Region:Europe

Author(s):Rebecca

Product Code:KRAA3340

Pages:82

Published On:September 2025

By Product Type:The product type segmentation of the market includes various categories such as Dietary Supplements, Functional Foods & Beverages, Herbal & Traditional Products, Probiotics & Prebiotics, Omega Fatty Acids, Vitamins & Minerals, Sports Nutrition, Weight Management Products, and Others. Among these, Dietary Supplements are leading the market due to their convenience and effectiveness in addressing specific health concerns. The increasing trend of self-medication and preventive healthcare is driving the demand for these products, making them a preferred choice for consumers. The market is also witnessing growth in plant-based and personalized supplement offerings, aligning with evolving consumer preferences .

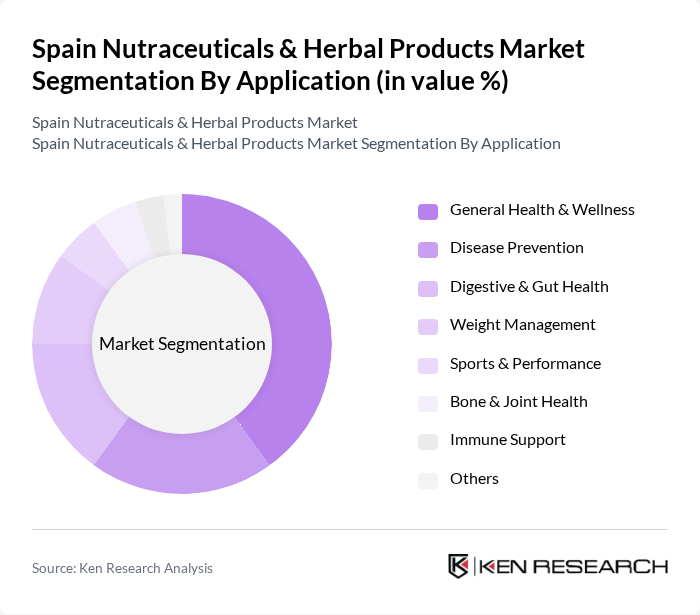

By Application:The application segmentation includes General Health & Wellness, Disease Prevention, Digestive & Gut Health, Weight Management, Sports & Performance, Bone & Joint Health, Immune Support, and Others. The General Health & Wellness segment is the most dominant, driven by a growing awareness of health and wellness among consumers. This trend is further supported by the increasing prevalence of lifestyle-related diseases, prompting consumers to seek preventive solutions through nutraceuticals. Immunity, digestive health, and energy support are among the most sought-after applications in the current market landscape .

The Spain Nutraceuticals & Herbal Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Faes Farma S.A., Laboratorios Ordesa S.A., Arkopharma S.A., Herbes del Moli S.L., Naturhouse Health S.A., Biosearch Life (Kerry Group), ADM Biopolis S.L., Bayer Hispania S.L., Nestlé S.A., GlaxoSmithKline España S.A., Pfizer S.L.U., SuperSmart España, Bioderma España, Nutriben (Laboratorios Alter S.A.), Herbalife Nutrition Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Spain nutraceuticals and herbal products market appears promising, driven by increasing health consciousness and a shift towards preventive healthcare. As the population ages, demand for products that support health and wellness will likely rise. Additionally, advancements in technology and research will facilitate the development of innovative, personalized nutraceuticals. Companies that adapt to these trends and address regulatory challenges will be well-positioned to capture market share and meet evolving consumer needs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dietary Supplements Functional Foods & Beverages Herbal & Traditional Products Probiotics & Prebiotics Omega Fatty Acids Vitamins & Minerals Sports Nutrition Weight Management Products Others |

| By Application | General Health & Wellness Disease Prevention Digestive & Gut Health Weight Management Sports & Performance Bone & Joint Health Immune Support Others |

| By Distribution Channel | Online Retail Supermarkets & Hypermarkets Pharmacies & Drugstores Health Food Stores Direct Sales Others |

| By Consumer Demographics | Age Group (Infants, Children, Adults, Seniors) Gender Income Level Lifestyle (Active, Sedentary, Health-Conscious, etc.) Others |

| By Packaging Type | Bottles Sachets Blister Packs Jars Tetra Packs & Cartons Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers New Entrants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical Retailers | 100 | Store Managers, Product Buyers |

| Herbal Product Manufacturers | 80 | Production Managers, Quality Control Officers |

| Health and Wellness Influencers | 60 | Nutritionists, Fitness Coaches |

| Consumers of Nutraceuticals | 120 | Health-Conscious Individuals, Regular Supplement Users |

| Regulatory Experts | 40 | Compliance Officers, Legal Advisors |

The Spain Nutraceuticals & Herbal Products Market is valued at approximately USD 4.1 billion, reflecting a significant growth trend driven by increasing health consciousness and a shift towards preventive healthcare among consumers.