Region:Africa

Author(s):Geetanshi

Product Code:KRAA3640

Pages:98

Published On:September 2025

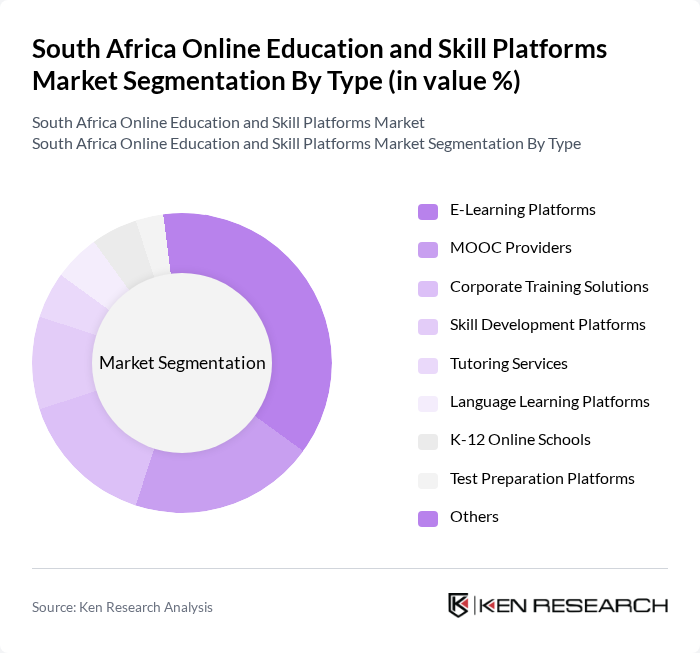

By Type:The market is segmented into various types, including E-Learning Platforms, MOOC Providers, Corporate Training Solutions, Skill Development Platforms, Tutoring Services, Language Learning Platforms, K-12 Online Schools, Test Preparation Platforms, and Others. Among these, E-Learning Platforms are leading due to their widespread adoption across various demographics, driven by the need for flexible and accessible education. The growth of e-learning platforms is revolutionizing the education sector, with significant rise in digital platforms for K-12, university, and professional courses, fueled by increased internet penetration, mobile access, and demand for flexible learning opportunities.

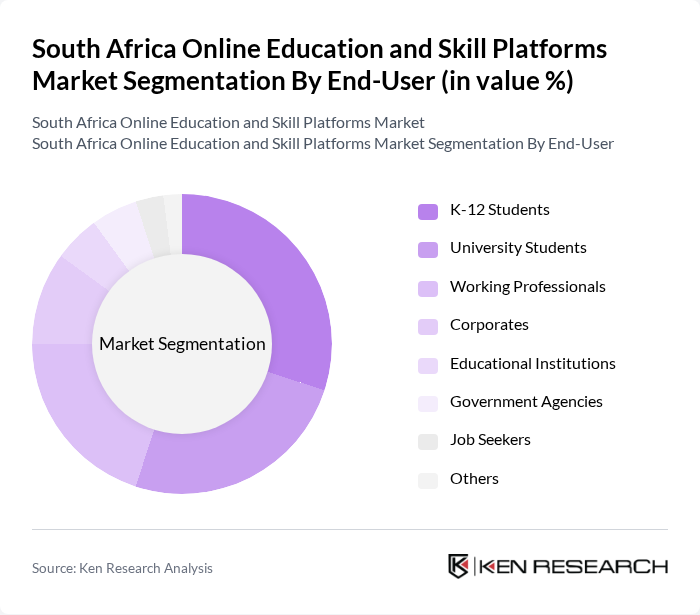

By End-User:The end-user segmentation includes K-12 Students, University Students, Working Professionals, Corporates, Educational Institutions, Government Agencies, Job Seekers, and Others. The K-12 Students segment is currently the most significant due to the increasing integration of technology in schools and the growing acceptance of online learning as a supplement to traditional education. This trend is further supported by parents seeking additional resources for their children's education. Corporate training and professional development courses have also moved online extensively, offering employees opportunities to upgrade their skills from the comfort of home.

The South Africa Online Education and Skill Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as GetSmarter (a 2U, Inc. brand), UCT Online High School, AdvTech Group (including Rosebank College, Varsity College, and The IIE's online offerings), Boston Online Home Education (Boston City Campus), HyperionDev, MasterStart, Coursera, Udemy, LinkedIn Learning, Khan Academy, FutureLearn, Skillshare, Pluralsight, Alison, Snapplify, Siyavula, Teachable, Codecademy, Skillsoft, Digicampus, Koa Academy, Eduvos, Stadio Holdings, LearnDash contribute to innovation, geographic expansion, and service delivery in this space.

The South African online education market is poised for significant transformation, driven by technological advancements and evolving learner preferences. As mobile learning solutions gain traction, platforms are expected to integrate more interactive and personalized learning experiences. Additionally, the rise of corporate training programs will further stimulate demand for online courses, particularly in sectors requiring continuous skills development. These trends indicate a robust future for online education, with increasing participation from diverse demographics across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | E-Learning Platforms MOOC Providers Corporate Training Solutions Skill Development Platforms Tutoring Services Language Learning Platforms K-12 Online Schools Test Preparation Platforms Others |

| By End-User | K-12 Students University Students Working Professionals Corporates Educational Institutions Government Agencies Job Seekers Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Mobile Learning Offline-Enabled Learning Others |

| By Subject Area | Technology and IT Business and Management Arts and Humanities Health and Wellness Science and Engineering Language Learning Test Preparation Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Corporate Licensing Government-Funded Others |

| By Certification Type | Accredited Courses Non-Accredited Courses Professional Development Certifications Skill Badges Micro-Credentials Others |

| By Geographic Reach | National Provincial/Regional Pan-African International Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 Online Learning Platforms | 120 | Teachers, School Administrators |

| Higher Education E-Learning Solutions | 85 | University Professors, Academic Deans |

| Vocational Training Online Courses | 75 | Training Coordinators, Industry Experts |

| Corporate E-Learning Platforms | 65 | HR Managers, Learning and Development Specialists |

| EdTech Startups and Innovations | 55 | Founders, Product Managers |

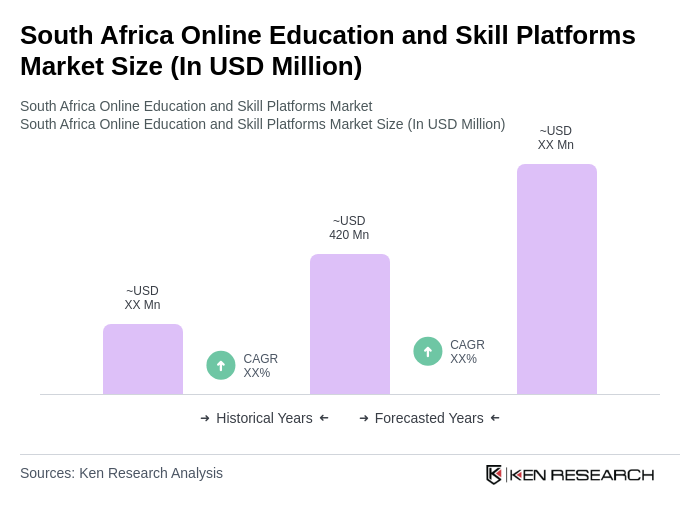

The South Africa Online Education and Skill Platforms Market is valued at approximately USD 420 million, reflecting significant growth driven by increased demand for flexible learning solutions and digital literacy, particularly accelerated by the COVID-19 pandemic.