Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3689

Pages:91

Published On:September 2025

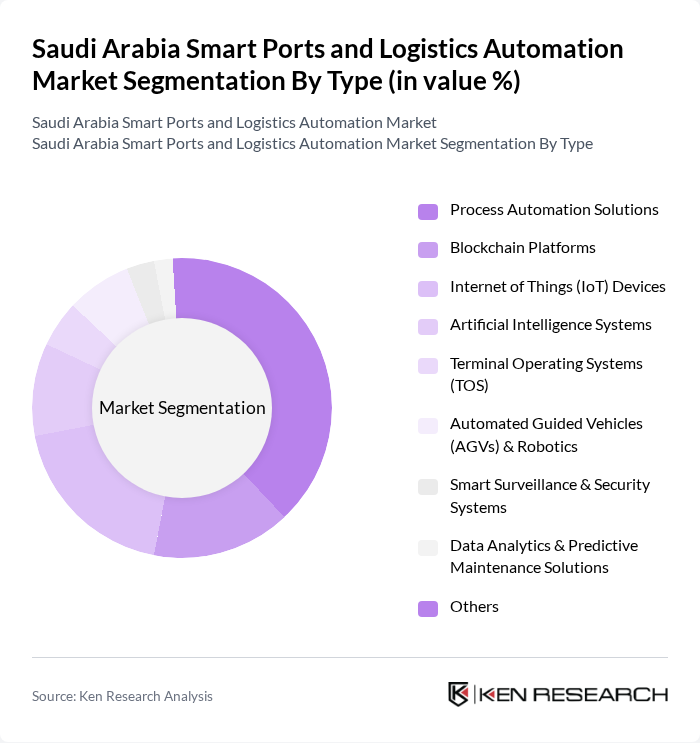

By Type:The market is segmented into various types, including Process Automation Solutions, Blockchain Platforms, Internet of Things (IoT) Devices, Artificial Intelligence Systems, Terminal Operating Systems (TOS), Automated Guided Vehicles (AGVs) & Robotics, Smart Surveillance & Security Systems, Data Analytics & Predictive Maintenance Solutions, and Others. Among these,Process Automation Solutionsare leading the market due to their ability to enhance operational efficiency and reduce human error in logistics operations. Blockchain Platforms are experiencing the fastest growth, driven by the need for secure, transparent, and real-time data sharing among stakeholders .

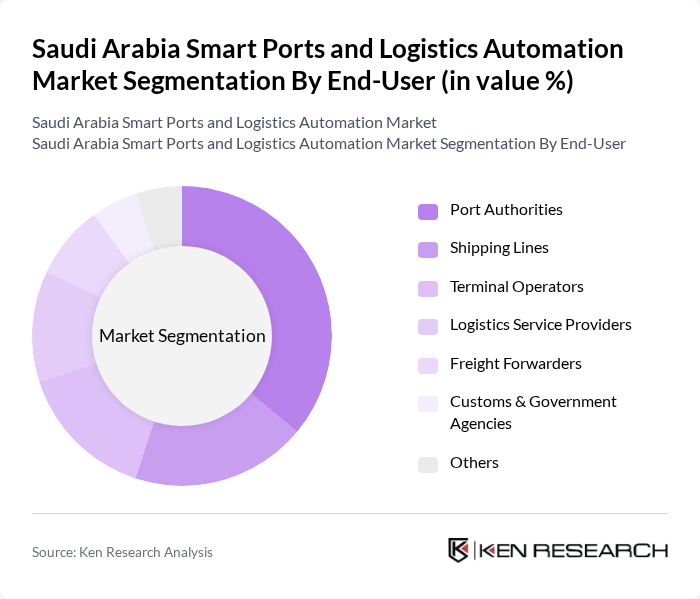

By End-User:The end-user segmentation includes Port Authorities, Shipping Lines, Terminal Operators, Logistics Service Providers, Freight Forwarders, Customs & Government Agencies, and Others.Port Authoritiesare the dominant end-user segment, as they are responsible for implementing smart technologies to enhance port operations and improve service delivery. Shipping Lines and Terminal Operators are also rapidly adopting automation to optimize cargo handling and turnaround times .

The Saudi Arabia Smart Ports and Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World, Saudi Ports Authority (Mawani), Bahri (The National Shipping Company of Saudi Arabia), Gulftainer, Red Sea Gateway Terminal (RSGT), Saudi Arabian Logistics Company (SAL), APM Terminals, Maersk, Kuehne + Nagel, Agility Logistics, DB Schenker, CEVA Logistics, DSV, ABB Ltd., and Trelleborg AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia smart ports and logistics automation market appears promising, driven by ongoing government initiatives and technological advancements. As the Kingdom continues to invest in infrastructure and digital transformation, the integration of smart technologies will enhance operational efficiency and sustainability. The focus on renewable energy and smart city initiatives will further shape the logistics landscape, creating a more resilient and adaptive supply chain ecosystem that meets the demands of a rapidly evolving global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Process Automation Solutions Blockchain Platforms Internet of Things (IoT) Devices Artificial Intelligence Systems Terminal Operating Systems (TOS) Automated Guided Vehicles (AGVs) & Robotics Smart Surveillance & Security Systems Data Analytics & Predictive Maintenance Solutions Others |

| By End-User | Port Authorities Shipping Lines Terminal Operators Logistics Service Providers Freight Forwarders Customs & Government Agencies Others |

| By Application | Container Terminal Automation Bulk Cargo Management Yard & Gate Automation Vessel Traffic Management Warehousing & Inventory Solutions Customs Clearance & Compliance Real-time Tracking & Monitoring Others |

| By Distribution Mode | Direct Sales System Integrators Distributors & Channel Partners Online Platforms Others |

| By Investment Source | Government Funding Private Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Regulatory Support for Automation Others |

| By Technology | Process Automation Blockchain IoT Artificial Intelligence Big Data Analytics Robotics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Port Technology Adoption | 100 | IT Managers, Port Operations Directors |

| Logistics Automation Solutions | 80 | Supply Chain Managers, Automation Engineers |

| Government Policy Impact on Logistics | 60 | Policy Makers, Economic Advisors |

| Investment Trends in Port Infrastructure | 50 | Financial Analysts, Investment Managers |

| Challenges in Logistics Automation | 70 | Logistics Consultants, Operations Managers |

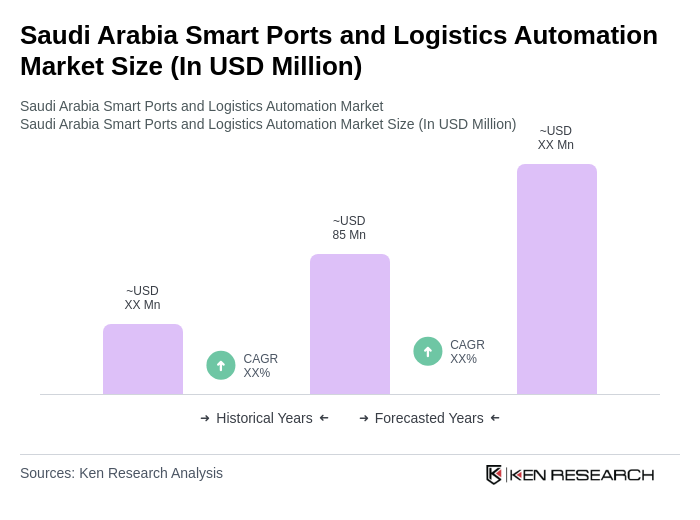

The Saudi Arabia Smart Ports and Logistics Automation Market is valued at approximately USD 85 million, reflecting a significant growth driven by the demand for efficient logistics solutions and government initiatives under Vision 2030.