Region:Asia

Author(s):Shubham

Product Code:KRAA3623

Pages:97

Published On:September 2025

By Type:The market is segmented into various types of nutritional supplements, including Vitamins, Minerals, Amino Acids, Botanicals, Probiotics, Enzymes, Sports Nutrition, Functional Foods and Beverages, and Fat Burners. Functional Foods and Beverages emerged as the largest revenue-generating segment, while Sports Nutrition represents the fastest-growing category due to increasing fitness consciousness and lifestyle changes. The growing trend of self-medication and preventive healthcare has led to an increased focus on personalized nutrition, with consumers seeking customized supplements for specific health issues including immunity and digestion.

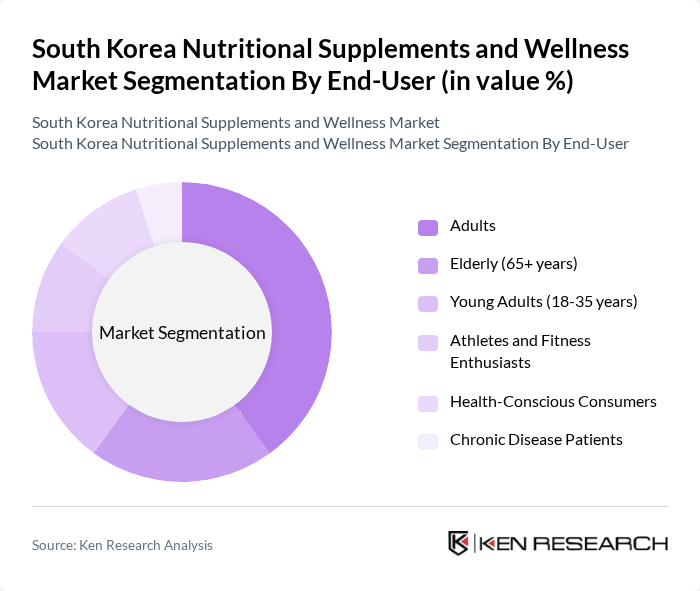

By End-User:The end-user segmentation includes Adults, Elderly (65+ years), Young Adults (18-35 years), Athletes and Fitness Enthusiasts, Health-Conscious Consumers, and Chronic Disease Patients. The Adult segment remains the largest due to the increasing awareness of health and wellness among this demographic. The elderly segment shows particularly strong growth driven by the need for products that assist in maintaining age-related health issues. Additionally, the growing number of fitness enthusiasts and health-conscious individuals, particularly among younger, tech-savvy consumers who prefer online purchasing platforms, has led to a surge in demand for nutritional supplements tailored to their specific needs.

The South Korea Nutritional Supplements and Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories Korea, Pfizer Inc. Korea, Bayer AG Korea, GlaxoSmithKline Korea, Amway Corporation Korea, Herbalife International Korea, Nature's Sunshine Products Korea, dsm-firmenich Korea, Glanbia Plc Korea, The Archer-Daniels-Midland Company Korea, CJ Wellcare Corporation, CKD Health Corporation, GNC Holdings Korea, Thorne Research Inc. Korea, NOW Foods Korea contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean nutritional supplements market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, companies are expected to leverage data analytics to tailor products to individual health needs. Additionally, the integration of digital health solutions will enhance consumer engagement, fostering loyalty. With a focus on sustainability and organic products, brands that adapt to these trends will likely capture a larger market share, ensuring long-term viability in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Amino Acids Botanicals Probiotics Enzymes Sports Nutrition Functional Foods and Beverages Fat Burners |

| By End-User | Adults Elderly (65+ years) Young Adults (18-35 years) Athletes and Fitness Enthusiasts Health-Conscious Consumers Chronic Disease Patients |

| By Distribution Channel | Online Platforms Offline Stores Pharmacies Health Food Stores Direct Sales Supermarkets/Hypermarkets |

| By Formulation | Pills Shots Capsules Tablets Powders Liquids |

| By Application | Weight Management Immunity Support Joint Health Cognitive Well-being Bone Health Preventive Healthcare |

| By Brand Type | Multinational Brands Domestic Korean Brands Private Labels |

| By Regulatory Approval | MFDS Approved Products Health Functional Foods General Dietary Supplements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutritional Supplements | 100 | Store Managers, Product Buyers |

| Consumer Health Trends | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Online Supplement Sales | 80 | E-commerce Managers, Digital Marketing Specialists |

| Wellness Program Implementers | 60 | Corporate Wellness Coordinators, HR Managers |

| Healthcare Professionals | 90 | Doctors, Nutritionists, Dietitians |

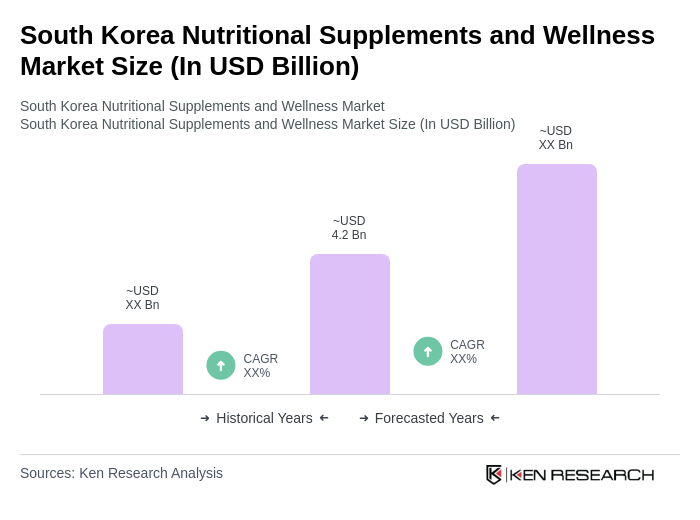

The South Korea Nutritional Supplements and Wellness Market is valued at approximately USD 4.2 billion, reflecting a significant growth trend driven by increasing health consciousness and a rise in chronic diseases among consumers.