Region:Middle East

Author(s):Shubham

Product Code:KRAA3612

Pages:88

Published On:September 2025

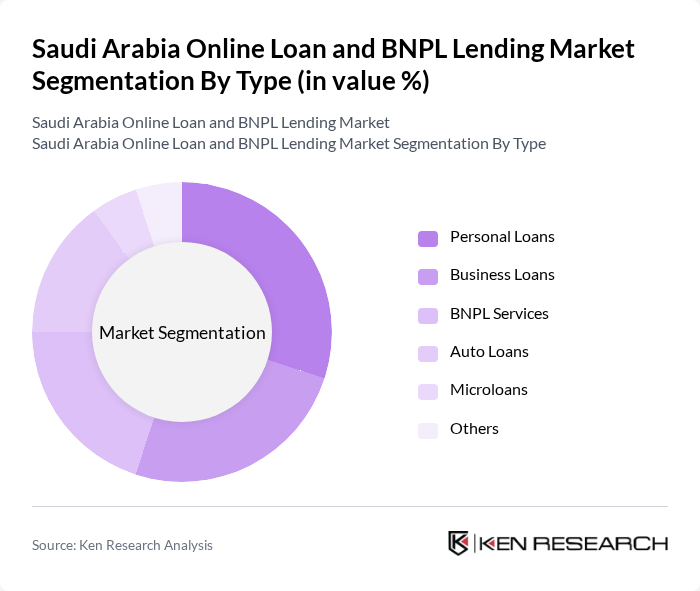

By Type:The market is segmented into various types of lending products, including Personal Loans, Business Loans, BNPL Services, Auto Loans, Microloans, and Others. Personal Loans are widely adopted due to their flexibility and ease of access, catering to diverse financial needs of individual consumers. BNPL Services have seen rapid uptake, especially among younger consumers who prefer installment-based payments for retail and e-commerce purchases .

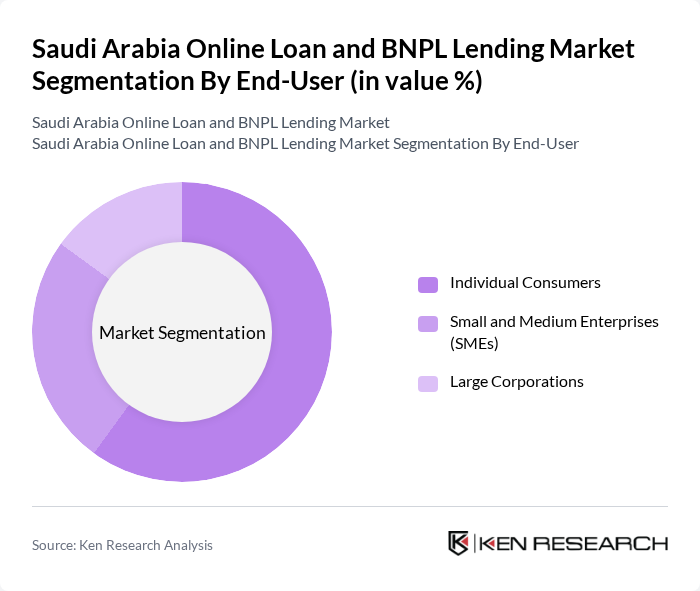

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), and Large Corporations. Individual Consumers are the primary market segment, driven by the growing need for personal financing and digital-first solutions. SMEs are also significant contributors, leveraging online lending and BNPL platforms to access working capital and support business growth .

The Saudi Arabia Online Loan and BNPL Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tamam Financing Company, Raqamyah Crowdlending Company, Lendo Platform, Emkan Finance, Tabby, Tamweel Aloula, Nayifat Finance, Tasheel Finance, Tamara, Alinma Bank, Saudi National Bank (SNB), Al Rajhi Bank, STC Pay, PayTabs, Gulf International Bank (GIB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online loan and BNPL lending market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, lenders are likely to enhance their offerings, integrating AI and machine learning for better risk assessment. Additionally, the increasing collaboration between fintech companies and traditional banks will likely create a more competitive landscape, fostering innovation and improving service delivery, ultimately benefiting consumers and driving market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans BNPL Services Auto Loans Microloans Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations |

| By Application | Retail Purchases Service Payments Business Investments |

| By Distribution Channel | Online Platforms Mobile Applications Financial Institutions |

| By Customer Segment | Millennials Gen Z Working Professionals |

| By Loan Amount | Small Loans (up to SAR 10,000) Medium Loans (SAR 10,001 - SAR 50,000) Large Loans (above SAR 50,000) |

| By Payment Terms | Short-term Loans Medium-term Loans Long-term Loans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Loan Users | 120 | Consumers aged 18-45 who have taken online loans |

| BNPL Service Users | 100 | Consumers who have utilized BNPL services in the last 12 months |

| Financial Advisors | 60 | Financial consultants and advisors with experience in digital finance |

| Fintech Executives | 40 | Senior management from fintech companies operating in Saudi Arabia |

| Regulatory Bodies | 40 | Officials from financial regulatory authorities in Saudi Arabia |

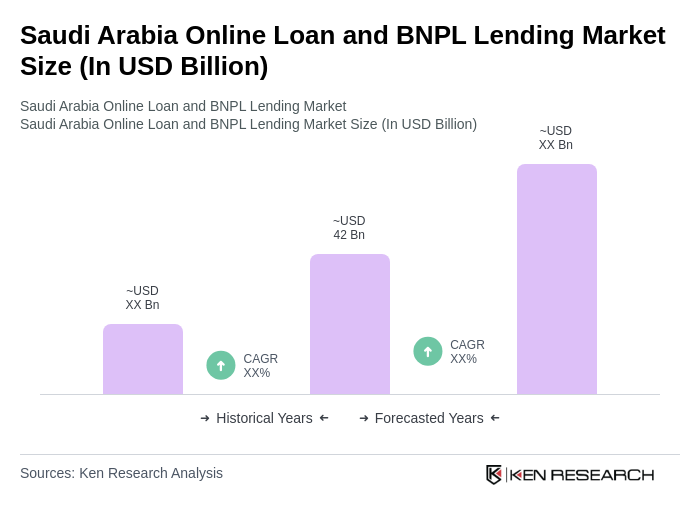

The Saudi Arabia Online Loan and BNPL Lending Market is valued at approximately USD 42 billion, driven by the rapid adoption of digital financial services and a growing young population seeking flexible payment options.