Region:Africa

Author(s):Geetanshi

Product Code:KRAA3827

Pages:81

Published On:September 2025

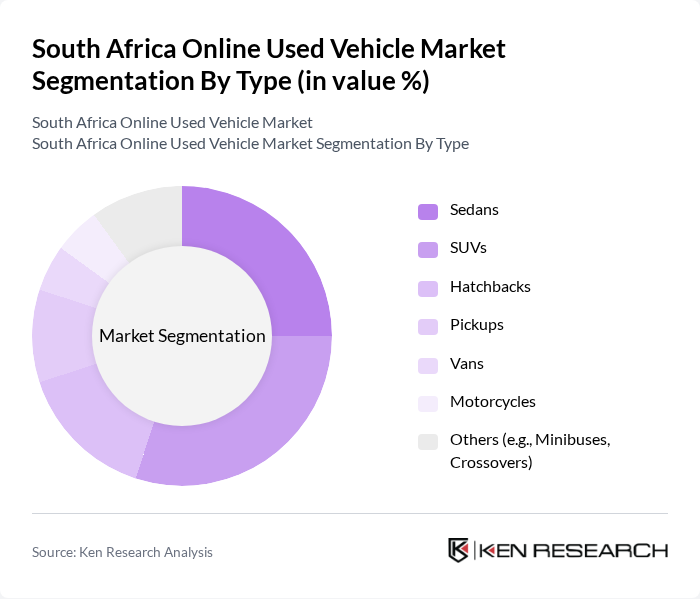

By Type:The market is segmented into various vehicle types, including Sedans, SUVs, Hatchbacks, Pickups (bakkies), Vans, Motorcycles, and Others (e.g., Minibuses, Crossovers). Each type caters to different consumer preferences and needs. SUVs and Sedans are particularly popular due to their versatility, comfort, and suitability for both urban and rural environments. Bakkies (pickups) also maintain strong demand, especially for commercial and utility purposes .

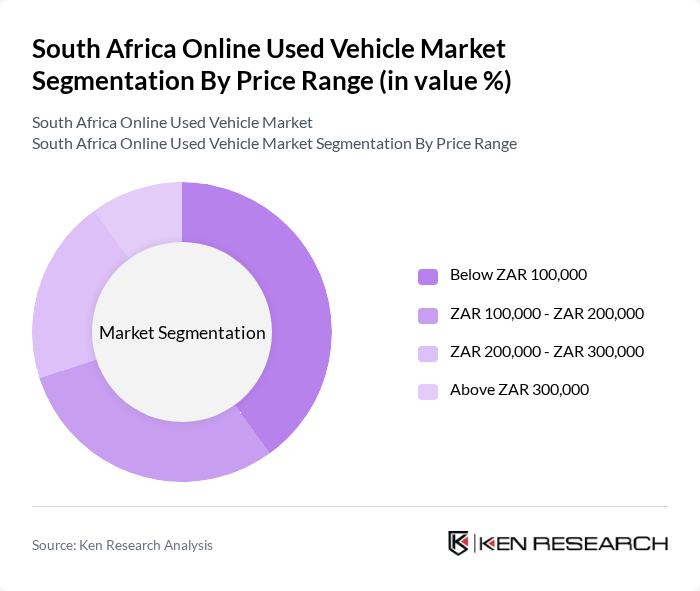

By Price Range:The market is also segmented by price range, including categories such as Below ZAR 100,000, ZAR 100,000 - ZAR 200,000, ZAR 200,000 - ZAR 300,000, and Above ZAR 300,000. This segmentation reflects the diverse financial capabilities of consumers and their varying preferences for vehicle types. The majority of transactions occur in the lower price brackets, indicating a strong demand for affordability in the used vehicle segment .

The South Africa Online Used Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as AutoTrader South Africa, Cars.co.za, Gumtree South Africa, Bidvest McCarthy, WeBuyCars, Carfind.co.za, MotorHappy, Cubbi, CarZar, Auto24.co.za, Autochek Africa, Cars 4 Africa, DriveAway, CarShop, South African Vehicle Sales contribute to innovation, geographic expansion, and service delivery in this space.

The South African online used vehicle market is poised for growth, driven by technological advancements and changing consumer behaviors. As internet access continues to expand, more consumers will engage with online platforms for vehicle purchases. Additionally, the integration of AI and data analytics will enhance user experiences, providing personalized recommendations. The increasing focus on sustainability will also drive demand for eco-friendly vehicles, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedans SUVs Hatchbacks Pickups Vans Motorcycles Others (e.g., Minibuses, Crossovers) |

| By Price Range | Below ZAR 100,000 ZAR 100,000 - ZAR 200,000 ZAR 200,000 - ZAR 300,000 Above ZAR 300,000 |

| By Condition | Certified Pre-Owned Used (Non-Certified) Damaged/Salvage |

| By Sales Channel | Online Marketplaces (Pure-Play Platforms) Dealerships (Franchise & Independent) Private Sales (Peer-to-Peer) Online Auctions |

| By Financing Options | Cash Purchases Bank Loans Installment Plans Platform-Integrated Financing |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By User Demographics | First-Time Buyers Families Business Users (e.g., SMEs, Fleet Buyers) Repeat Buyers/Upgraders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Used Vehicle Buyers | 100 | Recent purchasers, age 25-45, diverse income levels |

| Dealership Owners | 60 | Owners and managers of used vehicle dealerships |

| Automotive Industry Experts | 40 | Analysts, consultants, and researchers in the automotive sector |

| Online Vehicle Platform Managers | 50 | Managers from online vehicle sales platforms |

| Consumer Behavior Analysts | 40 | Researchers focusing on automotive consumer trends and preferences |

The South Africa Online Used Vehicle Market is valued at approximately USD 21.7 billion, driven by factors such as increasing internet penetration, consumer preference for online shopping, and the demand for affordable transportation options.