Region:Europe

Author(s):Shubham

Product Code:KRAA3597

Pages:100

Published On:September 2025

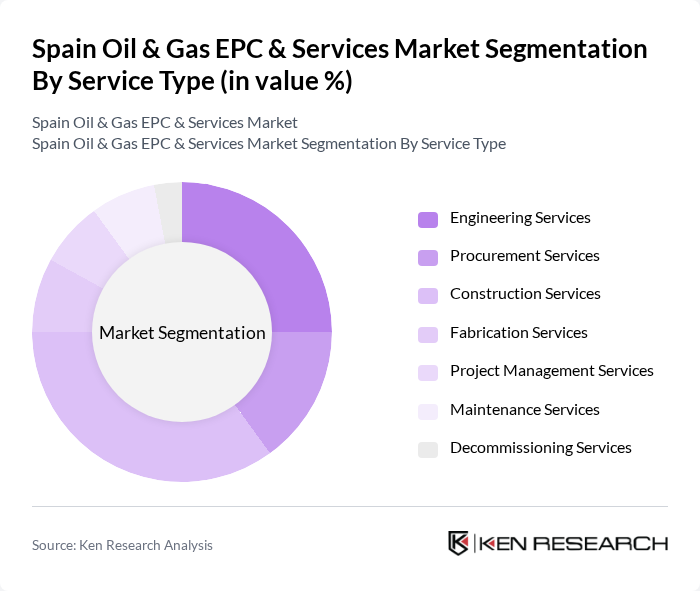

By Service Type:The service type segmentation includes various essential services that support the oil and gas industry. The subsegments are Engineering Services, Procurement Services, Construction Services, Fabrication Services, Project Management Services, Maintenance Services, and Decommissioning Services. Among these, Construction Services is the leading subsegment due to the continuous rise in global energy demand fueling investments in oil and gas facility construction and the integration of digital technologies for enhanced design and analysis capabilities.

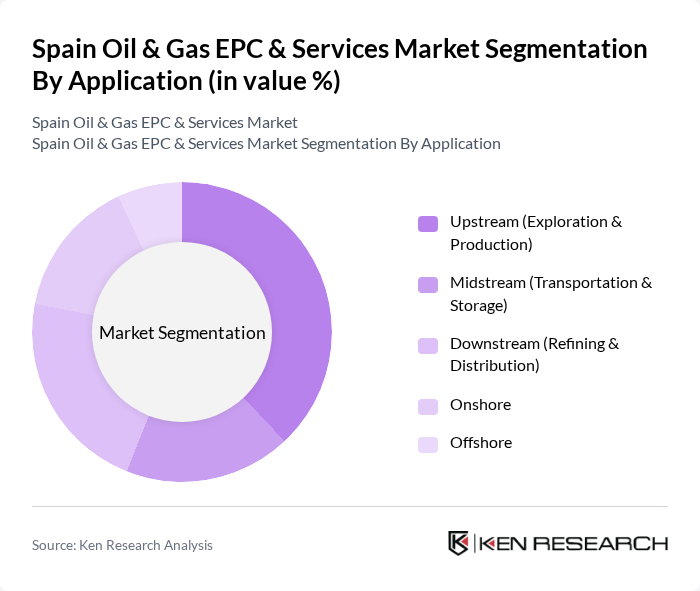

By Application:The application segmentation encompasses various stages of the oil and gas value chain, including Upstream (Exploration & Production), Midstream (Transportation & Storage), Downstream (Refining & Distribution), Onshore, and Offshore. The Onshore segment is currently the most dominant, capturing the largest market share due to the adequacy of onshore hydrocarbons and supportive government policies, with approximately 70% of global oil and gas exploration activities performed onshore.

The Spain Oil & Gas EPC & Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Repsol S.A., Técnicas Reunidas S.A., Acciona S.A., Ferrovial S.A., Sener Ingeniería y Sistemas S.A., Saipem S.p.A., KBR, Inc., Wood Group PLC, Aker Solutions ASA, Bilfinger SE, Halliburton Company, Schlumberger Limited, Baker Hughes Company, Worley Limited, TechnipFMC plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain Oil & Gas EPC and Services market appears promising, driven by a combination of technological advancements and a strong push towards sustainability. As the government implements stricter emission reduction targets, companies will increasingly adopt innovative solutions to enhance operational efficiency. Additionally, the integration of digital technologies will streamline processes, reduce costs, and improve safety standards, positioning the sector for growth amidst evolving energy demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Engineering Services Procurement Services Construction Services Fabrication Services Project Management Services Maintenance Services Decommissioning Services |

| By Application | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Distribution) Onshore Offshore |

| By End-User | Oil Companies Gas Companies Petrochemical Companies Government Agencies Industrial Users Utilities |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas EPC Projects | 100 | Project Managers, Engineering Directors |

| Oilfield Services Market | 80 | Operations Managers, Service Line Leaders |

| Renewable Energy Integration | 50 | Business Development Managers, Sustainability Officers |

| Regulatory Compliance in Oil & Gas | 40 | Compliance Officers, Legal Advisors |

| Market Trends and Innovations | 60 | Industry Analysts, R&D Managers |

The Spain Oil & Gas EPC & Services Market is valued at approximately EUR 13.2 billion, reflecting significant growth driven by increasing energy demand, investments in renewable energy, and modernization of oil and gas infrastructure.