Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3712

Pages:88

Published On:September 2025

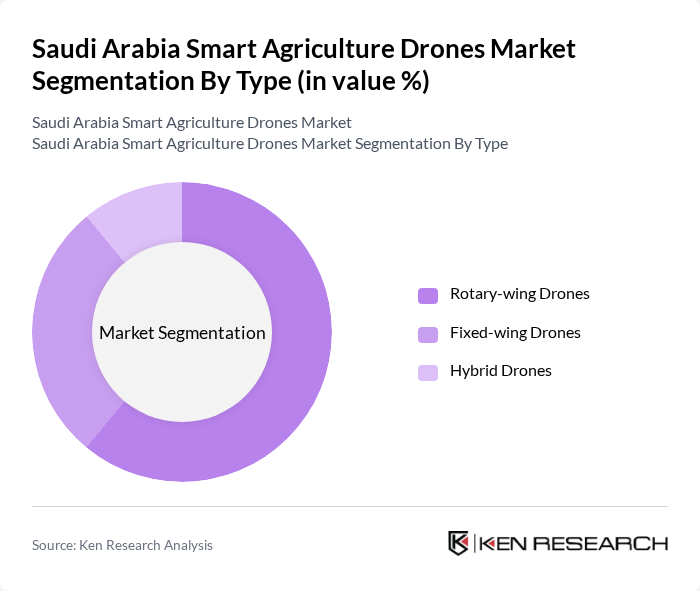

By Type:The market is segmented into three main types of drones: Rotary-wing Drones, Fixed-wing Drones, and Hybrid Drones. Among these,Rotary-wing Dronesare currently leading the market due to their versatility, vertical takeoff/landing capability, and ability to hover, making them ideal for tasks such as crop monitoring, precision spraying, and imaging. Fixed-wing Drones, while efficient for covering larger areas, are less favored for detailed inspections and confined field operations. Hybrid Drones combine the advantages of both types, but their adoption is still growing as farmers seek more specialized solutions for complex terrains and targeted applications.

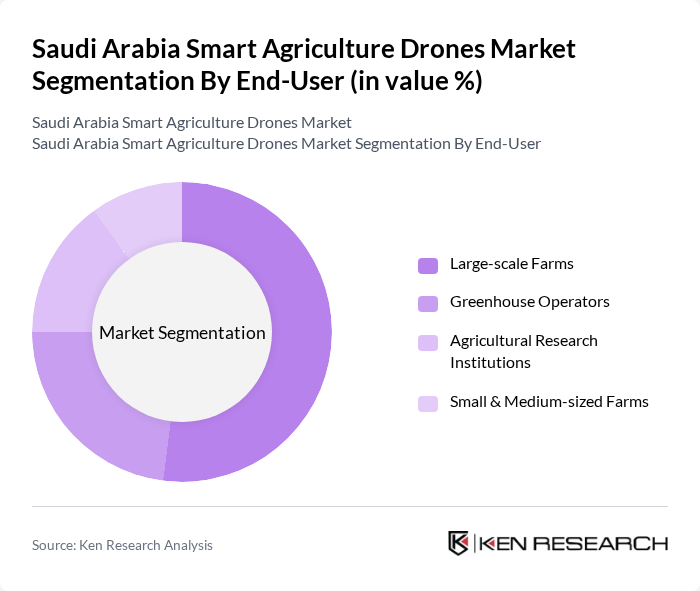

By End-User:The end-user segmentation includes Large-scale Farms, Greenhouse Operators, Agricultural Research Institutions, and Small & Medium-sized Farms.Large-scale Farmsdominate the market as they require advanced technologies to manage extensive land areas efficiently and are most likely to benefit from precision agriculture solutions. Greenhouse Operators are also significant users, leveraging drones for monitoring, resource management, and targeted spraying. Agricultural Research Institutions utilize drones for data collection, analysis, and pilot projects, while Small & Medium-sized Farms are gradually adopting these technologies as costs decrease and awareness grows, supported by government programs and training initiatives.

The Saudi Arabia Smart Agriculture Drones Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., XAG Co., Ltd., Parrot Drones S.A., senseFly (an AgEagle Company), AgEagle Aerial Systems Inc., Yuneec International Co., Ltd., Delair SAS, DroneDeploy, Inc., AeroVironment, Inc., Skyfront Corp., FlytBase, Inc., Aerialtronics B.V., Quantum Systems GmbH, Wingtra AG, Saudi Agricultural and Livestock Investment Company (SALIC), FalconViz (Saudi Arabia), Terra Drone Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the smart agriculture drones market in Saudi Arabia looks promising, driven by technological advancements and increasing government support. In future, the integration of drones with IoT and AI technologies is expected to enhance data collection and analysis, leading to more informed decision-making in agriculture. Additionally, the growing trend of autonomous drones will likely streamline operations, making them more accessible to farmers. As awareness of these technologies increases, adoption rates are expected to rise significantly, transforming the agricultural landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary-wing Drones Fixed-wing Drones Hybrid Drones |

| By End-User | Large-scale Farms Greenhouse Operators Agricultural Research Institutions Small & Medium-sized Farms |

| By Application | Crop Monitoring & Health Assessment Precision Spraying (Fertilizers & Pesticides) Soil & Field Analysis Irrigation Management Livestock Monitoring |

| By Distribution Channel | Direct Sales Online Retail Authorized Distributors |

| By Payload Capacity | Below 5 kg kg to 10 kg Above 10 kg |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region |

| By Price Range | Low-end Drones Mid-range Drones High-end Drones |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drone Usage in Crop Monitoring | 100 | Agricultural Technicians, Farm Managers |

| Drone Applications in Pest Control | 60 | Pest Control Specialists, Agronomists |

| Market Adoption of Drone Technology | 120 | Farm Owners, Agricultural Consultants |

| Regulatory Impact on Drone Usage | 50 | Policy Makers, Regulatory Affairs Managers |

| Future Trends in Smart Agriculture | 80 | Research Analysts, Technology Innovators |

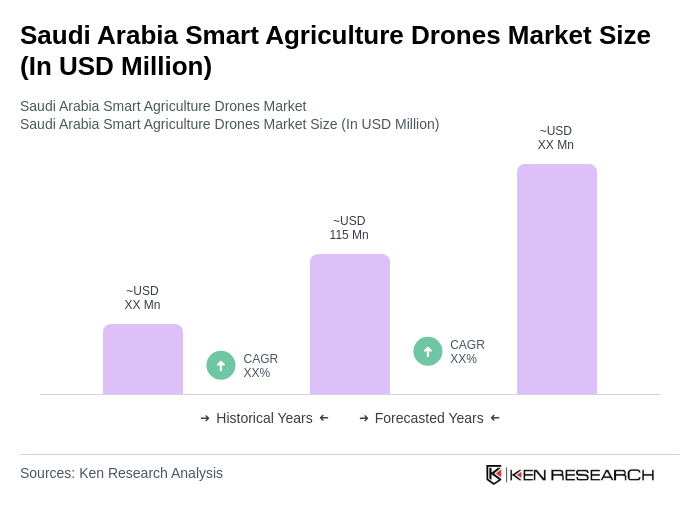

The Saudi Arabia Smart Agriculture Drones Market is valued at approximately USD 115 million, reflecting a significant growth trend driven by the adoption of precision agriculture techniques and advanced technologies like AI and IoT in farming practices.