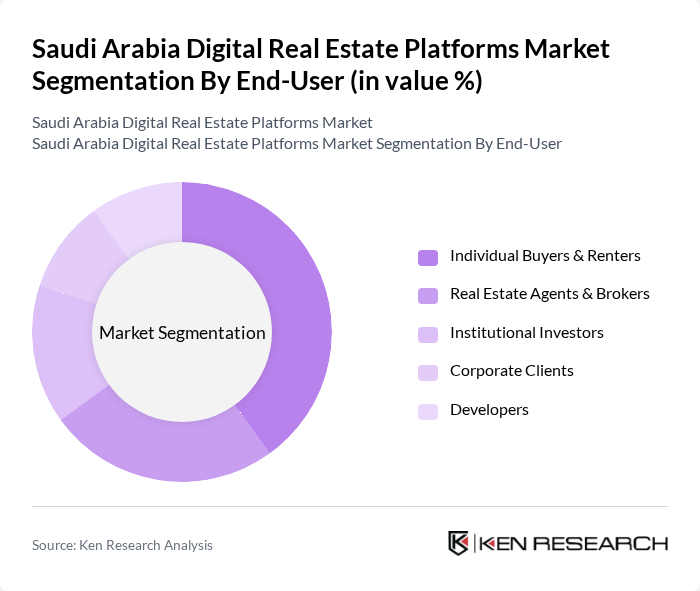

By End-User:The end-user segmentation includes individual buyers and renters, real estate agents and brokers, institutional investors, corporate clients, and developers. Each group has unique requirements and preferences, influencing the types of platforms they utilize. Individual buyers and renters are increasingly adopting digital channels for convenience and transparency, while institutional investors and developers leverage platforms for portfolio management and market intelligence .

The Saudi Arabia Digital Real Estate Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder, Bayut, Aqar, Haraj, Sakani, Ejar, OpenSooq, Sakan, Wasalt, Makanak, Aqarat, Real Estate Saudi, Aqarat.com, Aqarat.sa, Aqar.com, Imkan Properties, DarGlobal, Zawaya Real Estate, Tamam, Retan Real Estate Platform contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia digital real estate market appears promising, driven by ongoing urbanization and government support for housing initiatives. As digital adoption continues to rise, platforms are likely to integrate advanced technologies such as AI and big data analytics, enhancing user experiences and operational efficiencies. Furthermore, the increasing focus on sustainable development and smart city initiatives will create new avenues for digital platforms, fostering innovation and attracting investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Rental Platforms Investment Platforms Auction Platforms Property Management Platforms PropTech Service Platforms Others |

| By End-User | Individual Buyers & Renters Real Estate Agents & Brokers Institutional Investors Corporate Clients Developers |

| By Sales Channel | Online Sales (Web & Mobile Apps) Offline Sales (Physical Offices, Kiosks) |

| By Application | Property Listing & Search Virtual Tours & Visualization Transaction & Document Management Lease & Rental Management Data Analytics & Valuation Tools |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies for First-Time Buyers Tax Incentives for Developers Regulatory Support for Digital Platforms |

| By Market Maturity | Emerging Platforms Established Platforms Niche Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 100 | Home Buyers, Real Estate Agents |

| Commercial Real Estate Platforms | 60 | Commercial Property Managers, Investors |

| Real Estate Investment Trusts (REITs) | 40 | Investment Analysts, Financial Advisors |

| Property Management Software Users | 50 | Property Managers, IT Managers |

| Real Estate Marketing Platforms | 45 | Marketing Directors, Digital Strategists |

The Saudi Arabia Digital Real Estate Platforms Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by urbanization, internet penetration, and a shift towards online property transactions.