Region:Asia

Author(s):Shubham

Product Code:KRAA3599

Pages:85

Published On:September 2025

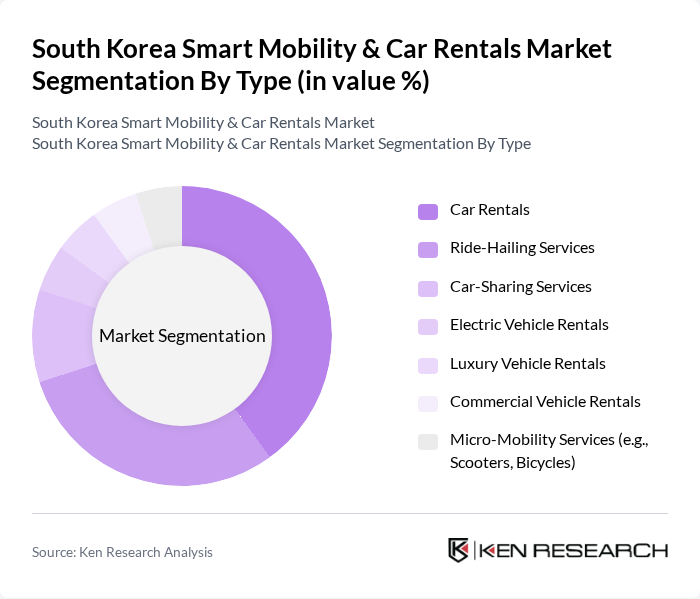

By Type:The market is segmented into various types, including Car Rentals, Ride-Hailing Services, Car-Sharing Services, Electric Vehicle Rentals, Luxury Vehicle Rentals, Commercial Vehicle Rentals, and Micro-Mobility Services (e.g., Scooters, Bicycles). Among these, Car Rentals and Ride-Hailing Services are the most prominent segments, driven by consumer preferences for flexibility and convenience in urban transportation. The increasing popularity of shared mobility solutions is also reshaping consumer behavior, leading to a growing demand for car-sharing and electric vehicle rentals.

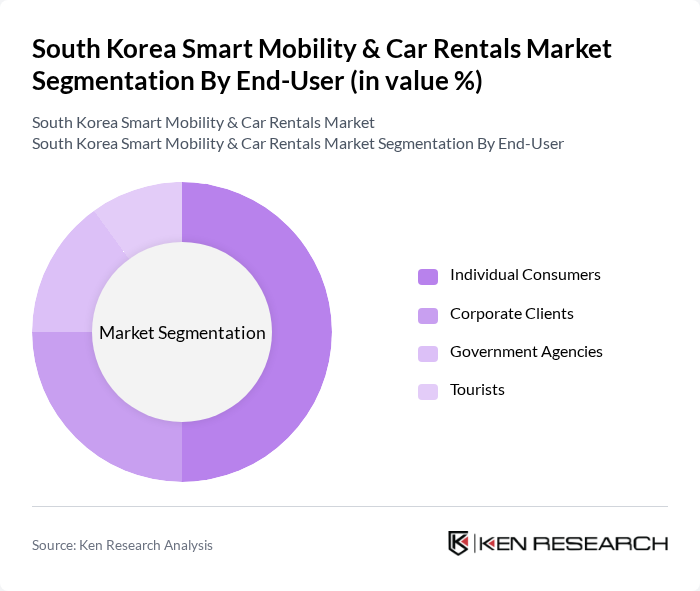

By End-User:The market is segmented by end-users, including Individual Consumers, Corporate Clients, Government Agencies, and Tourists. Individual Consumers represent the largest segment, driven by the increasing trend of urban mobility and the need for flexible transportation options. Corporate Clients also contribute significantly, as businesses seek efficient solutions for employee travel and logistics. The growing tourism sector further boosts demand for rental services, particularly in major cities.

The South Korea Smart Mobility & Car Rentals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyundai Motor Company, Kia Corporation, SK Telecom, Lotte Rental, AJ Rent-a-Car, Green Car, Kakao Mobility, T Map Mobility, SoCar, Rent-A-Car Korea, Carrot Mobility, Daejeon Car Rental, Tada, Zipcar, Ucar contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean smart mobility and car rentals market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As urbanization continues, the integration of AI and big data will enhance service efficiency and customer experience. Additionally, the increasing focus on sustainability will further propel the adoption of electric vehicles. Partnerships between mobility service providers and technology firms are expected to foster innovation, creating a more dynamic and responsive market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Rentals Ride-Hailing Services Car-Sharing Services Electric Vehicle Rentals Luxury Vehicle Rentals Commercial Vehicle Rentals Micro-Mobility Services (e.g., Scooters, Bicycles) |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tourists |

| By Rental Duration | Short-Term Rentals Long-Term Rentals |

| By Vehicle Type | Economy Cars SUVs Vans Luxury Cars |

| By Payment Model | Pay-Per-Use Subscription Models |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Business Travelers Leisure Travelers Local Residents |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Car Rentals | 120 | Frequent Renters, Occasional Users |

| Smart Mobility Adoption Trends | 90 | Urban Commuters, Tech-savvy Consumers |

| Impact of Electric Vehicles on Rental Choices | 70 | Environmentally Conscious Consumers, Fleet Managers |

| Market Dynamics in Urban Areas | 100 | City Planners, Transportation Policy Makers |

| Consumer Attitudes Towards Shared Mobility | 60 | Millennials, Gen Z Users |

The South Korea Smart Mobility & Car Rentals Market is valued at approximately USD 2.5 billion, driven by technological advancements, urbanization, and a growing preference for sustainable mobility solutions among consumers.