Region:Africa

Author(s):Geetanshi

Product Code:KRAA3646

Pages:86

Published On:September 2025

By Type:The market is segmented into various types, including Online Learning Platforms, Learning Management Systems (LMS), Corporate Training Solutions, Assessment Tools, Content Development Services, Tutoring Services, Special Needs & Accessibility Solutions, School Administration Software, and Others. Among these, Online Learning Platforms and Corporate Training Solutions are particularly prominent due to the increasing preference for flexible, mobile-based learning options and the necessity for businesses to upskill their employees in response to technological change and evolving job requirements .

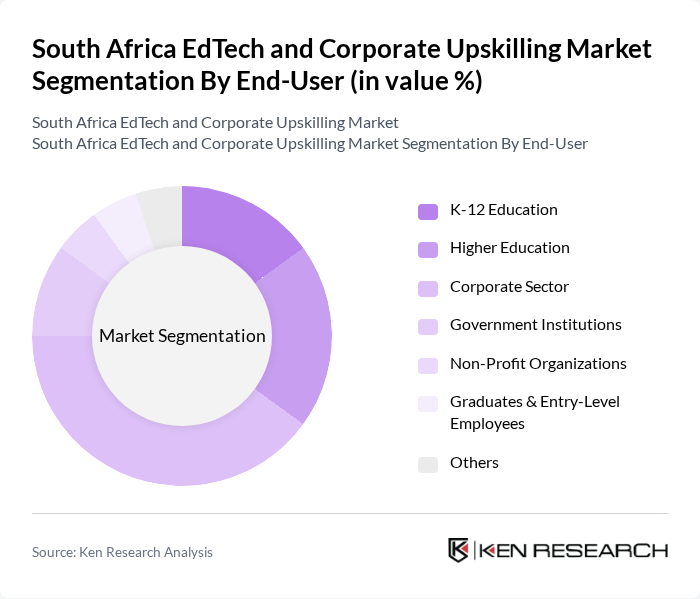

By End-User:The market is further segmented by end-users, including K-12 Education, Higher Education, Corporate Sector, Government Institutions, Non-Profit Organizations, Graduates & Entry-Level Employees, and Others. The Corporate Sector is the leading end-user, driven by the need for continuous employee training and development in a rapidly changing job market. K-12 and Higher Education segments also contribute significantly, supported by government and private sector investments in digital learning infrastructure .

The South Africa EdTech and Corporate Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as GetSmarter (a 2U, Inc. brand), The Student Hub, FoondaMate, Siyavula Education, Mindset Learn, iXperience, LearnFast, The Digital Academy, Enko Education, Valenture Institute, AdvTech Group, Snapplify, UCT Online High School, HyperionDev, Tuta-Me contribute to innovation, geographic expansion, and service delivery in this space .

The South African EdTech market is poised for significant transformation, driven by technological advancements and evolving educational needs. As digital learning becomes more mainstream, the integration of artificial intelligence and personalized learning experiences will enhance engagement and effectiveness. Additionally, the emphasis on lifelong learning will encourage continuous upskilling, particularly in corporate environments. With government support and increasing investment in infrastructure, the market is expected to adapt and thrive, addressing both educational and workforce challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Learning Platforms Learning Management Systems (LMS) Corporate Training Solutions Assessment Tools Content Development Services Tutoring Services Special Needs & Accessibility Solutions School Administration Software Others |

| By End-User | K-12 Education Higher Education Corporate Sector Government Institutions Non-Profit Organizations Graduates & Entry-Level Employees Others |

| By Application | Skill Development Compliance Training Professional Development Language Learning Technical Training Digital Literacy Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Mobile Learning Offline/Low-Bandwidth Solutions Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Licensing Institutional Contracts Others |

| By Content Type | Video Content Interactive Content Text-Based Content Assessment Content Gamified Content Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Micro-Credentials Digital Badges Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| EdTech Product Adoption | 120 | EdTech Founders, Product Managers |

| Corporate Training Programs | 90 | HR Managers, Learning & Development Managers |

| Upskilling Initiatives in Corporates | 60 | Training Coordinators, Business Unit Leaders |

| Government Education Initiatives | 50 | Policy Makers, Educational Administrators |

| Higher Education Institutions | 70 | University Deans, Curriculum Developers |

The South Africa EdTech and Corporate Upskilling Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for digital learning solutions and corporate training initiatives.