Region:Africa

Author(s):Geetanshi

Product Code:KRAA3663

Pages:86

Published On:September 2025

By Type:The digital banking and wallets market is segmented into mobile banking apps, digital wallets, online banking platforms, payment processing solutions, peer-to-peer payment services, cryptocurrency wallets, contactless payment solutions, Buy Now Pay Later (BNPL) services, and others. Among these, mobile banking apps and digital wallets are the most prominent, driven by consumer demand for convenience, real-time access, and enhanced security features in managing finances. The adoption of contactless and peer-to-peer payment solutions is also rising, supported by the proliferation of smartphones and regulatory encouragement of digital payments .

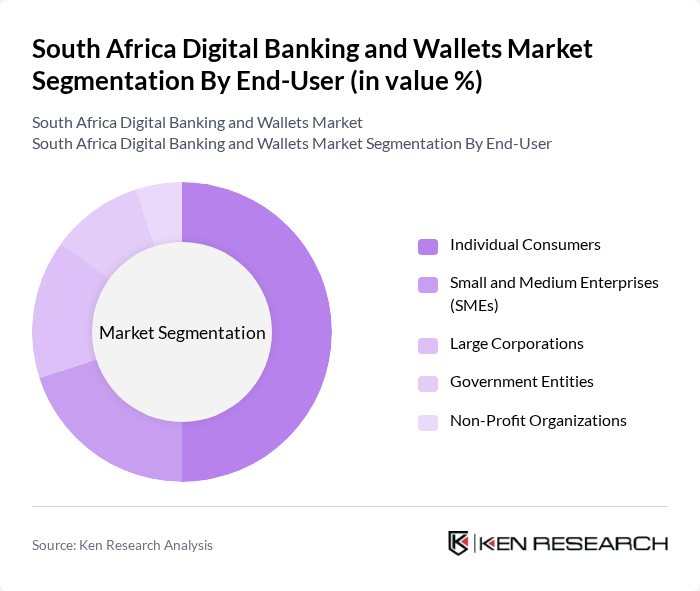

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, government entities, and non-profit organizations. Individual consumers represent the largest segment, driven by the widespread use of digital banking solutions for personal finance management, e-commerce, and daily transactions. SMEs and large corporations are increasingly adopting digital banking platforms to streamline operations, manage payments, and enhance financial transparency .

The South Africa Digital Banking and Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Standard Bank Group, Absa Group Limited, FirstRand Limited (FNB), Nedbank Group, Capitec Bank, Discovery Bank, Investec Bank, TymeBank, Bank Zero, PayFast, Yoco, SnapScan, Zapper, Luno, Ozow, Peach Payments, Mukuru, MTN Mobile Money (MoMo), Vodacom Financial Services contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital banking and wallets market is poised for significant transformation, driven by technological advancements and changing consumer behaviors. As more users embrace digital solutions, the integration of artificial intelligence and machine learning will enhance customer experiences and operational efficiencies. Furthermore, the focus on sustainability will shape banking practices, with institutions increasingly adopting eco-friendly initiatives. This evolving landscape presents opportunities for innovation and growth, positioning South Africa as a leader in the digital banking sector within the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Apps Digital Wallets Online Banking Platforms Payment Processing Solutions Peer-to-Peer Payment Services Cryptocurrency Wallets Contactless Payment Solutions Buy Now Pay Later (BNPL) Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Non-Profit Organizations |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments QR Code Payments EFT (Electronic Funds Transfer) |

| By Service Type | Transaction Services Account Management Services Financial Advisory Services Investment Services Bill Payment Services |

| By User Demographics | Age Groups Income Levels Urban vs Rural Users Education Level |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies Fraud Detection Systems |

| By Customer Engagement | Loyalty Programs Customer Support Services Feedback Mechanisms Digital Onboarding Experience |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Banking Users | 120 | Retail Banking Customers, Digital Account Holders |

| Mobile Wallet Users | 120 | Frequent Users, Occasional Users |

| Fintech Industry Experts | 40 | Product Managers, Business Development Executives |

| Regulatory Stakeholders | 40 | Policy Makers, Compliance Officers |

| Small Business Owners | 80 | Entrepreneurs, Financial Decision Makers |

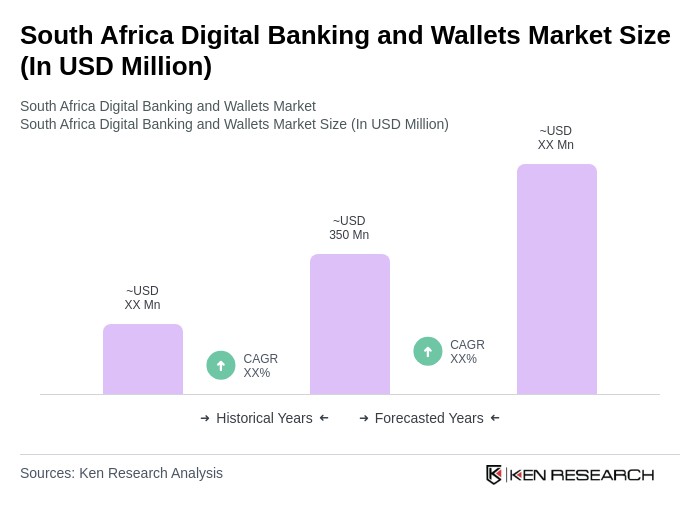

The South Africa Digital Banking and Wallets Market is valued at approximately USD 350 million, reflecting significant growth driven by increased smartphone adoption, internet penetration, and a shift towards cashless transactions, particularly accelerated by the COVID-19 pandemic.